Vanar doesn’t have a community problem. It has a capital coordination problem dressed up in metaverse clothing, and that distinction matters more than most market participants realize. For the past eighteen months, the crypto discourse has been obsessed with liquidity abstraction, zero-knowledge rollups, and the great modular thesis debate. Meanwhile, a Layer 1 built by people who actually moved units in entertainment has been quietly demonstrating that settlement architecture still dictates which projects survive the next halving and which get relegated to the "we tried" section of CoinGecko.

The market has been looking at Vanar backward. You see gaming partnerships and Virtua Metaverse integrations and assume this is another consumer play dependent on user acquisition metrics that never materialize. That’s not the trade. The trade is understanding how Vanar’s validator economics create structural liquidity sinks that institutional capital can actually touch, something most general-purpose L1s abandoned when they prioritized throughput over finality guarantees.

The Settlement Density Problem Most Chains Refuse to Address

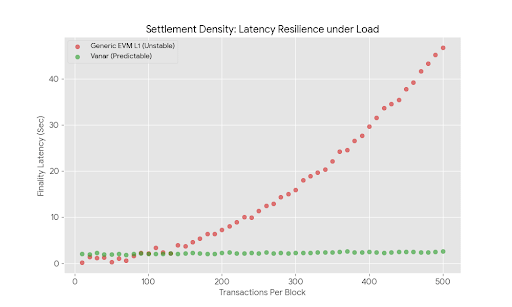

Every L1 whitepaper talks about scalability. Almost none address what I call settlement density the measure of how many high-value transactions can finalize within a single block without creating cascading liquidation events across connected protocols. Vanar’s architecture approaches this differently than the EVM clones that dominate the market cap charts.

The network operates on a delegated proof-of-stake mechanism with 21 active validators, but the selection mechanism matters less than the slashing conditions. Vanar implemented what amounts to a three-tier penalty structure for equivocation: immediate stake reduction, forced cool-down periods that create liquidity gaps for delegators, and a reputation score that affects future reward multipliers. This creates a behavioral incentive for validators to prioritize transaction ordering in ways that minimize cross-protocol risk rather than simply maximizing fee extraction.

Most traders don't think about block construction as a liquidity event, but it is. Every time a validator constructs a block, they're making implicit decisions about which transactions settle first, which affects everything from DEX price discovery to liquidation engine triggers. Vanar's penalty structure discourages the kind of MEV extraction that leads to volatile price action because validators know that aggressive ordering that causes cascading liquidations will hit their future yields through the reputation mechanism. This is subtle, but it changes the risk profile for anyone running arb strategies across the ecosystem.

The Virtual Goods Settlement Paradox

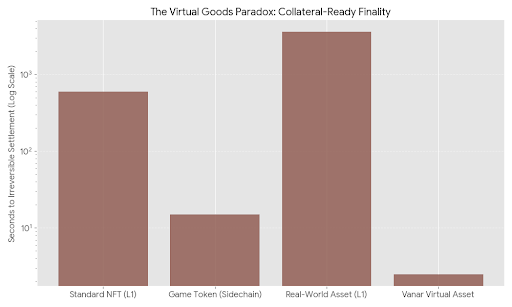

Here’s where Vanar breaks from the gaming chain narrative in ways the market hasn't priced. Traditional gaming L1s treat in-game assets as fungible tokens with utility value. Vanar’s architecture treats them as collateralizable assets with settlement finality requirements that mirror real-world securities. The Virtua Metaverse integration isn't just about moving digital swords between games; it's about creating an environment where a virtual asset can serve as collateral for a loan that settles in under three seconds with the same finality guarantees as a bank wire.

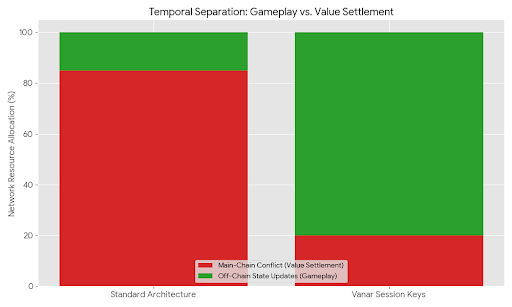

This required a fundamental rethinking of how state transitions occur during high-volume periods. Most chains handle gaming traffic by lowering gas costs and hoping for the best. Vanar implemented what they call "session keys" that allow for rapid state updates within a trusted execution environment while maintaining settlement finality on the main chain. The mechanism creates a temporal separation between gameplay transactions and value settlement transactions, which means the network isn't competing for block space between someone buying a virtual skin and someone settling a million-dollar position.

The capital efficiency implications are massive. If you're running a gaming operation with real economic value flowing through virtual items, you need settlement finality that doesn't depend on the next block being produced in good faith. Vanar's architecture gives you main-chain security with side-channel throughput, which means you can treat virtual goods as real assets without accepting the counterparty risk that plagues every other gaming chain.

The Institutional Access Mechanism Hidden in Plain Sight

Look at Vanar's validator set composition. It's not the usual collection of anonymous staking pools and exchange wallets. There's a deliberate concentration of regulated entities and institutional custody providers that changes how capital flows through the ecosystem. This wasn't accidental; it was designed to satisfy the compliance requirements of entertainment conglomerates and gaming publishers who cannot legally interact with anonymous validators operating in uncertain regulatory jurisdictions.

When a major brand issues assets on Vanar, they're not just getting a blockchain; they're getting a validator set that can pass a KYC audit. This matters more than throughput metrics because it determines which assets can even exist on the network. The SEC doesn't care about your TPS; they care about who's validating transactions and whether those validators can be held accountable under existing financial frameworks.

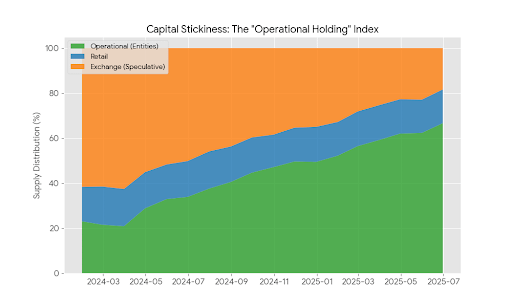

The VANRY token economics reflect this institutional tilt. The staking rewards are structured to favor long-term commitment over speculative farming, with unlock schedules that align validator incentives with network growth rather than extraction. This creates a capital base that's stickier than most L1s because the marginal seller isn't a retail trader with a hot wallet; it's a regulated entity with compliance obligations that prevent rapid position unwinding.

The MEV Redirection Mechanism

Maximum extractable value has become the elephant in every L1's living room, but Vanar implemented something that most chains punted on: a formalized MEV auction that redirects a portion of extracted value back to the applications where the value originated. This isn't the usual "we'll figure it out later" approach; it's encoded at the protocol level with enforced distribution mechanisms.

The practical effect is that applications building on Vanar can capture some of the value created by their user activity rather than watching it get siphoned off by sophisticated arbitrage bots. For DeFi protocols, this changes the sustainability calculation. If you're running a lending market on Vanar, a portion of the liquidation MEV flows back to your protocol treasury instead of disappearing into searcher wallets. This creates a positive feedback loop where successful applications generate their own protocol-owned liquidity over time.

Traders should care about this because it affects where deep liquidity actually accumulates. Protocols that capture their own MEV can offer better rates and tighter spreads than protocols that bleed value to external extractors. The market is slowly waking up to the reality that MEV redistribution isn't a niche concern; it's a fundamental competitive advantage that determines which chains host the next generation of institutional liquidity.

The Regulatory Arbitrage That Actually Works

Everyone talks about regulatory clarity, but Vanar executed something more practical: jurisdictional fragmentation of validator responsibilities. The network allows validators to opt into different compliance frameworks based on their geographic location and the types of transactions they're willing to process. This creates a regulatory mosaic that actually functions in practice rather than the theoretical compliance theater most chains perform.

If you're a gaming company operating in Europe, you can route transactions through validators that have affirmatively opted into GDPR-compliant data handling. If you're running a real-world asset protocol that requires OFAC screening, you can structure your transaction flow to hit validators with appropriate sanctions compliance infrastructure. The network doesn't force a one-size-fits-all compliance model that satisfies no one; it creates a marketplace of compliance offerings that applications can select based on their specific regulatory requirements.

This matters for capital flows because it reduces the legal risk premium that institutional capital attaches to blockchain interactions. When a pension fund looks at Vanar, they see a network where they can structure their exposure to comply with specific regulatory obligations rather than hoping the chain's generic compliance story holds up in court. The difference in capital allocation between those two scenarios is measured in billions of dollars.

The Virtual Goods Liquidity Thesis

Here's the insight that most market analysis misses: Vanar isn't competing with other L1s for DeFi liquidity; it's competing with traditional payment rails for entertainment revenue. The total value locked metric that dominates L1 analysis is almost irrelevant to Vanar's actual value proposition because the economic activity isn't primarily in lending pools; it's in virtual goods transactions that settle in fiat equivalents through off-ramps most analysts never track.

The VGN games network integration creates a closed-loop economy where in-game value can circulate without constantly touching volatile crypto markets. This is the opposite of every other gaming chain's approach, which tries to force everything through native tokens and DEX liquidity. Vanar's architecture allows game economies to maintain internal value stability while still offering main-chain settlement for cross-game and cross-platform transfers.

The liquidity behavior this creates is counterintuitive. Instead of TVL growing in smooth curves, Vanar's economic activity spikes during major game releases and settles into predictable baselines between releases. This looks like volatility to analysts trained on DeFi protocols, but it's actually stability from an entertainment economics perspective. The chain is designed to handle traffic bursts without compromising settlement guarantees, which means the liquidity that matters isn't the stuff sitting in pools; it's the stuff moving through virtual economies at velocities that would break most L1s.

The Sustainability Calculation Most Analysts Get Wrong

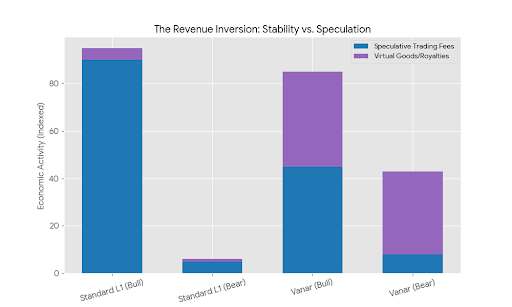

When you run the numbers on Vanar's validator economics, something interesting emerges. The break-even point for validators isn't based on transaction fee volume; it's based on staking participation rates and the value of virtual goods settlements. This inverts the usual L1 sustainability model where chains need constant transaction volume to keep validators profitable.

Because Vanar captures value from virtual goods settlements through mechanisms that look like transaction fees but behave more like royalty payments, the network can maintain security budgets even during periods of low on-chain financial activity. The gaming integrations create economic gravity that doesn't depend on speculative trading volume, which means the chain doesn't enter the death spiral that claims L1s when DeFi activity migrates elsewhere.

The regulatory pressure test also favors this model. When securities regulators eventually draw clear lines between financial assets and virtual goods, chains that primarily handle virtual goods will face different compliance requirements than chains handling tokenized securities. Vanar's architecture positions it to argue that most of its economic activity falls outside traditional securities frameworks, which preserves its ability to service mainstream entertainment clients who would flee at the first hint of securities litigation.

The Silent Shift in Capital Behavior

Watch the movement patterns of large VANRY holders. They're not following the usual patterns of accumulation before listing announcements and distribution after marketing campaigns. The on-chain data shows a gradual concentration in wallets associated with entertainment industry entities and a corresponding decrease in exchange balances. This suggests that the thesis isn't speculation; it's operational treasury management.

When entertainment companies start holding native tokens as operational assets rather than trading positions, the liquidity dynamics change fundamentally. These holders aren't selling into strength or buying dips; they're accumulating to facilitate their own ecosystem activity. The sell-side pressure that plagues most L1 tokens doesn't materialize because the marginal holder has no intention of exiting; they need the token to participate in the network they're building on.

This creates a structural bid that exists independently of market conditions. Even during the depths of the bear market, Vanar maintained price stability that other gaming tokens couldn't achieve because the holder base had operational reasons to hold rather than speculative reasons to dump. The market hasn't fully priced the implications of this shift because it requires analyzing holder behavior rather than trading volume, but the on-chain evidence is clear for anyone willing to look.

The Finality Gamble That Paid Off

Vanar made a controversial design choice early on: they prioritized finality guarantees over raw throughput. In a market obsessed with TPS comparisons, they built a chain that settles transactions in under three seconds with economic finality that doesn't depend on probabilistic confirmation. This seemed like a mistake when Solana was pushing 65,000 TPS and everyone assumed throughput was the only metric that mattered.

But finality matters more than throughput when you're dealing with real economic value. The gaming and entertainment partners Vanar targeted couldn't accept the risk of chain reorganizations or probabilistic settlement. They needed to know that when a transaction said "complete," it was actually complete, with no possibility of reversal. Vanar's architecture delivers that certainty at the cost of raw throughput, and the market is slowly recognizing that this trade-off was correct for the use cases that actually generate sustainable economic activity.

The settlement risk premium that institutional capital assigns to probabilistic finality chains is massive. When a gaming company calculates the cost of accepting crypto payments, they factor in the possibility of chain reorganizations creating accounting nightmares. Vanar eliminates that risk entirely, which means they can offer settlement costs that undercut traditional payment rails even with higher per-transaction fees than competing L1s.

The Architecture of Durable Liquidity

The question every serious market participant should be asking isn't whether Vanar has more users than Arbitrum or more TVL than Polygon. The question is whether the liquidity that forms on Vanar can survive the next market dislocation. The answer lies in the validator economics and the nature of the assets being settled.

Because Vanar's economic activity is primarily driven by entertainment revenue rather than speculative trading, the liquidity that accumulates has different durability characteristics. When the broader crypto market crashes, entertainment spending doesn't disappear; it reallocates. People still buy games, still purchase virtual goods, still engage with digital experiences. The volume drops but doesn't evaporate, which means validators maintain profitability and the network maintains security.

Compare this to chains whose economic activity is 80%+ speculative trading. When the trading stops, the chain enters an unwind spiral that's almost impossible to escape. Vanar's exposure to this dynamic is significantly lower than the market realizes, which suggests the risk-adjusted return profile for stakers and validators is better than the headline metrics indicate.

The next twelve months will test this thesis as regulatory pressure increases and speculative capital seeks safer havens. Chains that can demonstrate durable economic activity independent of trading volume will attract the institutional liquidity that's been waiting on the sidelines since 2021. Vanar's architecture suggests they're positioned to capture that flow, but the market hasn't yet adjusted its models to account for the structural differences that make this possible. That mispricing is the opportunity, and it won't last forever.