There’s a stage every serious infrastructure project eventually reaches.

It stops being asked, “Can this work?”

And starts being asked, “How much of the system can this control?”

That’s where Fogo’s real test begins.

Because once you position yourself around cross-environment coordination and execution integrity, expansion isn’t about features — it’s about scope.

And scope is dangerous.

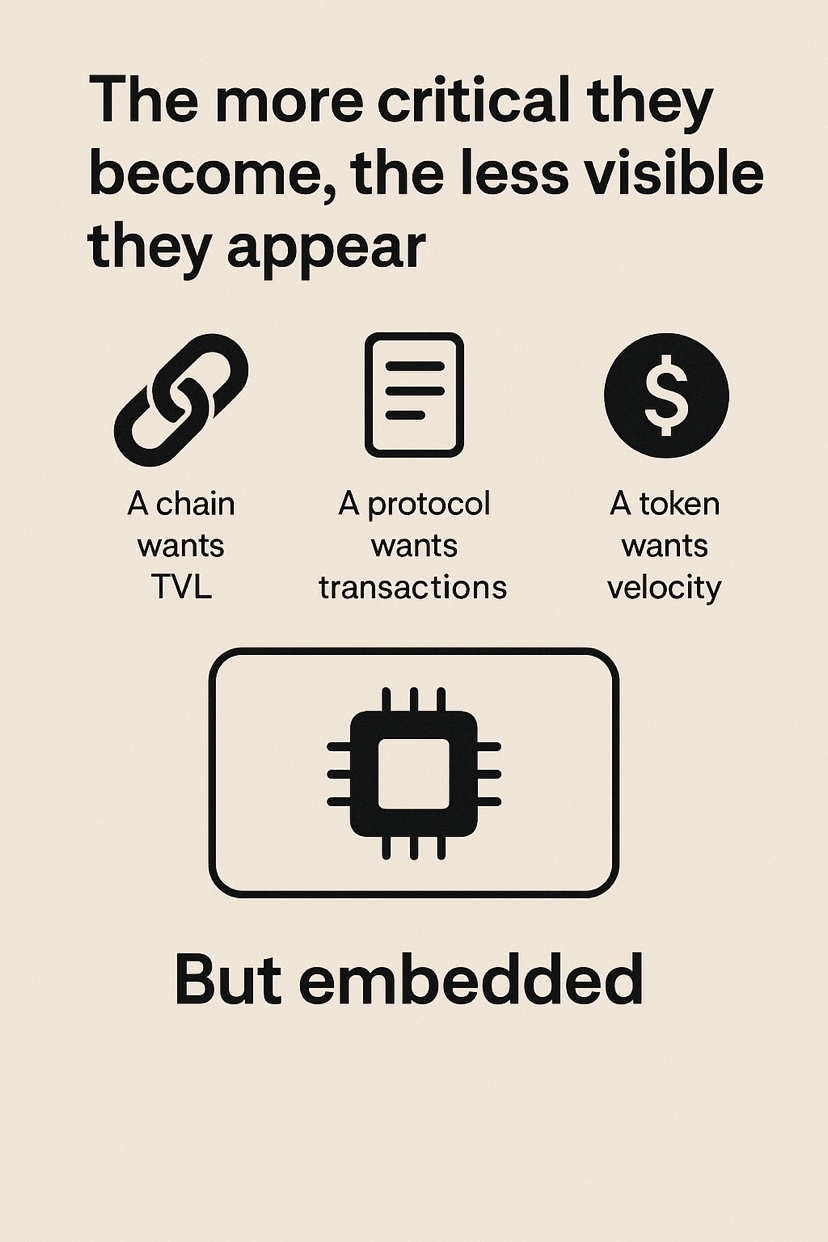

Crypto loves visible dominance.

A chain wants TVL.

A protocol wants transactions.

A token wants velocity.

But coordination infrastructure doesn’t show up cleanly on dashboards.

If Fogo succeeds, it won’t look loud. It’ll look embedded.

And embedded systems face a paradox:

The more critical they become, the less visible they appear.

Right now, most ecosystems still operate like islands pretending to be continents.

Assets move between them.

Liquidity hops.

Bridges patch holes.

Developers write custom logic to reconcile mismatches.

Everyone calls this “interoperability.”

It’s really structured improvisation.

Fogo’s thesis seems to attack that improvisation layer — not by adding more movement, but by standardizing how state coherence behaves across environments.

That’s subtle.

And subtle infrastructure is either foundational or ignored.

There’s rarely a middle ground.

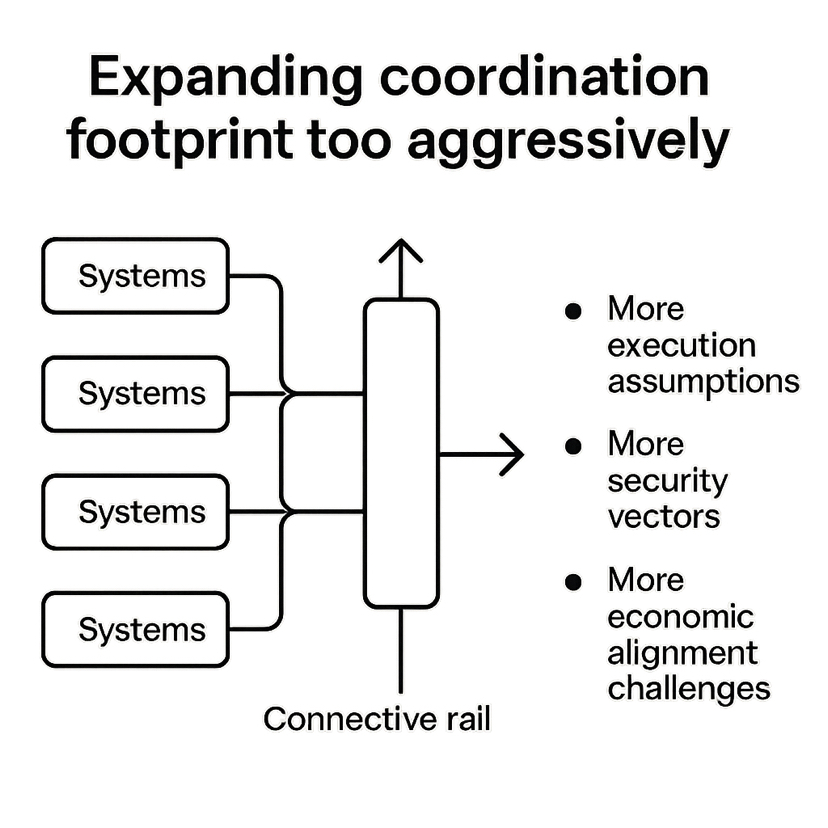

The temptation ahead for Fogo isn’t adding verticals like a consumer chain would.

It’s expanding its coordination footprint too aggressively.

If you become the connective rail between multiple systems, every new integration increases surface area:

More execution assumptions.

More security vectors.

More economic alignment challenges.

Infrastructure doesn’t break because of ambition.

It breaks because complexity compounds faster than discipline.

When I first looked at Fogo, I framed it incorrectly.

I tried to compare it to faster chains and modular stacks.

But speed isn’t the scarce resource anymore.

Coherent execution across trust domains is.

Once that clicked, the comparison set changed completely.

Fogo isn’t competing for blockspace narratives.

It’s competing for reliability positioning.

And reliability is a slow game.

Here’s the uncomfortable truth:

If Fogo does its job perfectly, users won’t even know it exists.

Developers will integrate it quietly.

Applications will rely on it implicitly.

Value will move without friction.

That’s not glamorous.

But it’s powerful.

Because when infrastructure becomes default, it stops being optional.

The risk is expanding before default status is achieved.

If Fogo tries to serve too many environments too quickly, it could dilute its strongest asset: execution discipline.

Coordination layers don’t need to be everywhere.

They need to be trusted where they operate.

There’s also a governance tension most people overlook.

Cross-environment infrastructure eventually interacts with institutional rails.

Institutions don’t care about ideological purity.

They care about:

Predictability.

Escalation paths.

Liability boundaries.

Operational guarantees.

That shifts design decisions.

Neutrality becomes more complex.

Validator incentives must align across heterogeneous ecosystems.

Finality guarantees can’t wobble under stress.

That’s not a marketing problem.

That’s a systems architecture problem.

Crypto cycles reward expansion.

Reliability compounds through restraint.

If Fogo leans into being a coordination rail, it will face constant pressure to:

Add more integrations.

Support more execution environments.

Broaden narrative appeal.

But infrastructure that tries to touch everything often ends up trusted by nothing.

There’s power in selective integration.

There’s power in saying no.

The real fork ahead isn’t technical scaling.

It’s architectural identity.

Does Fogo become:

A broadly marketed interoperability brand?

Or

A narrowly optimized execution integrity layer that ecosystems quietly depend on?

The first path brings attention.

The second path builds leverage.

Most people will judge Fogo by activity metrics.

I think the more telling signal will be dependency density.

How many systems begin to rely on it in ways that are hard to unwind?

Because in infrastructure, the strongest moat isn’t growth.

It’s entrenchment.

And entrenchment requires discipline more than ambition.

That’s the real tension unfolding here.

#FogoChain @Fogo Official $FOGO #fogo