Hi traders,

One issue shows up again and again for market participants. Too many indicators produce misleading entry and exit signals. They look impressive on paper, but in real trading conditions they often add noise rather than useful insight.

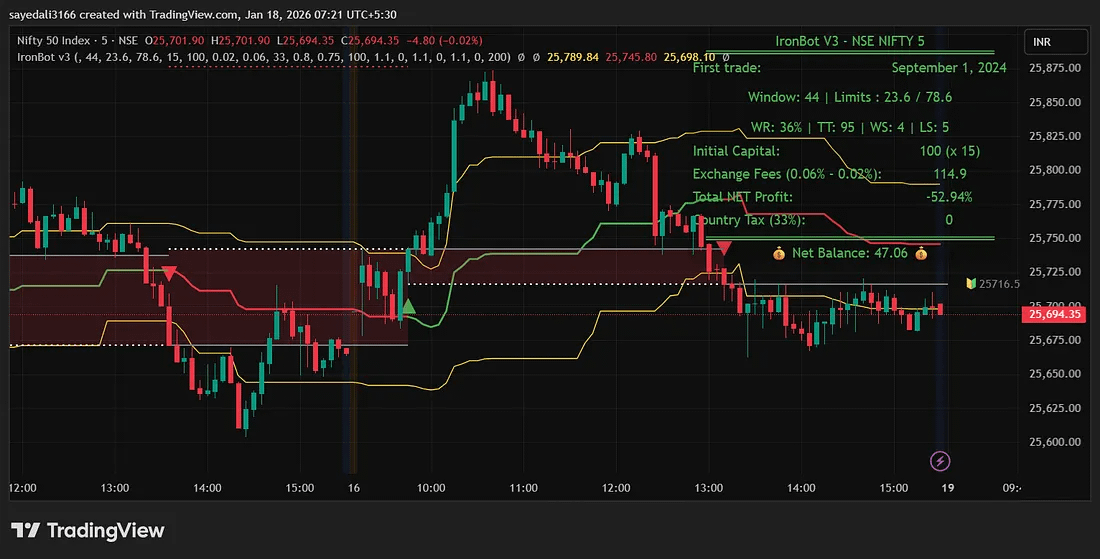

In this article, I am walking through a trading approach built around IronBot V3. This TradingView indicator is designed to filter out weak signals by first defining the dominant market direction, then validating momentum, and only after that issuing buy or sell alerts. Rather than responding to every minor price fluctuation, IronBot is built to highlight setups with higher probability. Below, I will explain how the indicator functions and how to apply it properly.

What Is the IronBot V3 Indicator?

IronBot V3 is a TradingView indicator that combines trend direction and momentum analysis into a single framework. Its guiding principle is straightforward. Only trade when direction and strength point the same way. Rather than producing constant, low quality alerts, IronBot begins by evaluating two core elements.

First, it identifies the prevailing market bias, whether price is operating in a bullish or bearish environment. Second, it measures the strength behind that move to determine if momentum is genuinely present. Buy or sell signals appear on the chart only when both of these factors confirm each other. This layered filtering significantly reduces the number of false entries.

Indicators Included in the Strategy

This approach relies on a paired indicator setup. The IronBot indicator on TradingView highlights potential long and short opportunities and also functions as a dynamic reference level that can be used for stop placement. The Iron Rod Trigger System complements it by displaying a momentum oscillator at the bottom of the chart, indicating whether buying or selling pressure is dominant. Together, these tools create a confirmation driven system rather than one based on assumptions.

Chart Setup and Timeframe

The strategy is applied on a three minute timeframe, making it suitable for scalping and intraday trading. Consistent results depend on disciplined execution and careful risk control.

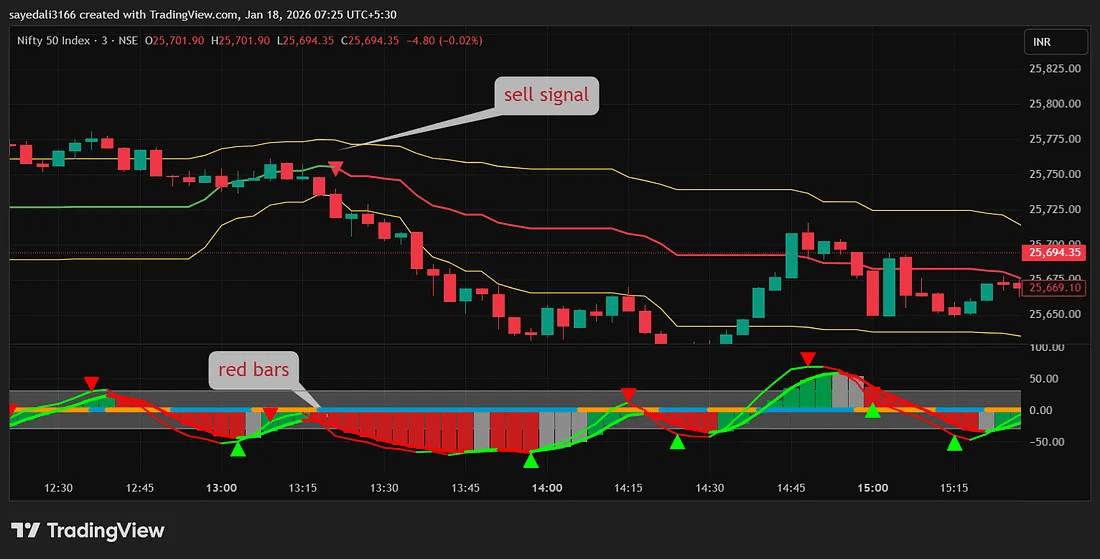

Short Trade Criteria

A sell position is considered only when every required condition is met.

Short Trade Conditions

-IronBot prints a clear sell signal on the chart.

-Price action confirms weakness through bearish candle formation.

-The Iron Rod Trigger System shows bearish momentum bars.

Trade Execution Rules

Entry is taken after the confirmation candle closes. The stop loss is placed above the upper boundary of the IronBot indicator, using it as a dynamic risk reference. The risk to reward structure is set at 1 to 1.5. When these guidelines are respected, past examples show price often reaching the target smoothly without excessive drawdown.

For anyone looking for additional material, my ebooks are now available on Gumroad.

Ultimate Trading Bundle 2025 with 12 Premium eBooks for Only $50 for a Limited Time

Search ‘Ultimate Trading Bundle 2026 Gumroad’ on Google

Stock Market Basics for Beginners priced at $15

20 Intraday Trading Methods for 2026 available for $15

25 Intraday Trading Techniques for 2025 priced at $20

15 Intraday Trading Indicators Explained for $15

Beginner’s Guide to Options and Futures 2025 priced at $20

10 Custom Buy and Sell Intraday Indicators for 2025 available for $25

CPR Master Class Training priced at $10

Candlestick Patterns and Indicator Guide for $15

10 Forex Short Selling Strategies available for $15

Five Proven Supertrend Strategies for 2026

How to Earn Your First $100 Online

A Practical Guide to Making Money on Medium

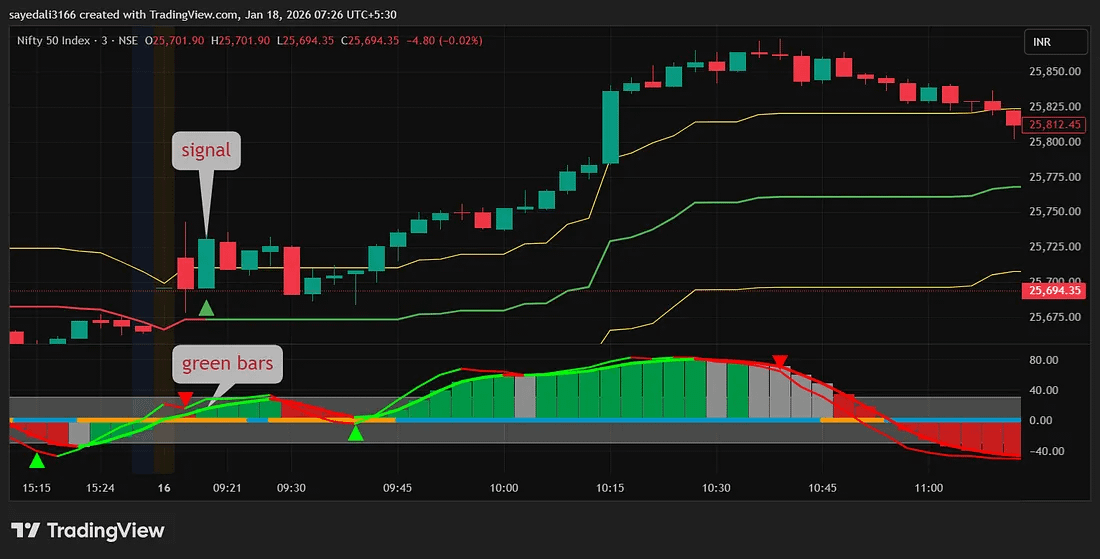

Long Trade Setup Explained Step by Step

A buy position uses the same criteria, applied in reverse.

Buy Trade Conditions

1. IronBot prints a clear buy alert on the chart.

2. Price action confirms strength through bullish candle formation.

3. The Iron Rod Trigger System displays bullish momentum bars.

Trade Execution Guidelines

The entry is taken after the confirmation candle has closed. The stop loss is positioned below the lower boundary of the IronBot indicator, using it as a dynamic support reference. The risk to reward framework is set at 1 to 1.5, which keeps downside controlled while allowing gains to extend beyond losses.

Why This Approach Outperforms Most Indicators

The edge of this strategy comes from layered confirmation. Trades are never triggered by a single signal. Trend direction, candle structure, and momentum must all align. This reduces impulsive trading decisions. A large portion of misleading signals is filtered out.

Because of this, IronBot V3 is particularly well suited for beginners seeking clarity, intraday traders who must act quickly, and scalpers who depend on accuracy.

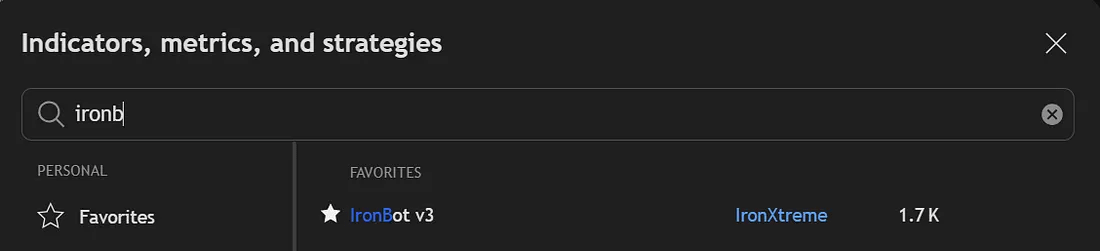

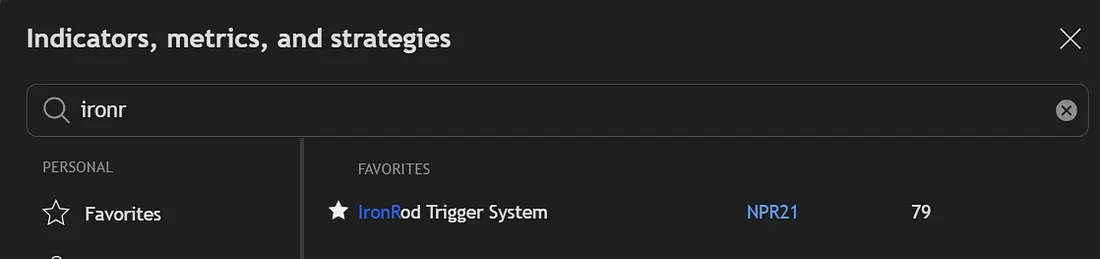

Setting Up IronBot V3 on TradingView

Follow these steps within the TradingView platform to get started.

Open the indicator panel in TradingView.

Type IronBot V3 into the search field.

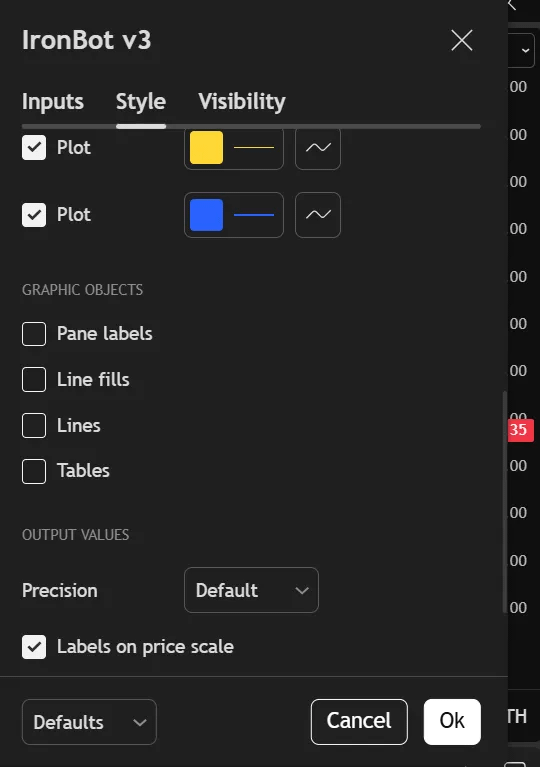

Select the indicator and apply it to your chart.

Customize the settings by disabling any features you do not need.

Search for the Iron Rod Trigger System in the indicator menu.

Apply it so it appears beneath the main price chart.

Once both indicators are active, the trading setup is complete.

Closing Thoughts

IronBot V3 is not a magic solution, but it succeeds where many indicators fall short.

It cuts through market noise.

It keeps trades aligned with the prevailing trend.

It enforces structured decision making.

It promotes sensible risk to reward execution.

When the rules are followed consistently and over trading is avoided, this system can serve as a dependable tool within an intraday trading approach.