In the ever-evolving landscape of cryptocurrency, where scalability and efficiency often dictate the pace of adoption, Fogo emerges as a compelling force. This Layer 1 blockchain, leveraging the Solana Virtual Machine, addresses longstanding challenges in decentralized finance and trading. As we navigate through February 2026, with altcoins like Solana and Binance ecosystem tokens capturing widespread attention amid institutional inflows and market rebounds, Fogo stands out for its focus on ultra-low latency and robust performance. Recent trends on Binance highlight a surge in interest toward high-throughput networks, driven by the need for seamless on-chain experiences that rival centralized exchanges. Fogo, with its innovative architecture, aligns perfectly with these dynamics, offering traders and developers a platform that prioritizes speed without compromising security.

At its core, Fogo represents a sophisticated evolution in blockchain design. Built on the Solana Virtual Machine, known for its parallel processing capabilities, Fogo integrates Firedancer, a high-performance validator client developed by Jump Crypto. This combination enables block times as low as 40 milliseconds and confirmation speeds around 1.3 seconds, setting a new benchmark for real-time execution. Unlike traditional Layer 1 chains that struggle with congestion during peak activity, Fogo employs a curated validator set and colocated liquidity providers to ensure consistent throughput. This vertically integrated tech stack includes native price feeds and an enshrined decentralized exchange, creating an environment tailored for professional trading. For those new to the space, understanding Layer 1 blockchains is essential: these are foundational networks that handle transactions directly, without relying on secondary layers for scaling. Fogo's approach mitigates common pitfalls like high gas fees and slow finality, making it accessible even for beginners venturing into DeFi.

Delving deeper into its mechanics, Fogo's utilization of the Solana Virtual Machine allows for compatibility with existing Solana tools and applications, fostering a synergistic ecosystem. Developers can deploy smart contracts with minimal adjustments, benefiting from the VM's ability to process thousands of transactions per second. This interoperability is particularly relevant amid current trends, where Solana-based projects are seeing renewed vigor, with prices climbing and trading volumes spiking. Fogo enhances this by incorporating gas-free sessions for frequent traders, reducing friction in high-frequency operations. The project's mainnet launch in January 2026, following a successful $7 million token sale on Binance, underscores its momentum. Institutional interest, a hot topic in recent Binance reports, is evident as validators from major firms join the network, bolstering its decentralization while maintaining elite performance levels.

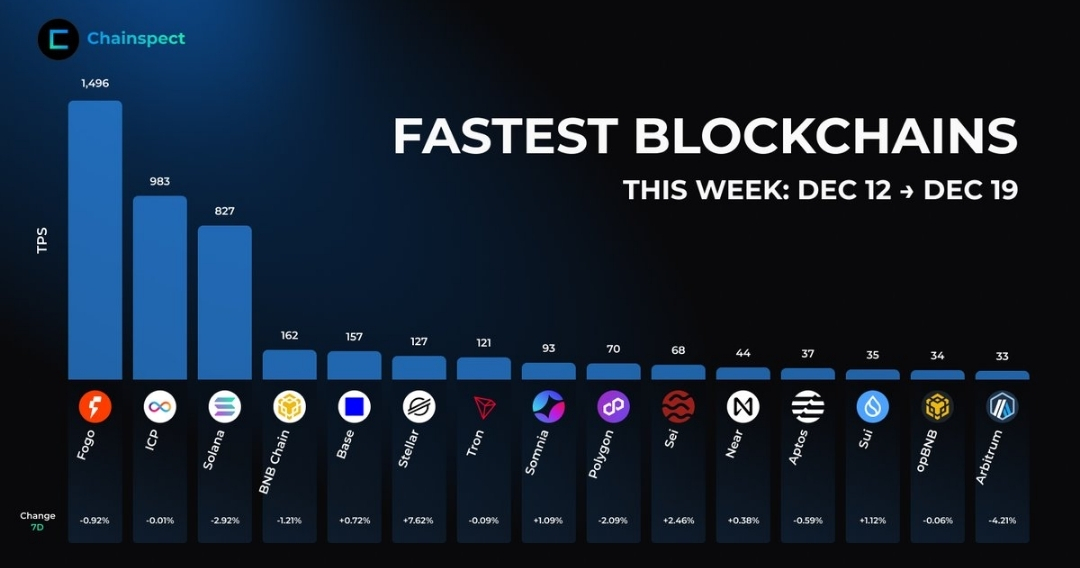

For beginners, grasping the significance of performance metrics can transform how one approaches crypto investments. Consider transaction per second rates and latency as key indicators of a chain's viability. High TPS means more activities can occur simultaneously, preventing bottlenecks that plague networks like Ethereum during bull runs. Fogo excels here, often outperforming peers in benchmarks. To illustrate, let's examine a comparative chart of leading Layer 1 blockchains' speeds.

This visual depicts average TPS across various chains, with Fogo leading at over 1,400, surpassing Solana and others. Notice how the bars taper off, highlighting Fogo's edge in handling demanding workloads. For newcomers, this chart serves as a guide: higher bars indicate better scalability, which translates to lower costs and faster trades. In practical terms, if you're swapping tokens or participating in yield farming, a chain like Fogo minimizes the risk of front-running or slippage, common issues in slower environments.

Shifting focus to market implications, Fogo's tokenomics play a pivotal role in its ecosystem. The native token, $FOGO, facilitates gas payments, staking for network security, and governance decisions. With a circulating supply of around 3.8 billion and a market cap hovering near $88 million, $FOGO reflects the project's early-stage potential. Priced at approximately $0.023, it has shown resilience amid broader market volatility, including the recent October 10 liquidation event that rattled exchanges like Binance. Trending narratives around Binance ecosystem growth suggest that tokens integrated with high-performance chains could see 10-15% uplifts as adoption accelerates. Fogo's alignment with these trends positions it as a strategic pick for portfolios eyeing long-term gains in DeFi and on-chain trading.

To aid beginners in monitoring such assets, price charts offer invaluable insights. They reveal patterns like support levels and resistance points, helping predict future movements. Here's a recent snapshot of Fogo's price trajectory.

This line graph from Binance tracks the token's value over the past 24 hours, showing a 4.88% increase to $0.023. Observe the upward trend in the latter half, indicative of buying pressure. For those starting out, interpret the green percentage as positive momentum, while the volume bar at $25.6 million signals healthy liquidity. Use this as a beginner's tool: dips might present entry points, but always correlate with overall market sentiment, such as Bitcoin's stability around $69,800.

Beyond technical prowess, Fogo's strategic positioning within the Binance ecosystem amplifies its appeal. As Binance continues to dominate with over 40% market share, projects like Fogo benefit from enhanced visibility and liquidity pools. Recent analyses from Binance Research point to themes like institutional adoption and energy-efficient scaling as drivers for 2026. Fogo embodies these, with its low-energy consensus model appealing to environmentally conscious investors. Moreover, its focus on fair execution—no preferential treatment for large players—addresses criticisms leveled at some centralized platforms. This resonates in a year where regulatory clarity, another trending topic, encourages shifts toward compliant, high-speed DeFi solutions.

Exploring potential applications, Fogo opens doors for advanced financial instruments. Perpetual futures, options, and automated market makers thrive on its infrastructure, attracting developers from Solana's vibrant community. For global viewers, this means diverse opportunities: Asian traders leverage Tokyo-based consensus for reduced latency, while European users appreciate the chain's emphasis on self-custody amid tightening regulations. Beginners should note that staking $FOGO not only secures the network but also yields rewards, providing a passive income stream. Start small, perhaps with a wallet compatible with Solana tools, and gradually explore DEX integrations.

Challenges remain, as with any emerging project. Competition from established Layer 1s like Sui and Aptos is fierce, and Fogo must sustain its performance claims through real-world stress tests. Yet, its unique blend of speed and trader-centric features positions it favorably. Follow @undefined for updates on ecosystem expansions, including upcoming trading apps that promise sub-second settlements.

In summary, Fogo encapsulates the innovative spirit driving crypto forward in 2026. As altcoins rally and Binance ecosystems flourish, this high-performance Layer 1 offers a gateway for both novices and experts. By mastering its core elements—SVM integration, rapid block times, and efficient tokenomics—one can navigate the complexities of decentralized trading with confidence. Whether analyzing charts or staking for yields, Fogo invites exploration in a market ripe with possibility. @Fogo Official #fogo $FOGO