Markets often search for answers in price movements, but major cycles are rarely driven by crowd psychology. They are shaped by the quiet actions of participants who do not need to optimize short-term returns. While most investors remain focused on Bitcoin’s volatility, central banks worldwide have been accumulating gold at the fastest pace in decades. These dynamics are not contradictory; they reflect different layers of behavior within a financial system entering a prolonged defensive phase.

1. Bitcoin and gold do not move together, but they move in the same direction

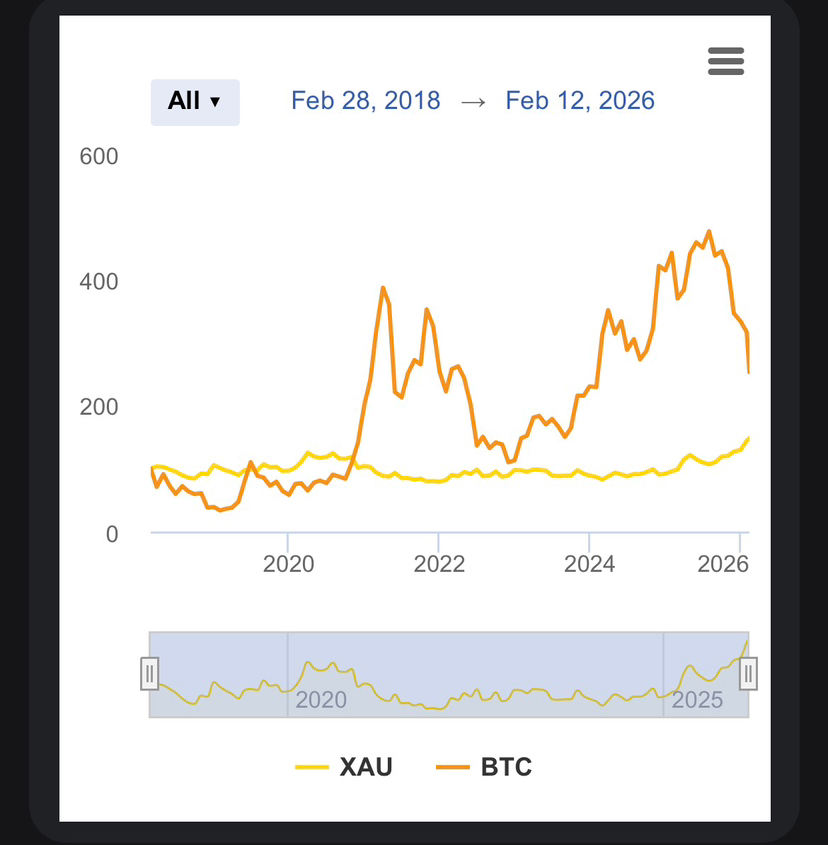

During periods of macro instability, markets typically return first to assets that preserve purchasing power, before expanding into scarcer and more volatile alternatives. Gold tends to reflect defensive demand at the system level, while Bitcoin approaches the same trend with a delay due to its sensitivity to liquidity, sentiment, and speculative flows. This causes Bitcoin to diverge from gold in the short term, yet converge structurally over the long term as the narrative of scarcity and value preservation becomes more dominant.

2. Bitcoin’s decline is a process, not a collapse

Over the past 12 months, Bitcoin has declined by roughly 28% from its peak, but this move does not resemble a systemic collapse. Instead, it represents a prolonged corrective process that erodes short-term expectations and removes speculative capital. This phase temporarily distances Bitcoin from its store-of-value narrative, before convergence resumes as market structure stabilizes.

3. Central banks confirm gold’s leading role

In contrast to speculative hesitation, central banks continue to increase their gold reserves. This is not a short-term response but a structural decision to strengthen national balance sheets. Gold assumes the leading role in the defensive phase, laying the groundwork for the later repricing of other scarce assets, including Bitcoin.

Central bank gold reserve data highlights large-scale, long-term accumulation.

4. Tokenized gold bridges traditional defense and modern infrastructure

The growth of gold-backed assets on blockchain reflects a transitional phase between traditional defensive assets and emerging financial infrastructure. It represents a preference for stability before the market re-engages with higher-volatility assets like Bitcoin.

In defensive cycles, gold tends to lead and Bitcoin tends to follow, but both align toward the same objective: preserving value in a potentially dilutive monetary system. Central bank gold accumulation confirms a system-level defensive phase, while Bitcoin’s correction reflects the natural lag of a higher-volatility asset. As macro conditions stabilize, Bitcoin increasingly converges toward the trajectory that gold has already established, not through speed, but through direction.

#Fualnguyen #GoldSilverRally