Imagine standing at the crossroads of digital finance in early 2026. After years of volatile evolution, Decentralized Finance (DeFi) is no longer a peripheral experiment; it has become the lifeblood of global capital flow. Yet, for the institutional treasurer and the retail participant alike, the choice of infrastructure remains a source of strategic friction.

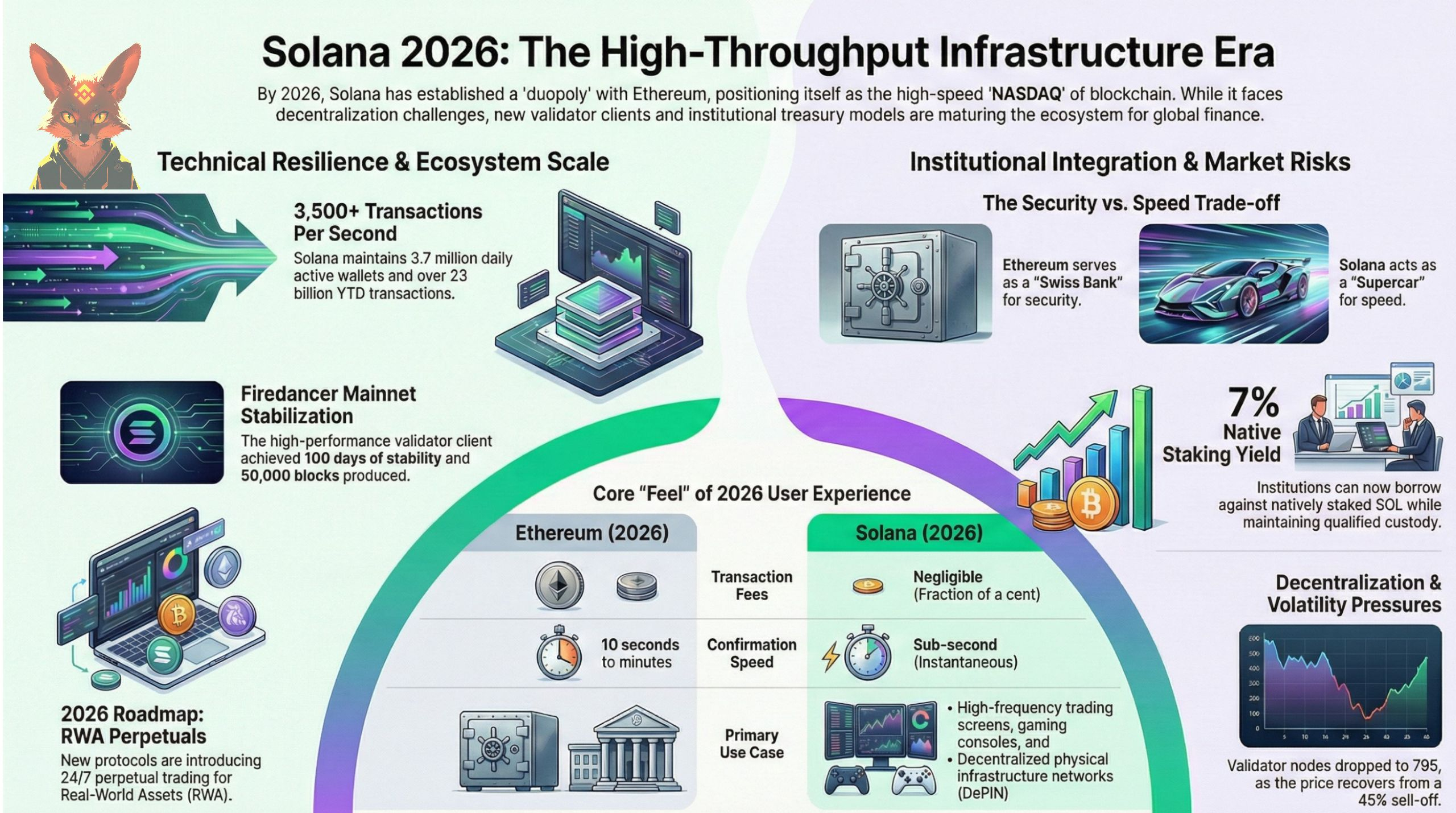

Choosing between the two dominant networks—Ethereum and Solana—is best understood as a "city commute" decision. Do you board the heavy Armored Vehicle, a bit slower but effectively indestructible, like a money transport truck? Or do you take the Supercar, a lightning-fast machine optimized for the F1 circuit of high-frequency trading? In the Web3 landscape of 2026, this isn’t a binary conflict. It is a calculated trade-off between the "Swiss Bank" security of Ethereum and the "NASDAQ-scale" throughput of Solana.

1 The "Ethereum Killer" Era is Over—Meet the iOS/Android Duopoly

By 2026, the industry has moved past the era of "Ethereum Killers." Instead, we have reached a state of infrastructure ossification. The market has settled into a duopoly remarkably similar to the mobile operating system landscape dominated by iOS and Android.

This stability isn't stagnation; it is market maturity. Through a relentless "Network Effect," these two ecosystems capture the overwhelming majority of Total Value Locked (TVL) and developer activity. As OSL research identifies:

"Ethereum, with its first-mover advantage, has accumulated the largest pool of assets. Solana, on the other hand, has captured high-frequency applications and mass consumer scenarios with its unique architecture. Understanding the differences between these two is essentially understanding half of the DeFi world."

While Ethereum remains the "Meticulous Artisan Workshop" where security is hand-crafted and absolute, Solana has emerged as the "Automated Industrial Production Line." One protects the world's "heirloom" assets; the other powers its real-time interactions.

2 Firedancer and the "Reliability" Debate’s New Risk Profile

For years, Solana’s Achilles heel was its reliability under load. The narrative shifted significantly on December 12, 2025, with the mainnet launch of Firedancer. This high-performance validator client, developed over three years by Jump Crypto, introduced critical "Client Diversity" to the network.

By moving from a single-client risk to a multi-client posture, Solana finally achieved institutional-grade resilience. While the "Frankendancer" hybrid bridged the gap during 2025, the full Firedancer client—rewritten entirely in C—has provided the technical foundation for Solana's 2026 stability.

Firedancer Performance Stats at Launch:

Stability: Stably running on nodes for 100 days prior to official launch.

Production: Successfully produced over 50,000 blocks during the stability phase.

Client Diversity: Effectively eliminated the single-point-of-failure risk inherent in the original Agave client.

However, a "Senior Strategist" must look at the residual risk. While software reliability has peaked, decentralization has faced a crisis. The number of validator nodes has plummeted from a 2023 peak of 2,560 to just 795—a 68% reduction. Consequently, the Nakamoto Coefficient has dropped to 20. This concentration of power is the price paid for "NASDAQ-scale" performance, and it remains the primary factor keeping Ethereum’s "Swiss Bank" premium intact.

3 The New Institutional Blueprint for Digital Treasuries

Institutional DeFi reached a milestone in early 2026 with the "Tri-Party Custody Model." Introduced by Solana Company (NASDAQ: HSDT) in collaboration with Anchorage Digital and Kamino, this model allows institutions to remain productive with their assets without sacrificing compliance.

The breakthrough allows firms to borrow against natively staked SOL while the assets remain in qualified custody. This is managed by Atlas, a sophisticated system used for rules-based Loan-to-Value (LTV) oversight, margin orchestration, and automated liquidations.

As Nathan McCauley, CEO of Anchorage Digital, noted:

"Institutions want access to the most efficient sources of on-chain liquidity, but they aren’t willing to compromise on custody, compliance, or operational control."

4 24/7 Global Markets and the Rise of "RWA Perpetuals"

At the Solana Accelerate APAC event, Byreal co-founder Emily Bao unveiled a 2026 strategic roadmap that marks the definitive shift toward Real-World Assets (RWAs). Solana’s Proof of History architecture allows it to function as a unified execution layer for global asset markets in a way Ethereum’s "Artisan Workshop" cannot match for high-frequency needs.

The Three Pillars of Byreal’s 2026 Strategy:

AI-Powered LP Infrastructure: Automated tools like AutoSwap for single-asset entry and AI-assisted strategy engines for optimized rebalancing.

Prop AMM Models: Protocol-managed liquidity featuring dynamic fees that adjust based on order flow quality to maximize capital efficiency.

RWA Perpetuals: 24/7 perpetual futures trading for real-world assets, using prediction market data as an on-chain signal layer.

This infrastructure allows Solana to process over 3,500 transactions per second, enabling a level of sophisticated market-making that mimics traditional stock exchanges.

5 The "Vintage" Hardware Lesson—Saga vs. Seeker

The hardware sector provided a sobering lesson in 2026 regarding the "disposable" nature of crypto-tech. Solana Mobile officially ended software support for the original Saga phone after only two years. This stands in sharp contrast to the seven-year support windows offered by traditional giants like Apple and Samsung.

However, the "Airdrop Phenomenon" saved the Saga from being a commercial disappointment. Rewards tied to the device provided holders with thousands of dollars in value, turning the hardware into a "golden ticket" for the ecosystem.

Solana has doubled down on this with the Seeker, a second-generation device launched at $500. The Seeker utilizes the SKR native ecosystem token to align builders and users. In 2026, crypto-hardware is no longer about the phone itself; it is about the SKR tokenomics and the long-term alignment of the community.

Operating in the 2026 Duopoly

Navigating this landscape requires a "multi-chain" mindset. Your choice of chain should be dictated by your capital size and operational goal:

The "Trial and Error" Strategy (Solana): For those new to DeFi or performing high-frequency actions, Solana is the venue. With fees often a fraction of a cent, the cost of learning is negligible. Use Solana for daily trading, gaming, and real-time interactions where "instant feedback" is essential.

The "Asset Accumulation" Strategy (Ethereum): Ethereum remains the premier venue for long-term wealth. Its focus on security and decentralization makes it the "Swiss Bank" for "heirloom" assets. Use Ethereum (and its mature Layer 2s) for storing high-value NFTs and significant capital that requires the world's most indestructible ledger.

The Mature Approach: Mature users in 2026 do not choose; they optimize. They keep the bulk of their net worth on Ethereum for maximum security while maintaining a "hot" trading balance on Solana to capture the speed of the 24/7 RWA markets.

Beyond the Price Prediction

As we look toward the remainder of the year, analyst consensus points to a bullish 2026 SOL price target of 229.10** and a bearish floor of **93.83. However, as a strategist, I would argue that the price is the least interesting part of the story.

The real reality of 2026 is the realization that technology is simply a tool. The duopoly of Ethereum and Solana has provided us with two distinct sets of rules for the flow of value. The core question is no longer "which chain wins?" but rather "how will you use these tools to rewrite your own financial future?" Stay curious, explore rationally, and navigate the digital wave with your eyes wide open.