Most traders wake up every morning trying to predict the future.

They stare at charts looking for clues. They stack indicators hoping for certainty. They consume news, follow signals, join Discord calls, all searching for the answer to one question:

Where is price going next?

This is the wrong question.

And it's why 90% of traders lose 90% of their capital within 90 days.

The Prediction Trap

The trading industry has sold you a lie dressed up as education.

The lie sounds like this: If you learn enough patterns, study enough indicators, and find the right system, you'll be able to predict market moves before they happen.

So you learned Head and Shoulders. You memorized RSI overbought and oversold levels. You stacked MACD on top of Bollinger Bands on top of Stochastic. You learned all of the 69+ ict pd arrays. You joined communities where people draw lines on charts and say things like "targeting 4200 by Friday."

And when the prediction works, you feel like a genius.

When it fails, you blame the strategy and search for a new one.

This is the trap, the endless search for certainty in a system that doesn't offer it.

Here's what nobody told you:

A casino doesn't know the outcome of a single spin of the roulette wheel. Not one. They have zero predictive ability on any individual bet.

Yet casinos are the most profitable businesses on the planet.

How?

They stopped predicting. They started operating.

The Casino Owner's Mind

Walk into any casino and watch the house.

They're not sweating individual bets. They're not hoping the next spin goes their way. They're not analyzing patterns in the roulette ball's trajectory.

They built a system with a mathematical edge. Then they execute that system thousands of times without emotional attachment to any single outcome.

Red or black. Win or lose. The casino doesn't care.

Because they know something most traders never learn:

Over a large enough sample size, the edge plays out.

One spin means nothing. One hundred spins means nothing. Ten thousand spins? The math becomes destiny.

The casino owner doesn't predict outcomes. They operate a system.

This is the shift that separates the 90% who blow accounts from the 10% who build wealth.

You Are Not a Fortune Teller

Let me be direct.

You don't know where price is going next. Neither do I. Neither does the guy on 𝕏 with 200,000 followers posting chart screenshots with rocket emojis.

Nobody knows.

The market is a complex adaptive system influenced by millions of participants, algorithmic flows, institutional positioning, geopolitical events, and randomness you can't model or predict.

Anyone who tells you they know what's coming next is either lying or delusional.

But here's the part that changes everything:

You don't need to know what happens next to make money.

You need a system with positive expectancy. Then you need the discipline to execute it without deviation.

That's it.

A 40% win rate is wildly profitable with a 3:1 reward-to-risk ratio. You can be wrong six times out of ten and still build wealth. The math doesn't lie.

But most traders can't accept this. Being wrong 60% of the time feels like failure. So they chase higher win rates, tighter predictions, more certainty.

And certainty is the most expensive thing in the market. we can all tell when we see PNL more like on $ONDO i saw around 600% with someone.

The Math That Sets You Free

Let's run the numbers that the prediction-addicted will never accept.

Assume you risk 1% of your account per trade. Your system has a 40% win rate. Your average winner is 3x your average loser.

Over 100 trades:

40 wins × 3R = 120R gained

60 losses × 1R = 60R lost

Net: +60R

You were wrong 60% of the time. You made 60% on your account.

Now run the predictor's math.

They chase a 90% win rate strategy. They find one (usually scalping), taking tiny profits while holding losers. The average winner is 0.5R. Average loser is 3R because they "give it room."

Over 100 trades:

90 wins × 0.5R = 45R gained

10 losses × 3R = 30R lost

Net: +15R

Looks profitable on paper. But here's what actually happens:

One bad day. One news spike. One "this time is different" hold. They take a 10R loss. Now they're negative on the month and revenge trading to recover.

The high win rate was an illusion. The certainty was a trap.

The 40% win rate operator sleeps well. The 90% win rate predictor blows his account.

The Identity Shift

Stopping prediction isn't a strategy change. It's an identity change.

You have to stop seeing yourself as someone who reads markets and start seeing yourself as someone who executes systems.

You're not a fortune teller. You're a factory manager.

Your job is quality control. Did the setup meet specifications? Was the execution clean? Was risk managed according to protocol?

The factory manager doesn't cry when a defective product comes off the line. It's expected. It's built into the model. They track the defect rate, optimize the process, and keep the line running.

A losing trade is a defective product. Expected. Accounted for. Not emotional.

This shift takes time. Your ego will resist. The prediction addiction runs deep, it's been chemically reinforced by every random win you've had.

But on the other side of that resistance is calm.

The calm of knowing you don't need to be right.

The calm of executing without hope.

The calm of watching a losing trade hit your stop and feeling nothing because you already knew this was possible, it was priced into the system, and one trade means nothing.

Control what you can. Release what you can't.

You can control your preparation. Your criteria. Your position size. Your stop loss. Your journal.

You cannot control the next candle.

Stop trying.

The Protocol

Here's how you start operating today:

Step 1: Define your edge in writing. What is your setup? Not five setups. One. What are the exact criteria? If you can't write it down in plain language, you don't have a system, you have a collection of impulses.

Step 2: Know your numbers. What's your historical win rate? What's your average R? What's your expectancy per trade? If you don't know these numbers, you're gambling. You're hoping. You're predicting.

Step 3: Pre-decide everything. Before the market opens, know your entries, stops, and targets. Know what you'll do in every scenario. The trade should be boring when you execute because you already made every decision in advance.

Step 4: Remove prediction language from your vocabulary. Stop saying "I think it's going up." Start saying "If it breaks and retests this level, my criteria are met." The first is fortune telling. The second is operating.

Step 5: Judge yourself on execution, not outcomes. Did you follow the plan? That's the only question. The P&L is a lagging indicator of your execution quality over time. It's meaningless on a single trade.

The Truth They Don't Want You to Know

The trading education industry profits from your prediction addiction.

Every new indicator, every signal service, every "secret institutional strategy," it's all selling certainty. Because certainty is what you crave. Certainty is what your brain, evolved for the savannah, demands before it feels safe.

But certainty doesn't exist in markets.

The traders who win accepted this. They stopped fighting it. They built systems that don't require certainty and executed them with the detachment of an actuary calculating insurance premiums.

They stopped predicting. They started operating.

You can make the same shift.

But you have to let go of the fantasy first.

The market will open tomorrow. You'll see setups. Your brain will whisper predictions.

Let it whisper.

Then ignore it.

Open your plan. Check your criteria. Execute or wait.

One trade in a thousand.

The math will handle the rest.

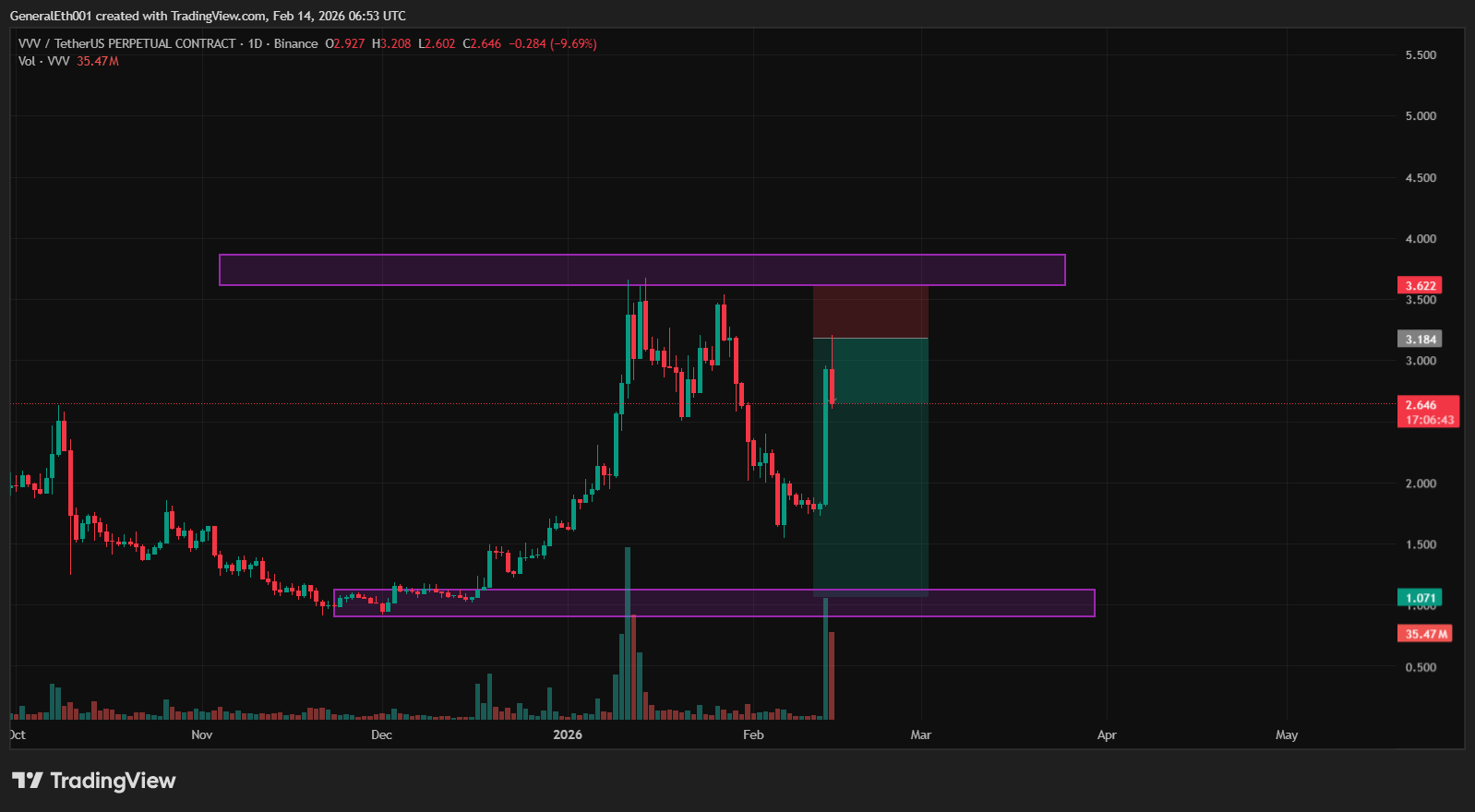

Bonus For readers

Short $VVV

The Trader doesn't predict the future.

They prepare for it.