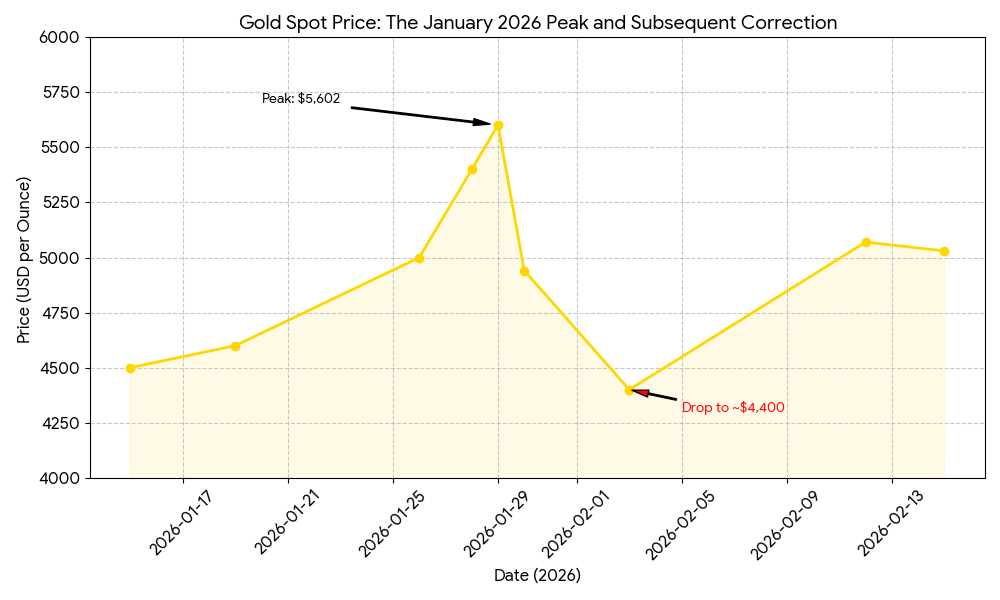

For decades, the "Safety Play" was simple: when the world gets messy, you buy Gold. But in 2026, the playbook has changed. We’ve recently seen Gold prices take a sharp tumble from their $5,600+ peaks, leaving many investors asking: If the "ultimate safe haven" is falling, where does that leave Bitcoin and the rest of the crypto market?

If you’re a beginner, this might look like a sea of red. But underneath the surface, a "Macro Shock" in Gold often reveals exactly where the next big move for Crypto is headed. Here is the breakdown.

1. The Death of the "Safe Haven" Monopoly

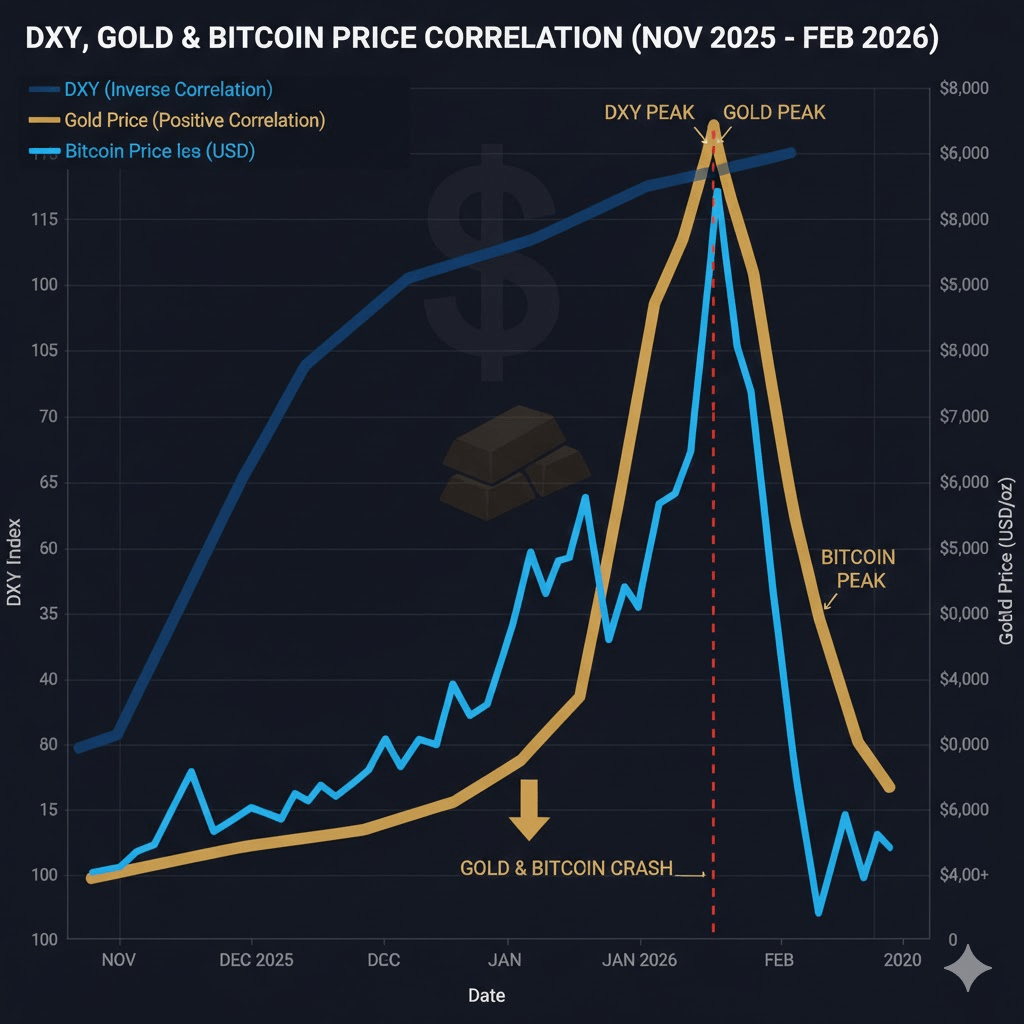

Historically, Gold and Bitcoin were seen as cousins. The narrative was that they’d both rise when people lost faith in the dollar. However, early 2026 has shown us a negative correlation.

When Gold falls, it often signals a shift in "Risk Appetite."

The "Risk-On" Rotation: When investors stop being terrified of immediate economic collapse, they sell their "defensive" assets (Gold) to fund "offensive" assets (Crypto).

The Result: A dip in Gold can actually be the starting gun for a Bitcoin rally, as capital seeks higher-growth opportunities.

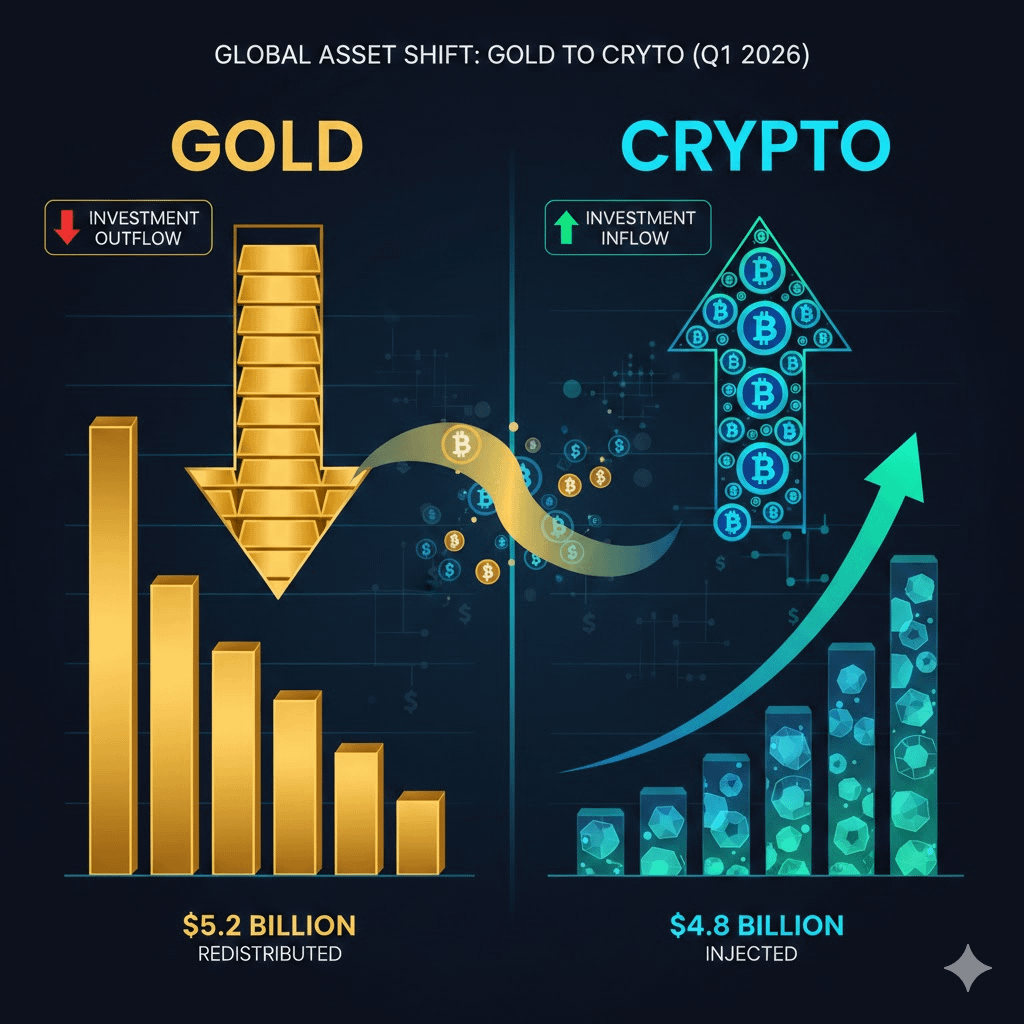

2. The "Digital Gold" Takeover

We are witnessing a generational hand-off. While central banks are still the biggest buyers of physical bars, the retail and institutional "smart money" is increasingly treating Bitcoin as the superior store of value.

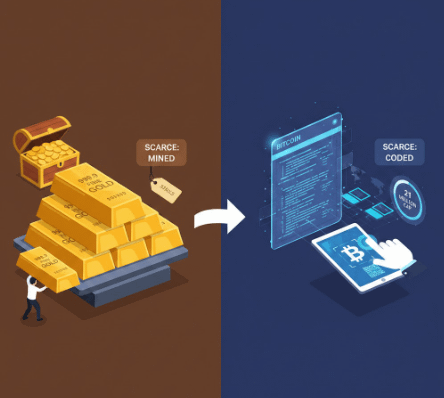

Portability & Liquidity: You can’t send $1 million in Gold across the world in 10 minutes for $5. You can with BTC.

Scarcity: Gold's supply increases whenever we find a new mine. Bitcoin’s supply is hard-capped at 21 million.

As Gold loses its luster, the "Digital Gold" narrative for Bitcoin grows stronger, attracting the liquidity that used to belong to precious metals.

3. The Shadow of the U.S. Dollar (DXY)

To understand why Gold is falling, you have to look at the U.S. Dollar Index (DXY).

Scenario A: If Gold is falling because the Dollar is getting stronger (due to high interest rates), this is a "Warning Signal" for Crypto. A monster dollar usually makes all other assets crypto included harder to pump.

Scenario B: If Gold is falling simply because of a "Sell the News" event or a rotation into tech, but the Dollar remains stable, it's a "Green Light" for a Crypto moon mission.

4. Institutional Margin Calls

Here is a "pro" tip for beginners: watch out for Liquidity Cascades. Sometimes, big hedge funds lose so much money on their Gold positions that they are forced to sell their Bitcoin to cover their losses (margin calls).

The Lesson: Don't panic if Crypto dips alongside Gold for 24–48 hours. This is usually "forced selling," not a change in the long-term trend.

🧭 How to Position Yourself

If you’re watching Gold slide today, don’t just stare at the price—stare at the volume.

Watch the Rebound: If Gold falls and Bitcoin stays flat (or goes up), the "decoupling" is real. This is incredibly bullish for the next 6 months of Crypto.

Check the Fed: Are interest rates staying high? If so, the "Gold Dip" might just be part of a broader market cooling.

Patience over Panic: Macro moves take weeks to play out. Don't trade the 5-minute candle; trade the 5-week trend.

Final Thought

Gold isn't the enemy of Crypto; it’s a mirror. It shows us how the "Old Guard" is feeling. When that mirror cracks, it usually means the "New Guard"—digital assets—is about to take center stage.