I used to brush off all the “fast chain” talk as hype, until a few trades slipped through my fingers because the network lagged by seconds. That’s when speed stopped feeling like a buzzword and started feeling like a real cost.

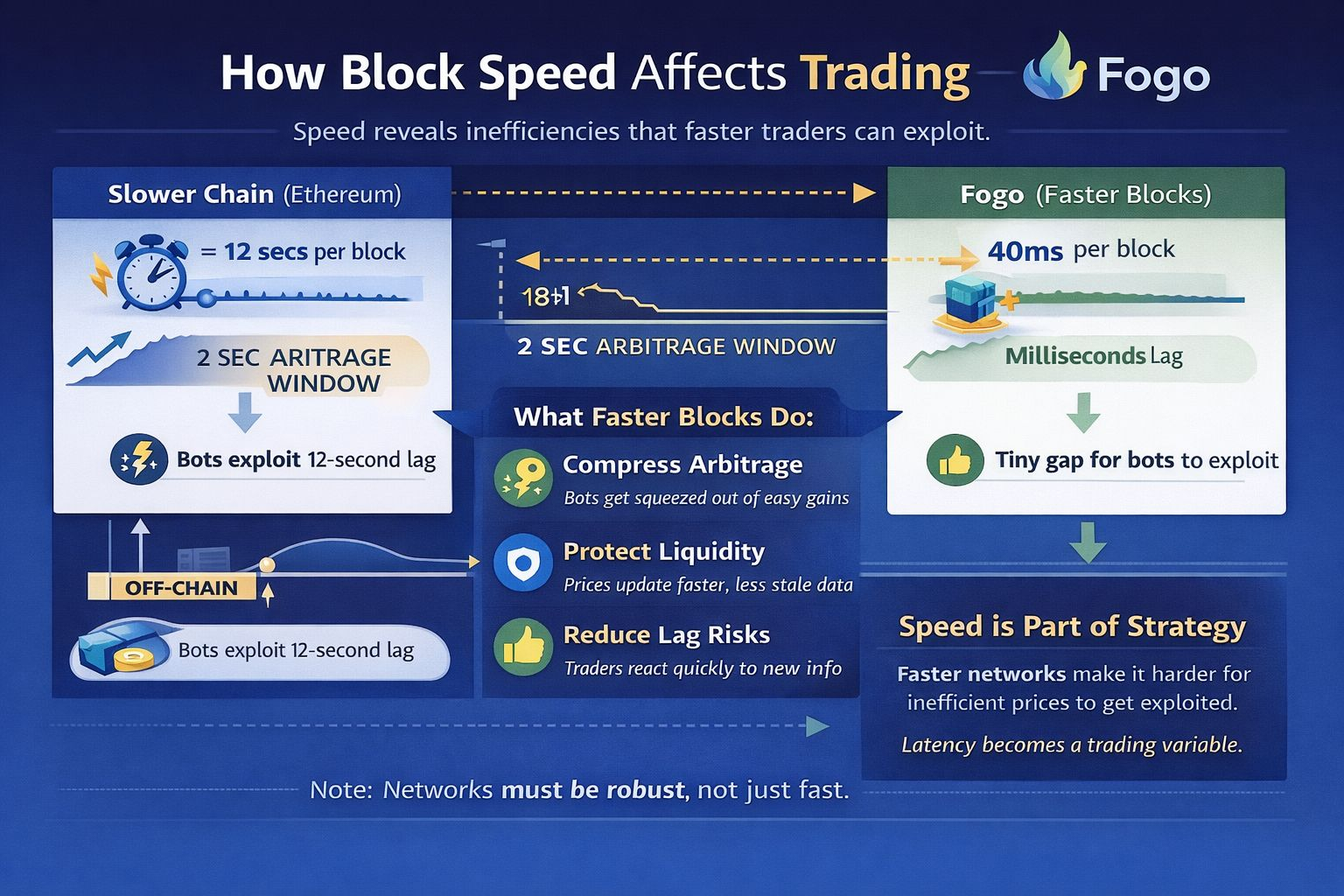

Speed in blockchain is often framed as a marketing metric, but in live markets it quietly shapes who wins and who loses. When a network can finalize blocks in tens of milliseconds, the difference isn’t just convenience. It changes how long price mismatches can survive before being corrected.

On Fogo, block times around 40 milliseconds compress the gap between off-chain prices and on-chain liquidity. In slower environments, even a small delay creates an opening. If a token jumps a couple of percent on a centralized exchange and the on-chain pool trails for a second or two, automated traders have a clear opportunity. That window is long enough to be exploited repeatedly. When blocks turn over dozens of times per second, the same discrepancy exists for only a fraction of that time. The edge narrows.

This shift has knock-on effects. Liquidity providers are constantly exposed to arbitrage when prices update slowly. The longer a pool reflects stale pricing, the more value can be extracted by fast-moving bots. Faster confirmation cycles reduce how long that exposure lasts. It doesn’t eliminate arbitrage, but it trims the damage that comes from being out of sync with the broader market.

None of this means raw speed is a guarantee of resilience. Networks that advertise high throughput have still stumbled when traffic surges or when validators become concentrated. Performance under calm conditions doesn’t always translate to stability during extreme volatility. Early signals suggest Fogo is handling current load without major disruption, but real stress tests only happen when markets turn chaotic.

What’s changing is how traders think about infrastructure. As daily volumes remain high and price swings stay sharp, latency itself becomes part of strategy. The time it takes a network to reflect new information can decide whether an opportunity exists at all. Speed stops being a headline number and becomes a structural feature of market behavior.

In that sense, faster blocks aren’t about bragging rights. They quietly reshape the microstructure of trading by shrinking the spaces where inefficiencies can hide.$FOGO