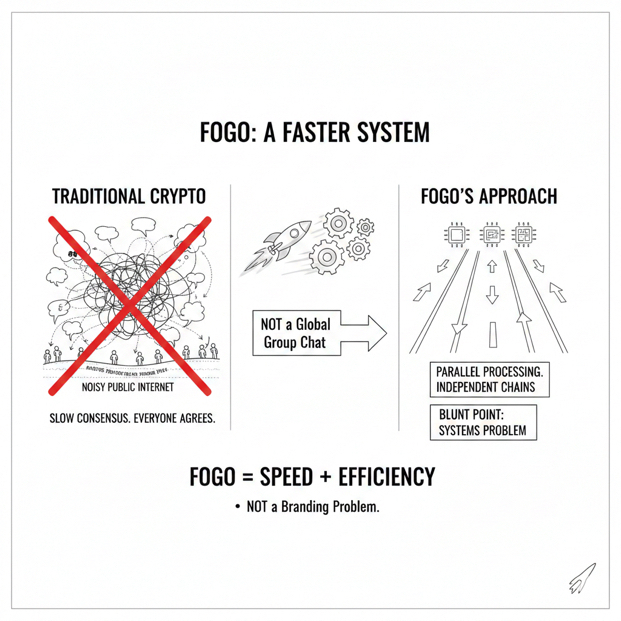

Fogo didn’t show up trying to win a popularity contest. It showed up with a fairly blunt point: most crypto feels slow because it’s built like a global group chat where everyone has to agree, in real time, over a noisy public internet. That’s not a branding problem. It’s a systems problem.

So the question worth asking isn’t “is Fogo fast?” Any chain can look fast under friendly conditions. The question is what Fogo had to change about the rules of participation to make speed the default instead of the exception.

When it went live in mid-January 2026, the launch narrative was tightly packaged: mainnet, listings, an airdrop, and a clean performance claim—around 40ms block times, plus early throughput numbers tied to its first mainnet app. Binance opened spot trading that day and tagged it as an early-stage, higher-risk asset. That detail matters because it tells you what kind of environment Fogo was entering: not a quiet rollout, but a liquidity event. Once people can trade, the chain’s first real test is usually market-driven chaos, not developer demos.

What separates Fogo from a lot of “fast chain” talk is where it puts its attention. It doesn’t spend much time trying to convince you that blockchain is important. It spends time on something most projects avoid saying out loud: the slowest validators drag down the whole experience. Not the average validator—the worst ones. The ones on weaker hardware, messy routing, bad tuning, or just in the wrong place geographically. That long tail is why a network can look fine in a benchmark and then feel sluggish when real users show up.

Fogo’s answer is basically: stop letting the slow tail define reality.

The first way it does that is by shrinking the “agreement circle” at any given moment. Instead of trying to have the entire world participate in consensus all at once, Fogo introduces validator zones. Only one zone is active for consensus in a given window, and the active zone rotates. Validators outside the active zone still sync the chain, but they aren’t voting or proposing blocks during that period, and they don’t earn consensus rewards while inactive.

That’s the heart of the design, and it’s where the trade-offs live.

If you’re an investor looking for the real risk profile, zoned consensus is the thing to stare at. It’s a performance technique, but it also changes what decentralization feels like in practice. At any moment, the chain’s “truth-making” power is concentrated in a slice of the validator set, not the full set. Over time it can still be broadly participatory, but in the moment it’s time-sliced.

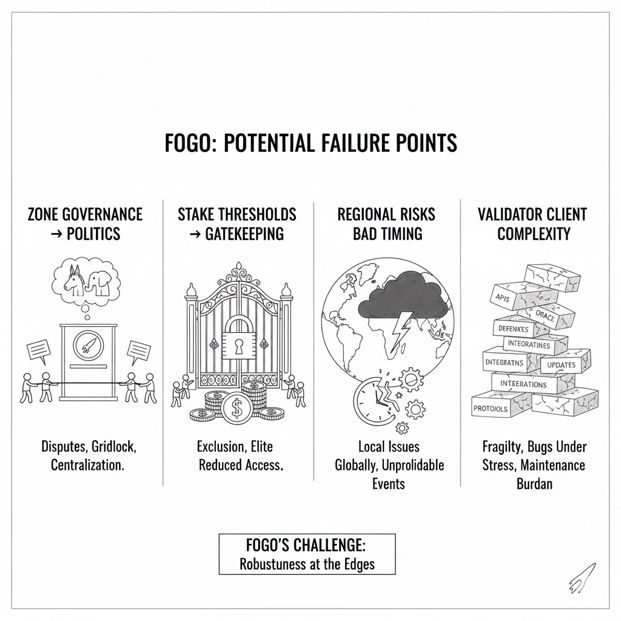

There are upsides: tighter geography usually means tighter latency. That’s the point. But you also inherit new sensitivities. Regional outages matter more. Routing events matter more. Jurisdictional and infrastructure concentration becomes more than a theoretical concern. And because zones can’t be allowed to become active with tiny amounts of stake (that would be asking for capture), the chain has to enforce stake thresholds for zones that are eligible to run consensus.

That enforcement is rational, but it reveals where power accumulates. Who defines zones? Who decides thresholds? How do assignments evolve if stake clusters in certain regions or among certain operators? These aren’t abstract governance questions; they’re directly connected to whether the “fast” experience stays honest over time.

The second way Fogo tries to control performance is by cutting down variance in validator behavior. Instead of treating the validator environment as a free-for-all, it leans hard into standardization. Its documents point to Firedancer—the high-performance validator client work in the Solana ecosystem—and then describe a hybrid production setup called “Frankendancer,” where Firedancer components handle certain jobs while other parts come from the mainstream Solana validator code lineage.

That reads like shipping reality: you want the performance edge, but you also want stability, so you bridge with a hybrid. The investor lens here is simple: hybrids can be useful, but they’re also messy. Mixing code paths expands the number of places subtle bugs can live. It also tends to create “complexity debt”—a stack that works, but only because a small group of engineers understand its quirks.

If you’re trying to gauge durability, the question becomes: does the client stack simplify over time, or does it stay in permanent “bridge mode”?

The engineering tone in Fogo’s materials is different from typical crypto writing. It talks about pinning processes to CPU cores, passing messages through shared memory queues, and avoiding extra copies—things you’d expect in low-latency trading infrastructure. That’s not proof of anything by itself, but it’s a signal that the team is thinking in the right unit of measurement: milliseconds that have to survive load, not slogans that survive a pitch deck.

Speed is only half the story, though. Trading UX breaks in other places: endless signing, fee friction, wallets that interrupt flow. Fogo tries to handle that by introducing a Sessions standard—basically a controlled way for a user to sign once and grant limited, time-bounded permissions via session keys stored locally. It’s trying to remove the “stop and approve” rhythm that makes on-chain trading feel clumsy compared to a centralized exchange. It also describes constrained fee sponsorship and flexible fee payment, which—if implemented carefully—can make the experience feel less like you’re constantly feeding a meter.

That’s a strategic move, not just a UX nicety. It’s Fogo saying: if the chain is going after trading behavior, it needs to compete on flow. Speed without flow is still friction.

There’s also a more institutional side to the project that’s worth noting: it published a MiCA-style crypto-asset white paper, framed around admission to trading and written in a tone that clearly anticipates regulatory interpretation. It explicitly positions the token as a utility asset used for protocol resources and staking, while disclaiming ownership rights or profit entitlements. Those statements don’t settle anything legally, but they do tell you the team expects to be judged under more formal frameworks than “community vibes.”

So where does that leave an analyst who doesn’t want hype and doesn’t want cynicism either?

The cleanest way to think about Fogo is as an attempt to build a trading-grade chain by accepting constraints other chains avoid. It’s trying to make low latency structural by (1) localizing the real-time consensus set and rotating it, and (2) standardizing the validator environment so the slow tail stops defining the network’s behavior.

That approach can work. It can also create predictable pressure points.

If it succeeds, it’ll probably be because the chain remains fast when it’s uncomfortable—when volumes spike, when a region has issues, when incentives pull validators in weird directions, when governance decisions get contentious. It’ll also be because the system doesn’t quietly collapse into a small club of operators who can afford the “right” setup.

If it fails, it’ll probably fail at the boundaries: zone governance turning into politics, stake thresholds becoming gatekeeping, regional risks showing up at the worst times, or the validator client stack accumulating complexity that eventually bites under stress.

Fogo doesn’t need you to believe it’s the fastest thing in crypto. It needs to show that its speed survives contact with markets, not just benchmarks. And the only way to judge that is to keep watching the operational reality: how the validator set evolves, how zone rotation behaves under real-world disruption, how quickly the client stack matures, and whether the “fast” experience holds up when the chain is being used the way liquid tokens are actually used—hard, inconsistently, and often at the worst possible moments.