Bitcoin and BNB do not represent the same philosophy, but they clearly operate at the same systemic level within the crypto market. They are not competing assets; they are different layers of infrastructure. One is built on trust that no longer requires a human presence, while the other operates on trust that is explicitly tied to responsibility and leadership.

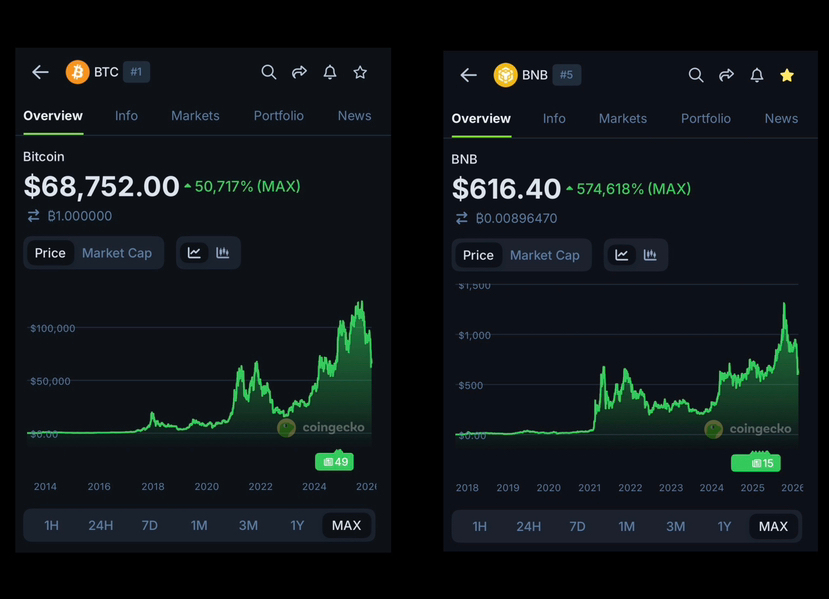

Bitcoin became a historical breakthrough not because of who created it, but because the creator, Satoshi Nakamoto, chose to disappear. Over the years, the market has repeatedly attempted to assign an identity to Satoshi, cycling through various candidates and narratives, yet Bitcoin continued to function unaffected. That absence was not a weakness; it was the foundation. By removing the human element entirely, Bitcoin transformed trust into code, incentives, and time. Its strength lies in the fact that no one can speak for it, control it, or be held hostage through it. Bitcoin is, fundamentally, the decentralized trust layer of the crypto economy.

Crypto, however, requires more than trust alone. Trust answers the question of legitimacy, but it does not solve the problem of operation. Markets need liquidity, coordination, infrastructure, and rapid response during periods of stress. These are functions that pure decentralization does not naturally provide at scale. This is the gap that BNB occupies.

BNB does not attempt to emulate Bitcoin, nor does it pretend to exist independently of human leadership. Instead, it is deeply embedded in the operational core of Binance, the largest liquidity hub in the crypto market. At the center of that ecosystem stands Changpeng Zhao (CZ). Unlike Satoshi, CZ did not vanish. He chose visibility, communication, and accountability. In moments of market panic, regulatory pressure, or systemic fear, CZ consistently acted as the human interface between the system and its users, anchoring confidence when it was most fragile.

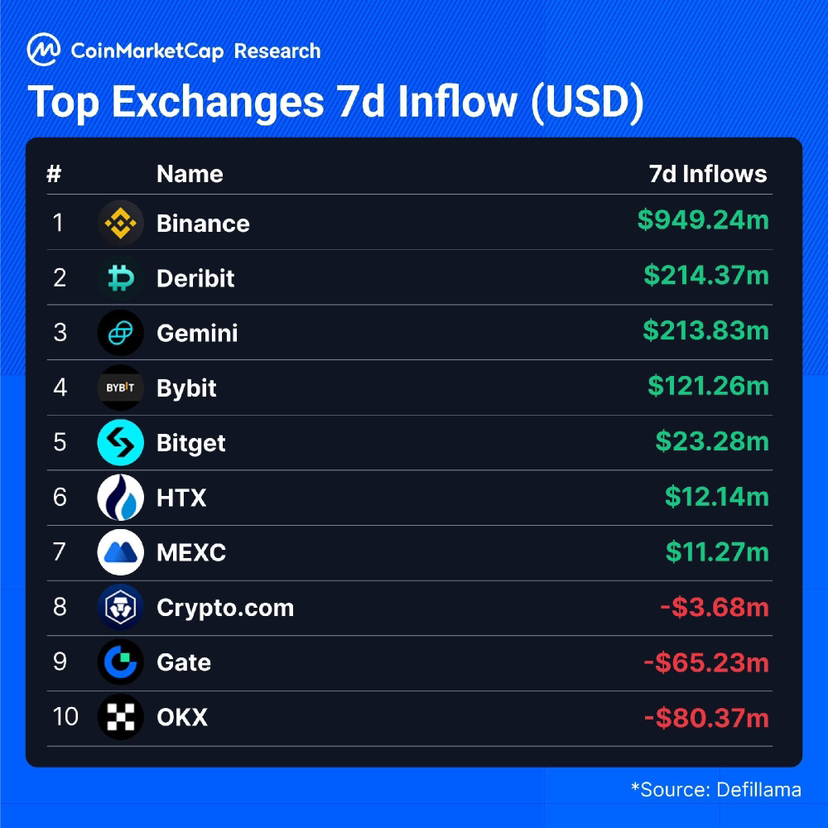

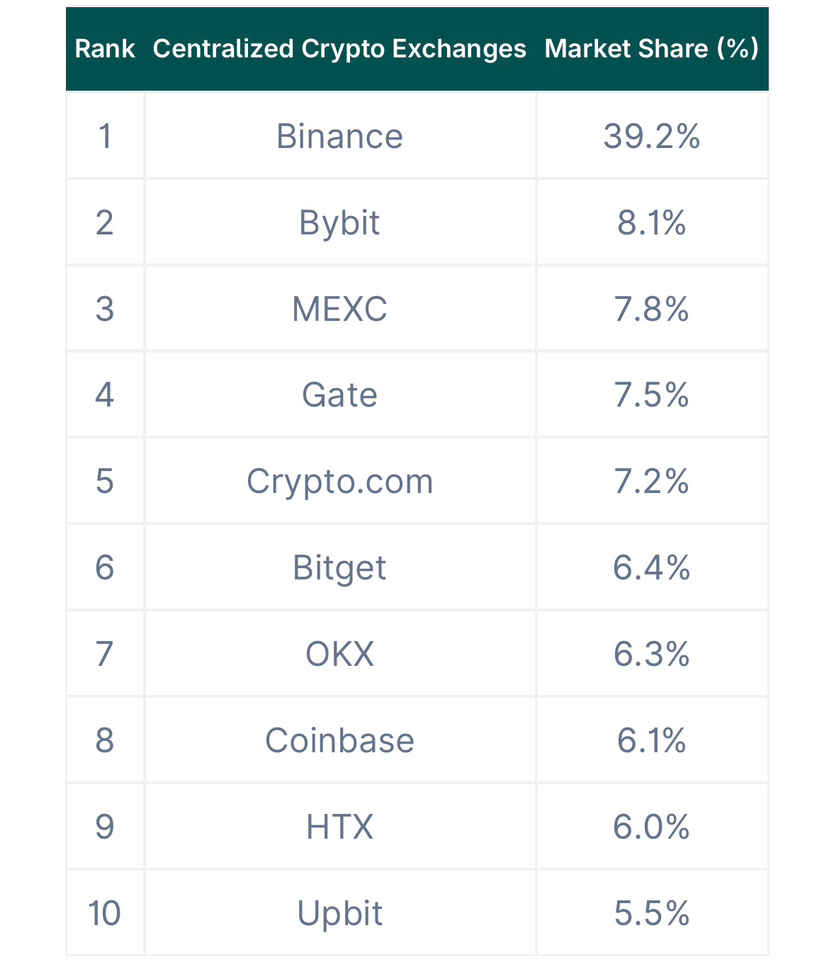

This distinction is critical. BNB is not strong because it is more decentralized, but because it is backed by an ecosystem that actively absorbs shocks. When trust in centralized exchanges collapsed across the industry, capital did not flee indiscriminately. It consolidated. Repeatedly, data showed that users continued to route liquidity toward Binance, even under stress. That behavior reveals a simple truth: in practice, markets place trust not only in code, but in systems that continue to function under pressure. BNB benefits directly from that role, as it is the core economic fuel of the infrastructure that keeps capital moving.

When viewed over a long time horizon, the contrast becomes even clearer. Bitcoin’s price history reflects the power of immutable design and game theory, surviving every cycle without leadership or intervention. BNB’s history reflects the resilience of an operating system for crypto, one that evolves, adapts, and remains relevant precisely because it is guided. These are two different sources of strength, but they exist on the same tier of importance.

Bitcoin is the foundation of decentralized trust. BNB is the operating and liquidity layer of the crypto market as it exists today. If Bitcoin were to disappear, crypto would lose its ideological and monetary anchor. If BNB were to disappear, crypto would lose much of its liquidity, coordination, and day-to-day functionality. That is why BNB should not be viewed as an altcoin competing for attention, but as infrastructure standing in the same category as Bitcoin, serving a different but equally critical function.

Bitcoin is strong because it doesn’t need Satoshi. BNB is strong because it has CZ.

#Fualnguyen #BNBholic #bitcoin