🚨Bitcoin Structure: Has the Long-Term Bull Trend Truly “Faded”?📊

Market sentiment from Consensus Hong Kong suggests a “rally” has “run its course,” yet charts reveal a more nuanced picture of liquidity and high-timeframe (HTF) resets. While headlines focus on the $85,000 pullback, savvy investors are closely monitoring the gaps left within the current structure

The Collapse:

📉 Price Action & Structure: Bitcoin's price is currently trapped within the $60,000-$70,000 range, struggling to find clear direction after a 45% decline from October highs. Unless a structural shift above $85,000 occurs, the “path of least resistance” remains bearish

🛡 Key Support Zone: All eyes are on the psychological $60,000 threshold. This represents a massive accumulation zone for buyers. Should this area break on a daily close, the 200-week moving average (currently near $58,000) becomes the ultimate “golden pocket” for a long-term reset

🔍 Volume & Indicators: We anticipate a potential fourth consecutive week of downward momentum. Volume remains stagnant, suggesting either a re-accumulation phase or capital slowly flowing into the major liquidity zone trapped between $58,000 and $60,000

The “Smart Money” Perspective

Institutional investors do not panic at trend “breaks”; they view them as liquidity sweeps. The price movement toward the 200-week moving average near $58,000 is a classic ‘shakeout’ designed to clear out overleveraged retail long positions before the next major expansion Whales typically exploit these “holy grail” technical levels to build substantial positions when retail panic peaks

Are you betting near the $60,000 support level now, or waiting for the $58,000 “golden stop-loss” at the 200-week moving average?

🎯 No Turning Back: Why Banks Are Embracing Crypto-Friendly Models

My days begin and end with the news. Bitcoin headlines, Trump quotes, macroeconomic noise—business as usual. But today I opened the 2026 Global Cryptocurrency Regulatory Report, and its core insight struck me: institutional investor interest is no longer a trend—it’s the new normal

Here's why 👇

Banks that have long ignored crypto are quietly becoming retirement savings vaults. Meanwhile, the most economically active demographic—those aged 20-40—are migrating to platforms that truly speak their language

Banks remain banks

Inside lies a fully-fledged crypto hub

CaaS enables banks to directly enter the crypto economy📊:

* Seamlessly buy, send, and receive cryptocurrencies with fiat currency within a single service

* Supports over 330 cryptocurrencies across more than 80 networks

* Advanced trading infrastructure handling $2.7 trillion in annual volume, with an ecosystem valued at $39 billion

Today, this bank no longer trades solely in fiat currency but directly enters the digital asset market. Its market capitalization continues to grow, its market position remains solid, and user retention persists.

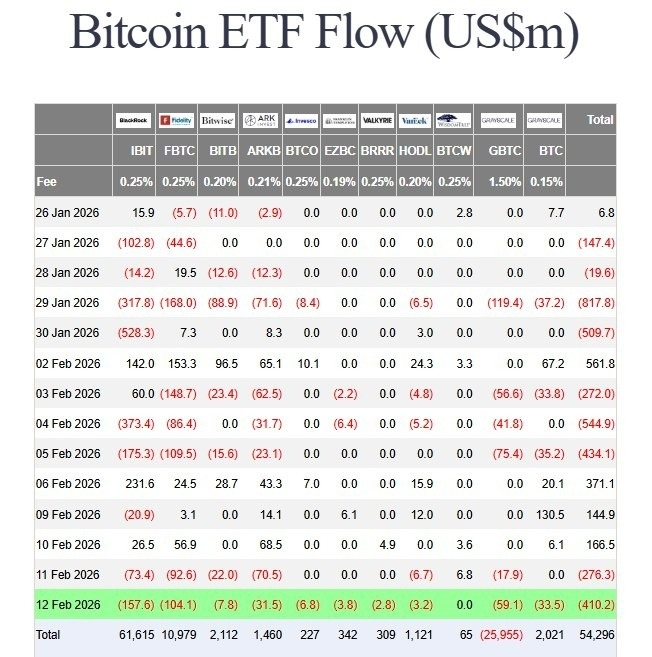

Bitcoin ETFs saw a single-day outflow of $410 million, marking the fourth consecutive week of redemptions. Assets under management have plummeted from a peak of $170 billion to approximately $80 billion, clearly indicating institutional investors are reducing risk rather than buying the dip

Standard Chartered further lowered its 2026 profit forecast. While maintaining a $100,000 Bitcoin target price, it warned the asset could first drop to $50,000. CryptoQuant noted Bitcoin's key support level near $55,000 remains untested—suggesting a reset may not occur

In summary: Institutions are retreating, not panicking. Yet history shows the true capitulation may still lie ahead.