I have been knee deep in DeFi since the early days, chasing yields across chains that promised the world but often delivered delays and frustrations. It's like trying to trade stocks on a dial up connection exciting in theory, painful in practice. That's what drew me to Fogo: a blockchain that doesn't just talk speed but engineers it into every layer, making high performance DeFi feel truly next gen.

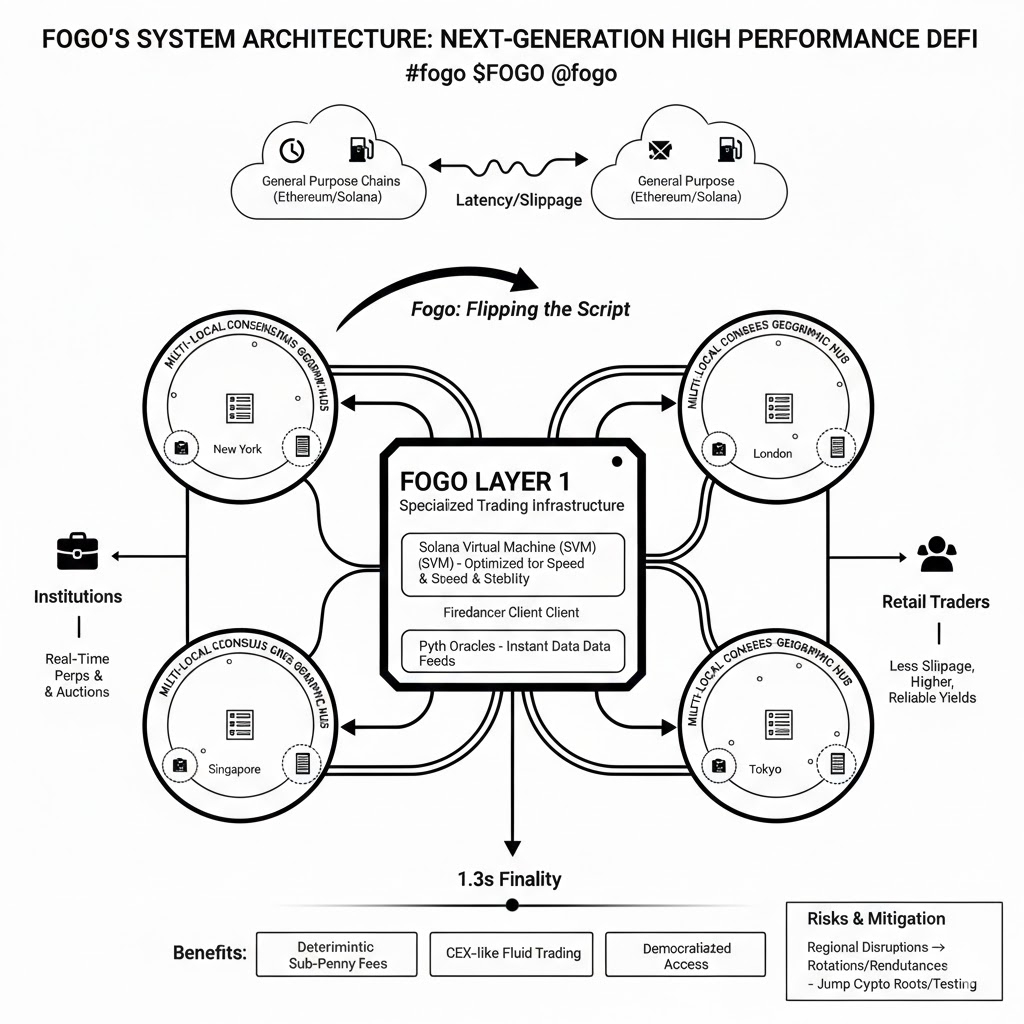

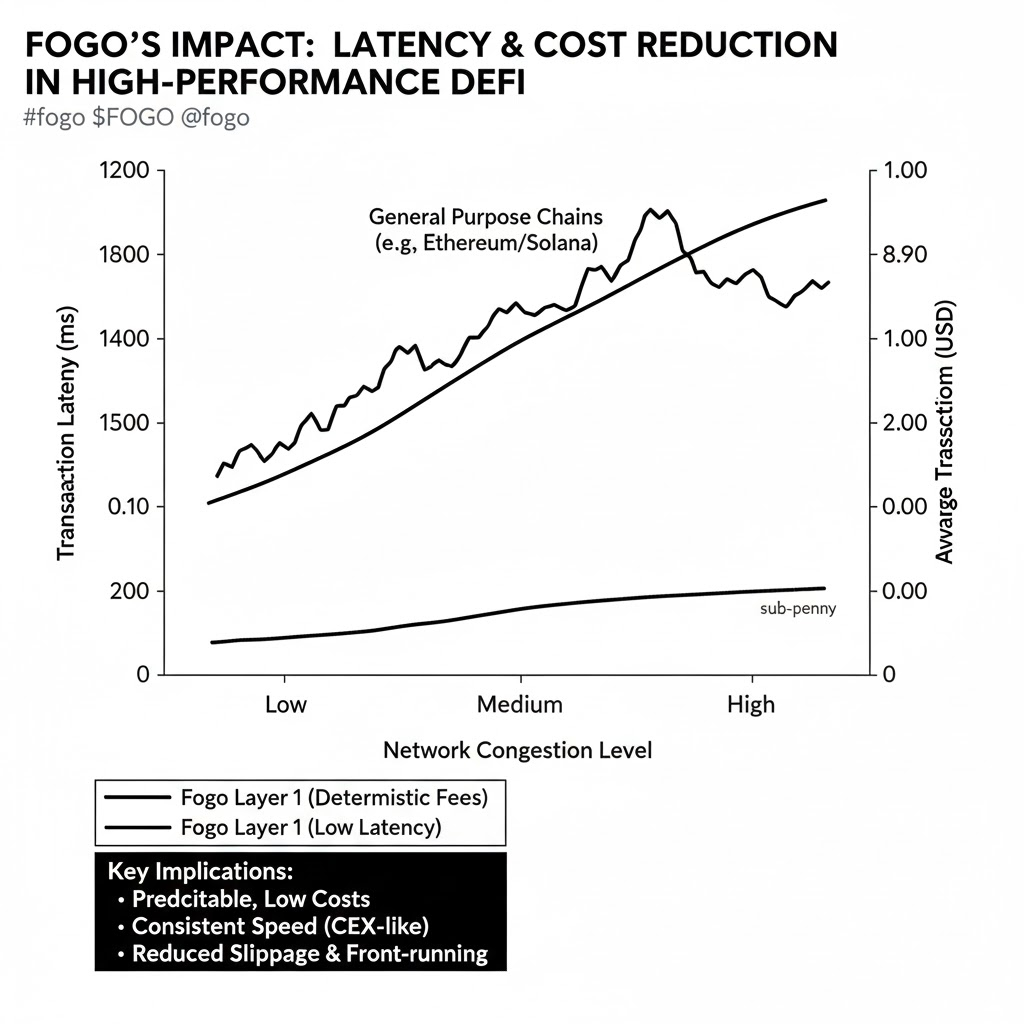

Right now, the market's caught in a tug of war. General purpose chains like Ethereum or Solana handle everything from memes to enterprise, but they choke under DeFi's demands latency spikes during volatility let bots front run retail, and institutions hesitate because onchain can't match their millisecond execution. Fogo steps in as a specialized Layer 1, flipping the script by prioritizing trading over universality, pulling liquidity toward purpose built efficiency.

At its heart, Fogo runs on the Solana Virtual Machine for parallel processing but supercharges it with a Firedancer based client, optimized for raw speed and stability. The standout is multi local consensus: validators cluster in geographic zones like data centers in major hubs to cut propagation times to near zero, achieving ~40ms block times and finality in about 1.3 seconds. This inverts the usual global scatter of nodes, where distance adds drag; instead, local agreement happens first, then syncs efficiently. Users get a shift from clunky waits to fluid, CEX like trades less slippage, more reliable yields. Economically, it democratizes access: everyday traders aren't priced out by spikes, fostering real participation over bot dominance.

Zooming in, fees are deterministic and sub penny, avoiding gas auctions that balloon costs in busy times. Incentives reward validators for zone uptime via staking, building network resilience. For institutions, it's a game changer ex Wall Street builders designed it for real time perps and auctions, with Pyth oracles baked into consensus for instant, trustworthy data. It aligns with the trend of vertical chains, where DeFi splits into niches like trading focused infra, pulling from Solana's ecosystem without full reinvention.

Risks exist, though: clustering could vuln to regional disruptions, like power outs in one zone. Fogo counters with rotations and redundancies for failover. Single client focus on Firedancer might echo bugs network wide, but its Jump Crypto roots and testing prioritize performance over multi-client diversity, as Ethereum does.

Critics say it fragments liquidity from bigger ecosystems or risks over specialization if trading hype fades. Valid, but SVM compatibility eases migrations, and early mainnet apps show organic growth pulling volume. Practically, in a world craving TradFi parity, this targeted approach might consolidate rather than split.

Ultimately, Fogo's setup could propel DeFi into maturity, where on chain rivals centralized speed without the trust issues. It's about utility earning its place better tools drawing users naturally, not forced pumps. We're early; real volume will prove it, but if behaviors shift toward seamless trading, it might inspire a fleet of optimized chains. Stay grounded, watch the adoption.