Many traders think a 5% drop is just a 5% drop. They see $BTC hitting $67k and blindly click "Buy" because it’s "cheap."

I disagree. As a trader who has survived three cycles, I’ve learned that how we get to a level is more important than the level itself. Today, I’m going to share the mental model that changed my PnL: The Physics of Market Velocity.

1. The "Aha" Moment: Velocity > Price

If you take 1,000 trades, you’ll realize that support levels don't fail because they are weak; they fail because the velocity of the approach was too high for buyers to absorb.

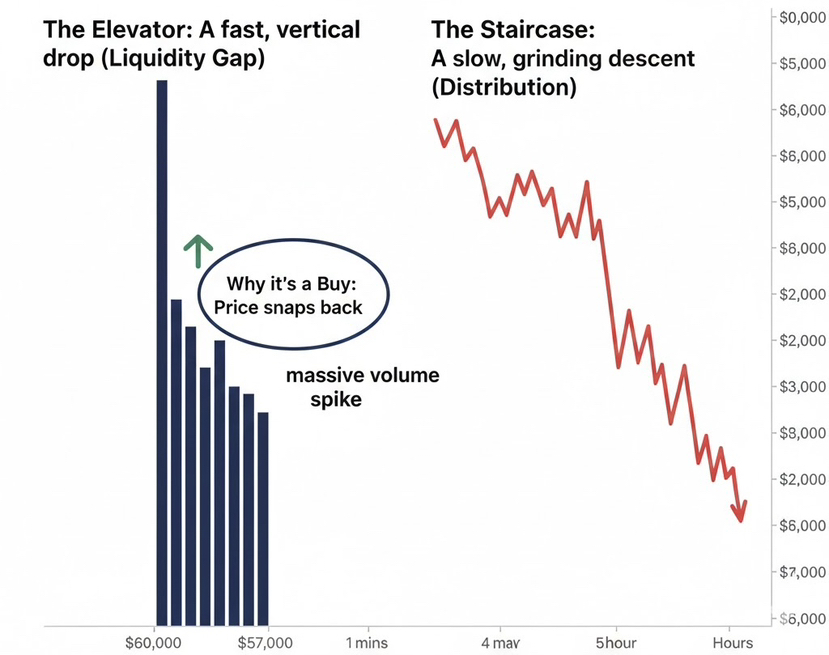

The Elevator: A fast, vertical drop (Liquidity Gap).

The Staircase: A slow, grinding descent (Distribution).

2. Trading the "Elevator" (The Flash Crash)

When $BTC moves like an elevator, dropping $3k in 5 minutes, it creates a "Liquidity Hole." There aren't enough orders to fill the gap, so the price "teleports" down.

Why it’s a Buy: These moves are usually driven by liquidations (forced selling), not fundamental change. Once the liquidations stop, price snaps back like a rubber band to fill the gap.

The Rule: Look for a massive volume spike + a vertical candle. This is "High Quality" volatility.

3. The "Staircase" (The Death Grind)

A "Staircase" is when $BTC grinds down slowly, creating small "steps" (lower highs and lower lows) over 12–24 hours. This is the most dangerous environment for a retail trader.

The Physics: This isn't a panic; it’s Distribution. Big players are slowly exiting their positions, and every "bounce" is just another step lower.

Why it’s a Trap: It feels "safe" because it’s not crashing, so traders keep adding to their longs. This is how you get "paper-cut" to death.

The Rule: If price is "grinding" into a support level with decreasing volume on the bounces, do not touch it.

4. The Math of Absorption

We can quantify this using a simplified Volume/Time ratio:

High Velocity (Elevator): High Price in low Time. This leads to Mean Reversion (Price returning to the average).

Low Velocity (Staircase): Low Price over high Time. This leads to Trend Continuation (Price breaking through support).

5. My Entry Checklist for $BTC at $67k

Before I long a support level, I run this 3-point check:

How did we get here? If it was an "Elevator" (fast spike), I’m looking for the long. If it was a "Staircase" (slow grind), I stay flat.

Volume Profile: Is there a "Volume Climax"? I want to see the highest volume candle of the day at the bottom of the move.

The "Spring" Test: Does the price bounce immediately? If it sits on support for more than an hour, the support is likely to break.

Summary: Respect the GrindIn 2026, the market is smarter than ever. The "Elevator" gives you a gift; the "Staircase" takes your capital.

Next time $BTC hits a major level, ask yourself: "Did we take the stairs or the elevator?

Are you currently caught in the $67k staircase, or are you waiting for a liquidation elevator to hit the bottom?

Hope you learned something new?