@Fogo Official , Fogo’s tokenomics are structured around a single primary differentiator: a controlled emission model designed to align validator security and developer incentives without relying on aggressive long-term inflation. The supply schedule is engineered to balance early network growth with predictable token distribution over time.

At its core, tokenomics refers to how a network creates, distributes, and manages its native token. In Fogo’s case, this includes total supply, how tokens enter circulation, who receives them, and how emissions decline or stabilize over time. Emissions refer to new tokens released into the market through staking rewards or ecosystem incentives.

Fogo uses its native token for three primary operational functions: transaction fees, validator staking, and governance participation. Transaction fees compensate validators for processing blocks. Staking requires validators to lock tokens as collateral to secure the network. Governance allows token holders to vote on protocol upgrades. Each function creates structured demand tied directly to network usage.

The differentiator lies in how Fogo manages emissions relative to network security. Instead of relying on high inflation to attract validators in early stages, Fogo calibrates emissions to reflect actual staking participation and network activity. This reduces excessive dilution while maintaining sufficient economic security. Dilution refers to the reduction in token ownership percentage when new tokens are minted.

In the current market, many Layer 1 networks face pressure from unsustainable reward programs. High early emissions can temporarily inflate staking participation but often create long-term sell pressure once tokens unlock. As of February 2026, several networks launched in 2023 and 2024 are experiencing elevated circulating supply increases exceeding 15 percent annually, which has placed downward pressure on token prices. Fogo’s approach attempts to limit that dynamic by moderating release schedules from inception.

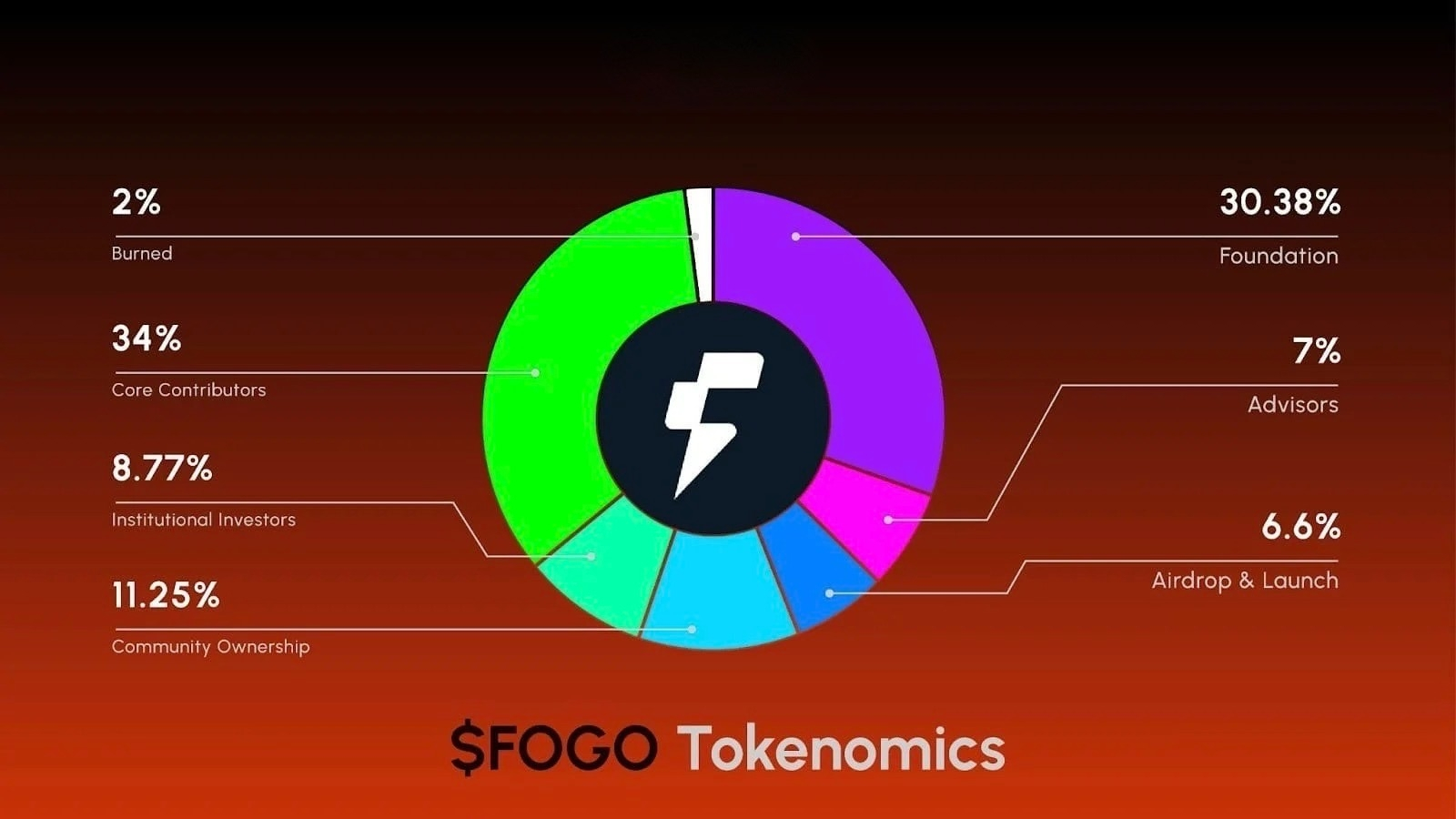

Supply structure is divided into fixed allocation categories. These typically include ecosystem incentives, validator rewards, foundation reserves, and early contributors. The key operational factor is vesting. Vesting defines how quickly allocated tokens become transferable. A structured vesting timeline reduces sudden liquidity shocks.

As of February 2026, Fogo’s circulating supply represents a controlled portion of total supply, with the remainder locked under predefined release schedules. This matters because circulating supply determines market liquidity and effective inflation. A slower release schedule stabilizes short-term volatility while allowing predictable future distribution.

Emission rates are tied to staking participation thresholds. When staking participation rises above a defined percentage of circulating supply, marginal rewards decline. When participation falls, rewards increase slightly to maintain validator incentives. This feedback mechanism prevents overpaying security costs during periods of excess staking. Security cost refers to the economic expense required to prevent network attacks.

For builders, this emission structure provides cost clarity. Transaction fees are not subsidized through extreme inflation, which reduces dependency on temporary reward programs. Developers can model long-term gas costs more reliably. Gas costs refer to fees required to execute transactions or smart contract operations.

Live validator participation metrics illustrate this alignment. As of February 2026, staking participation remains within a target range sufficient to secure block production while avoiding excessive reward expansion. This indicates that incentives are functioning as intended. Stable participation reduces the probability of abrupt yield compression events.

Ecosystem incentives are distributed through milestone-based programs rather than blanket emissions. This means tokens are allocated when measurable activity occurs, such as application deployment or transaction growth. Milestone-based distribution limits speculative farming behavior. Farming behavior refers to short-term activity solely intended to capture token rewards.

For users, the implication is lower structural inflation exposure. When emissions are controlled and tied to utility, token holders experience slower dilution. This does not guarantee price stability, but it reduces systemic oversupply risk relative to high-inflation networks.

Validator economics are also more predictable under this framework. Rewards scale with participation, and operational revenue correlates with real transaction volume rather than purely inflationary subsidy. This encourages professional validator infrastructure rather than opportunistic yield extraction.

There are tradeoffs. Lower emissions can reduce short-term yield attractiveness compared to aggressive incentive programs on competing chains. In early network phases, this may slow rapid validator expansion. However, the benefit is reduced long-term overhang from excessive unlocked supply.

Another risk relates to network activity growth. If transaction volume does not expand sufficiently, fee revenue may not offset declining emissions over time. In that case, validator profitability could compress. The model depends on real adoption rather than perpetual inflation to sustain security.

From an operational standpoint, Fogo’s tokenomics prioritize cost efficiency and predictable supply growth. Builders gain clearer integration economics. Validators receive structured, participation-adjusted rewards. Token holders face moderated inflation rather than aggressive early dilution.

As of February 2026, the emission schedule remains within its designed parameters, with supply expansion aligned to staking participation rather than uncontrolled issuance. This reflects deliberate calibration rather than reactive adjustment.

The primary differentiator is therefore not total supply size or allocation categories. It is the feedback-based emission structure that ties new token issuance directly to network security requirements. This creates measurable discipline in supply growth.

In execution terms, the model reduces dilution risk, improves cost predictability, and aligns validator incentives with actual network conditions. These characteristics matter more than headline supply figures because they shape long-term sustainability.

Fogo’s tokenomics design does not eliminate market volatility or adoption risk. It does, however, establish a controlled emission architecture intended to balance security, utility, and distribution over time. That structural discipline is the central feature of its supply model. #fogo