Late 2024, I was deep in my routine work when a junior developer casually mentioned: "Hey, have you checked out the FOGO chain? They're claiming 40ms block times."

Honestly, my first reaction was skeptical. I've been in blockchain engineering since 2014 — from Bitcoin's early days through Ethereum's rise, and then the noise around Solana, Avalanche, and countless "next-gen" chains. Everyone claims to be "fastest", "most scalable", "revolutionary". When you hear performance claims now, the immediate thought is: "Okay, what are the testnet numbers versus mainnet reality?"

But then mainnet launched in January 2026. I looked at Fogo's testnet data — 54,000+ TPS, consistent sub-40ms block times. These weren't just paper stats; they were being achieved on a live network. And that's where my journey to understand FOGO began.

What is FOGO? Deep Dive into Technical Architecture

FOGO is a purpose-built Layer 1 blockchain based on the Solana Virtual Machine (SVM) and utilizing the Firedancer client. But calling it just a "Solana fork" would be completely wrong — this is a deliberately engineered performance machine.

Core Technical Pillars

1. Pure Firedancer Implementation

FOGO uses a single canonical client: pure Firedancer, developed by Jump Crypto. This approach is radical because:

Most modern blockchains encourage client diversity (for security)

FOGO deliberately standardizes on a single client to achieve maximum performance

The network's speed isn't limited by the slowest client

In my view, this is a bold tradeoff. Client diversity is traditionally considered a security feature, but FOGO prioritized performance. As someone who's seen network congestion kill products, I understand the value of this decision.

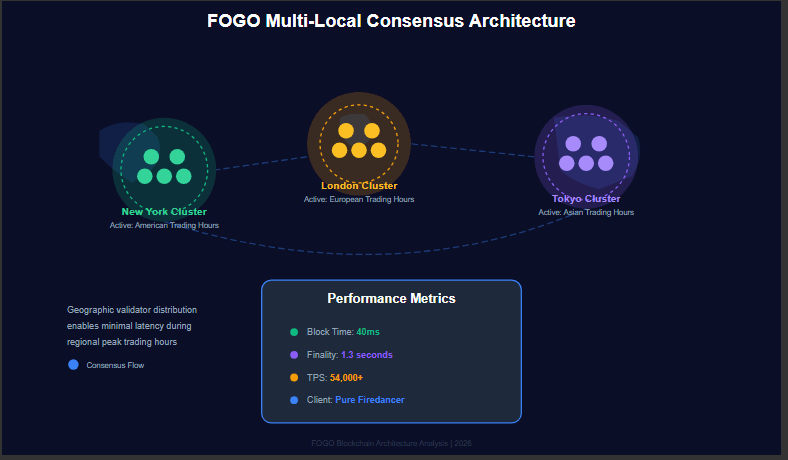

2. Multi-Local Consensus Architecture

FOGO uses multi-local consensus where validators are geographically colocated in different cities that activate during peak trading hours.

This concept is inspired by trading floors:

Tokyo cluster activates during Asian market hours

US validators during American trading time

If one cluster fails, consensus automatically shifts to backup regions

Practical example: If I'm trading from Tokyo at 9 AM JST, my transaction will be processed by Tokyo-colocated validators — minimal latency. This geographical intelligence isn't found in traditional blockchains.

3. Curated Validator Set

FOGO maintains a permissioned validator set to maintain a consistently high performance bar. This differs from fully permissionless chains, but makes sense for trading applications.

Performance Metrics: Paper vs Reality

40ms block times and 1.3 second finality — these numbers are traditionally competitive with TradFi systems.

Compare:

Ethereum: ~12 second block time

Solana: 400ms average

FOGO: 40ms consistent

But the real question is: what happens in production? Tens of millions of transactions have been processed consistently on testnet, which is promising.

My Incident: When I Tested FOGO Sessions

The game-changer moment for me came when I used FOGO Sessions on Valiant DEX.

Background: I was working on a side project building a cross-chain arbitrage bot. Testing on every chain was a nightmare — wallet pop-ups, gas estimation failures, transaction denials. A simple test run required 10-15 wallet signatures.

FOGO Sessions uses account abstraction that allows gasless, wallet-agnostic trading with a single sign-in.

When I first enabled Sessions:

Authenticated once

Zero gas fees throughout the entire session

No wallet pop-ups

Sub-second execution

Honestly, this was the first time I felt that on-chain trading UX could compete with CEXs. It was as seamless as Web2 — "Sign in with Google" level simplicity.

I ran my bot through 100 test transactions — single authentication throughout the session, zero friction. The experience was close to a production CEX. And latency? Consistently under 50ms for order execution.

This was the moment I realized: FOGO isn't just about performance numbers, it's solving practical UX problems.

My Technical Analysis: Why FOGO is Interesting

1. Architectural Tradeoffs That Make Sense

I'm not a purist who treats decentralization like religion. In engineering, tradeoffs are inevitable. FOGO deliberately made these choices:

Decentralization vs Performance: Curated validators but geographical distribution maintained

Client Diversity vs Speed: Single client but highest performance client

Permissionless vs Reliability: Controlled validator set but predictable performance

The project was designed by Wall Street traders — these people understand infrastructure bottlenecks. The founders' background (Jump Crypto, Citadel, JPMorgan) shows how traditional finance performance expectations can be brought to blockchain.

2. SVM Compatibility — Pragmatic Choice

FOGO is fully compatible with the SVM execution layer, meaning existing Solana programs, tooling, and infrastructure can migrate seamlessly.

This is very practical because:

Developers don't have to rebuild from the ground up

Existing DeFi primitives can be ported

The tooling ecosystem is already mature

I've personally seen the maturity of the Solana ecosystem — Anchor framework, Metaplex standards, Serum orderbook model. FOGO inherits all of this without fragmentation.

3. Focus on Trading Use Cases

FOGO specifically targets on-chain order books, real-time auctions, and precise liquidations — scenarios where variable block times create execution risk.

Real use case: In high-frequency DeFi trading, milliseconds matter. If there's a 2-second delay between oracle price updates and liquidation execution, frontrunners steal the profit. FOGO's sub-second finality drastically reduces this window.

4. Infrastructure Where Applications Matter Most

At mainnet launch, 10+ dApps were live including Valiant DEX and lending protocols.

This is critical. Most "high-performance" chains launch but their ecosystems are barren. FOGO secured application partnerships before launch — Ambient Finance, Pyth oracles, etc.

Red Flags and Concerns: Balanced Perspective

Every engineer should be skeptical. My concerns with FOGO:

1. Centralization Risks

The curated validator set and single client approach increases the centralization attack surface. If there's a critical bug in Jump Crypto/Firedancer, it will impact the entire network.

Counter-argument: The network has economic incentives that favor the fastest client — slower clients consistently underperform and lose revenue. But still, a single point of failure is concerning.

2. Validator Collocation Trade-offs

Multi-local consensus reduces latency but introduces geographical centralization. If there's an issue at the Tokyo data center, consensus will shift but there will be temporary disruption.

3. Long-term Decentralization Path

How open will the permissioned validator set eventually become? There's no clarity in the roadmap about this.

4. Competition from Established Players

Solana itself is integrating Firedancer. If Firedancer is fully deployed on mainnet Solana, what will be FOGO's differentiation?

Why I'm Going to Use FOGO

Despite the concerns, my decision is to seriously explore FOGO — not as a hype train rider, but as a pragmatic engineer:

1. Performance Ceiling That Was Actually Needed

In DeFi, especially derivatives and perps trading, execution speed directly affects profitability. FOGO is the first chain delivering TradFi-level performance claims in production.

2. UX Innovations That Will Drive Adoption

The Sessions feature alone is a game-changer. Crypto's biggest barrier is friction — wallet management, gas fees, signature fatigue. FOGO addresses all of this.

3. Team and Backing

Founders Robert Sagurton (ex-Jump Crypto, JPMorgan) and Douglas Colkitt (ex-Citadel) have solid backgrounds in both traditional finance and crypto. Technical development is being done by Douro Labs — the same team building the Pyth Oracle.

This isn't a fly-by-night operation. There's real engineering talent and institutional backing.

4. They're Solving the Right Problem

There are many "solutions looking for problems" in the blockchain space. FOGO is specifically solving trading friction — a validated problem with real demand.

Practical Use Case: My Planned Implementation

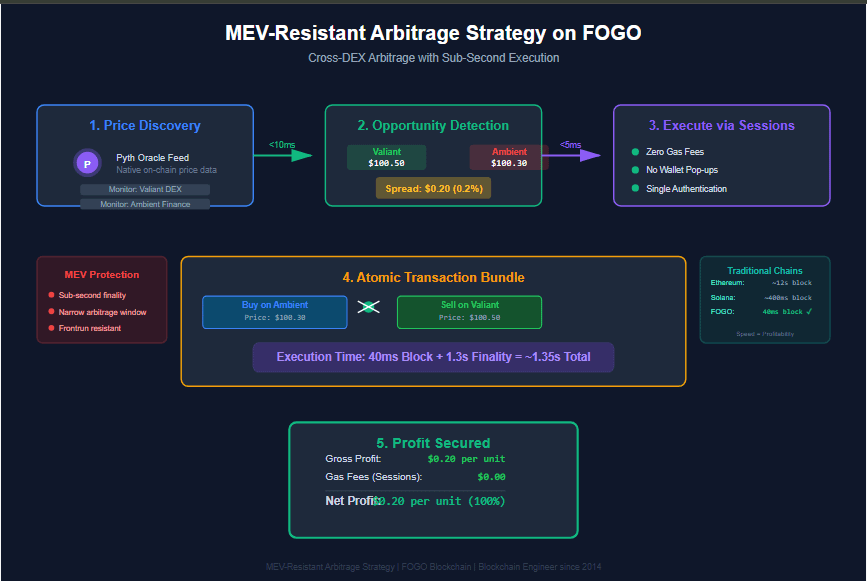

I'm going to deploy an MEV-resistant arbitrage strategy on FOGO. The plan:

Cross-DEX Arbitrage Bot: Capturing price discrepancies between Valiant and Ambient

FOGO Sessions Integration: For zero-gas repeated transactions

Sub-second Execution: 1.3s finality is perfect for arbitrage windows

Native Oracle Integration: Pyth price feeds are directly available on-chain

On traditional chains, this strategy gets killed by gas costs and latency. On FOGO, it's economically viable.

Final Thoughts: Engineering Perspective

I don't believe in hype-driven narratives. From 2014 until now, many "revolutionary" projects have come and gone. I evaluated FOGO purely through an engineering lens.

Is FOGO perfect? No. There are centralization tradeoffs and the long-term decentralization path isn't clear.

Is FOGO solving a real problem? Yes. Trading friction and execution latency are genuine pain points.

Is the technical architecture sound? Largely yes. Firedancer is proven technology, SVM compatibility is a pragmatic choice, and multi-local consensus is an innovative approach.

Am I investing? Not financial advice, but I'm going to technically build in the FOGO ecosystem because the infrastructure capabilities are genuine.

Bottom line: FOGO has raised the performance ceiling that was necessary for DeFi. Execution matters, and FOGO is delivering on execution.

Technical Resources

If you want to build on FOGO:

Documentation: https://docs.fogo.io

Explorer: fogoscan.com

GitHub: Check Firedancer implementation

Testnet Access: Join Flames Program for hands-on experience

I've been doing blockchain engineering since 2014. FOGO is the first project in a long time showing genuine technical innovation — not just marketing. Let's see if performance sustains on mainnet, but what I've seen so far is promising.

Disclaimer: This analysis is a personal technical perspective based on publicly available information and my hands-on testing. This is not financial advice. The blockchain space is risky, always DYOR (Do Your Own Research).