When I hear about a “new chain,” the pitch is usually the same: faster blocks, more TPS, lower latency. And yes, I care about speed. But I care way more about what happens after the hype, when real users show up, traffic spikes, and the chain has to perform under stress.

That’s why #fogo caught my attention.

Not because it’s trying to win the “fastest benchmark” contest — but because it feels like it’s being designed around stress tolerance and execution reliability, especially for trading-heavy environments. Binance Academy even frames Fogo as an SVM-based L1 optimized for decentralized trading and “performance + UX” — which is exactly the lane I’m evaluating it in.

Speed Isn’t the Flex Anymore… Staying Stable Is

I’ve watched this pattern too many times:

A chain launches → screenshots go viral → early activity spikes → real demand increases → congestion hits → fees jump → performance degrades → trust quietly leaks.

Infrastructure rarely fails because it lacked marketing.

It fails because it couldn’t hold up under load.

So when I look at Fogo, my main question isn’t “How fast is it on day 1?”

It’s: Does it stay predictable when things get chaotic?

Because that’s where real credibility is earned. Not on a clean testnet day — but on the messy days when traders are spamming transactions, users are bridging in, and apps are pushing the chain to its edge.

“Speed captures attention. Stability captures builders.”

The Part I Think People Are Underrating: Sessions

This is where @Fogo Official gets actually interesting to me — and it’s not a “TPS” point.

Fogo Sessions are positioned as a chain-level primitive that lets users interact with apps without signing every single action, using scoped permissions that expire automatically. In plain terms: you sign once, set the boundaries, and the app can operate inside those rules without constantly interrupting you.

And I love this because it tackles the most exhausting DeFi UX problem:

The DeFi Permission Trap (What I See Everywhere)

You usually get forced into one of these two extremes:

Sign every transaction → secure, but slow and annoying

Approve unlimited → smooth, but risky if something goes wrong

Fogo Sessions tries to sit in the middle.

“One signature. Clear limits. Automatic expiry. No hidden control.”

That sounds small, but in trading environments, it’s massive.

Trading is not one action. It’s dozens of small actions: place, edit, cancel, rebalance, manage collateral, repeat. If a chain is “fast” but my wallet interrupts me every 20 seconds, then the speed is just a marketing stat.

A Visual Way I Explain Sessions to Friends

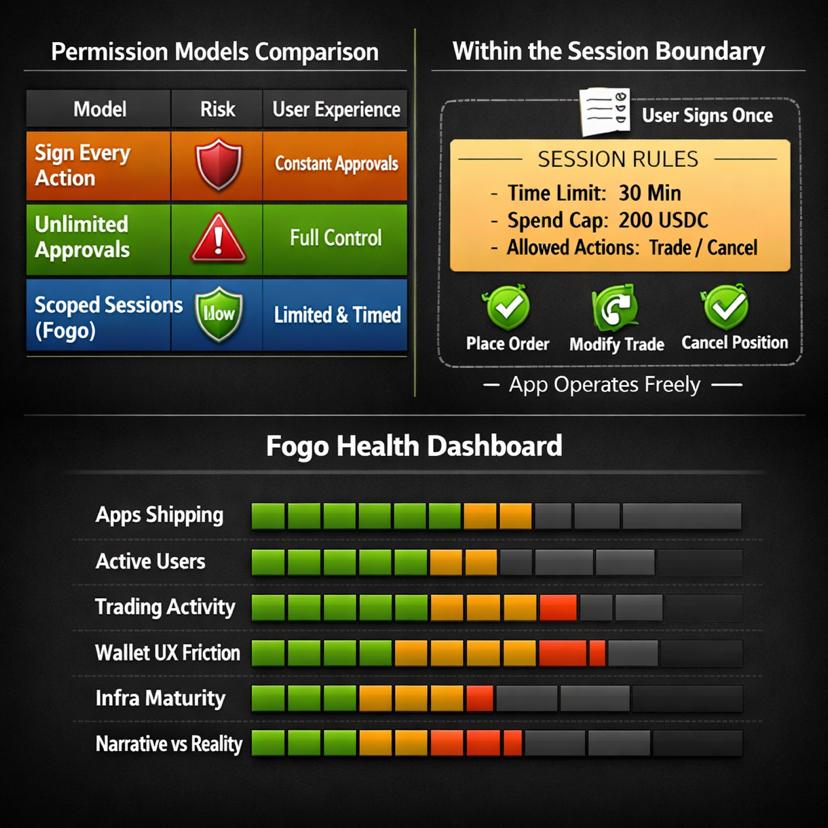

Permission Model Comparison Table

Sign every action

What it feels like: Constant pop-ups / approvals

Risk: Low

UX: Poor (slow + frustrating)

Unlimited approvals

What it feels like: Smooth and instant

Risk: High (too much access if something goes wrong)

UX: Good (but risky)

Scoped Sessions (Fogo style)

What it feels like: Smooth, but within clear boundaries

Risk: Medium–Low

UX: Best balance (fast + controlled)

Session Flow

User signs once

↓

SESSION RULES

Time window: 30 minutes

Max spend: 200 USDC

Allowed actions: Trade / Cancel

↓

App operates freely inside these limits

(Anything outside the limits = blocked)

The Real Test: Can Fogo Build Network Gravity?

Now I’m going to stay realistic, because I don’t do blind conviction.

Fogo is walking into a battlefield where ecosystems already have:

deep liquidity

mature tooling

sticky dev communities

powerful network effects

Builders don’t migrate easily. Liquidity doesn’t teleport overnight.

So for me, this is not a “narrative trade.”

This is an execution thesis.

I’m watching for signals like:

developer onboarding velocity

real apps shipping (not just “coming soon”)

consistent on-chain activity as load grows

validator + infra growth

ecosystem integrations that reduce friction

Fogo’s docs already show an ecosystem stack forming (oracle, bridge, multisig, explorer, indexer, RPC providers, data tooling), which is a good sign — because chains don’t scale on ideology, they scale on infrastructure maturity.

“Traction doesn’t need to be loud. It needs to be measurable.”

My Token Lens on $FOGO : Usage Density Beats Hype

I’ll say this the clean way:

Token value always resolves back to usage density.

If real apps deploy and users stick, demand forms naturally — fees, activity loops, liquidity behavior, and ecosystem gravity start creating “token pull.”

But if activity stays shallow, the market stops caring — even if the narrative is beautiful.

Now here’s the part I track that most people ignore: supply structure + unlock psychology.

Several sources reference a ~10B max supply and a large portion unlocked around genesis/mainnet timelines (with figures around the ~3.7–3.8B range being unlocked in some trackers). That doesn’t automatically mean bearish — it just means I want to be extra strict about whether usage is growing fast enough to absorb supply.

Quick Pressure Map (How I frame $FOGO risk vs adoption)

If Sessions adoption grows and the trading UX actually feels smooth:

I expect stronger user retention, more repeat actions, and a real “habit loop” forming on-chain.

If apps keep shipping and volume/TVL grows steadily (not just a one-week spike):

Token demand starts feeling earned — the ecosystem builds its own gravity instead of relying on hype.

If supply/unlocks increase but on-chain activity stays flat:

That’s where pressure shows up — weak absorption, possible sell-overhang, and price struggling to hold up long-term.

If the narrative gets loud but usage stays shallow:

I expect volatility first… then fading interest. Hype can move candles, but it can’t hold a structure without adoption.

“If traction builds, my conviction builds. If execution slips, my capital rotates.”

My “Fogo Health Dashboard” (The 6 Metrics I Track Weekly)

Here’s a simple scoreboard I keep in my own notes:

1) Apps shipping: ▓▓▓░░

2) Active users trend: ▓▓░░░

3) Trading activity: ▓▓▓░░

4) UX friction (wallet): ▓▓▓▓░

5) Infra maturity: ▓▓▓░░

6) Narrative vs reality: ▓▓░░░

I’m not pretending this is perfect data — it’s a framework that keeps me honest. Because the market is emotional, and I need systems that keep me rational.

The Bet I’m Actually Making (And It’s Quiet)

If Fogo pulls this off, the competitive edge won’t be “we’re faster.”

It’ll be: we feel better to use without sacrificing control.

That’s rare.

Most chains either optimize for benchmarks or optimize for vibes. Fogo is attempting something more practical: combine performance with permission design that reduces user fear and improves flow at the chain level.

And if the market truly moves into a phase where reliability becomes the flex again…

Fogo could end up being one of those projects that didn’t scream — it just kept working while others cracked.

“The next wave won’t reward the loudest chain. It’ll reward the chain that doesn’t flinch.”

Final Thought I’ll Leave You With

Speed will always trend.

But stability is what builders bet their reputations on.

So my real question isn’t “Will Fogo pump?”

My question is:

When activity gets violent again, which chains stay consistent — and which ones expose cracks?

That’s the cycle filter.

And that’s why I’m watching $FOGO