Most Layer-1 token stories still feel familiar to me.

The chain wants users.

The community wants activity.

And the token is somehow supposed to capture value from all of it.

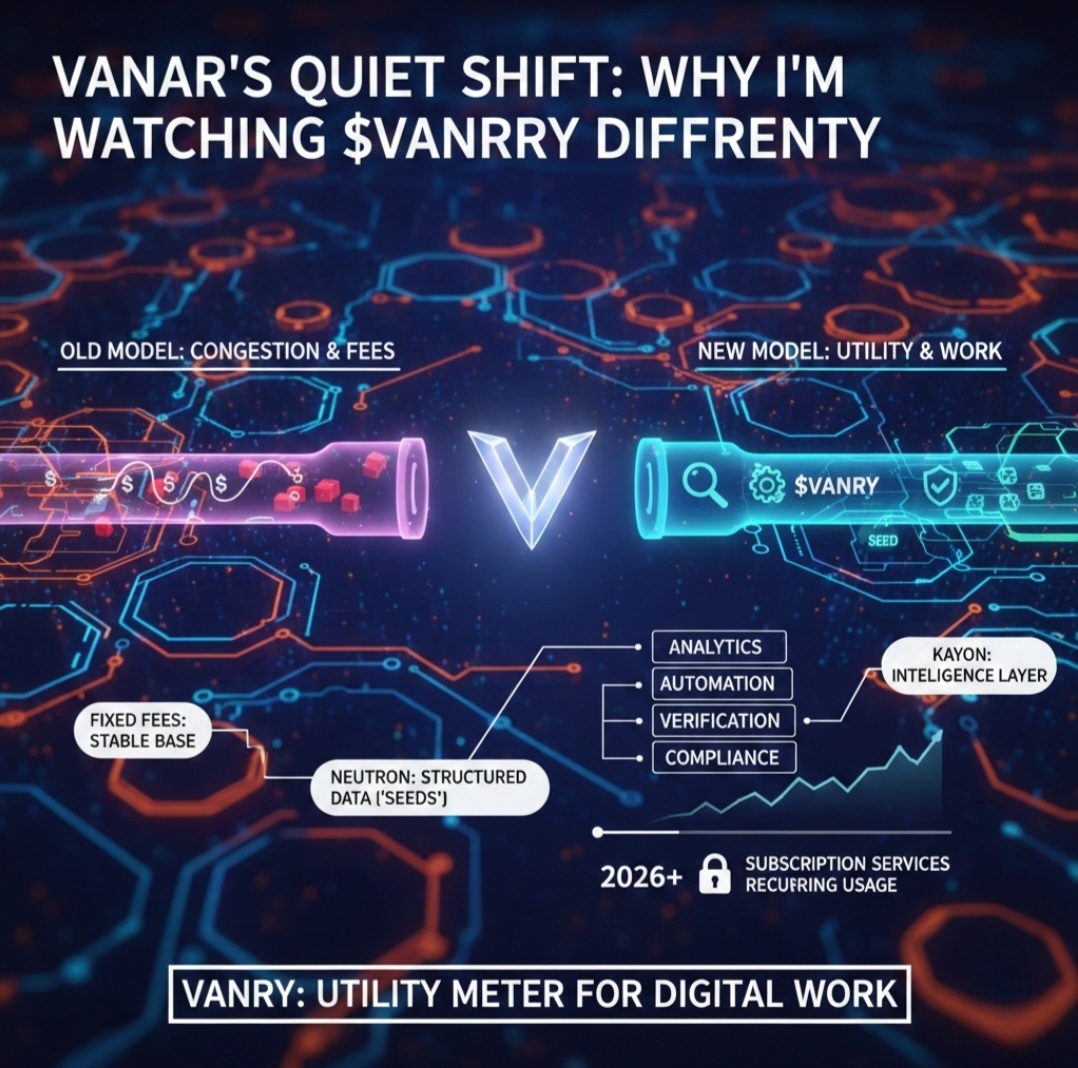

But in practice, many networks only really “earn” when the system gets stressed — when fees spike, blocks get crowded, and users start feeling friction. That has always felt like an awkward business model. It’s like building a highway that only becomes profitable when traffic turns into a jam.

What caught my attention with Vanar is that the team seems to be nudging the model in a different direction — quietly and gradually.

Instead of relying purely on blockspace demand, the architecture hints at something more familiar to the real world: paying for useful work, not just network movement.

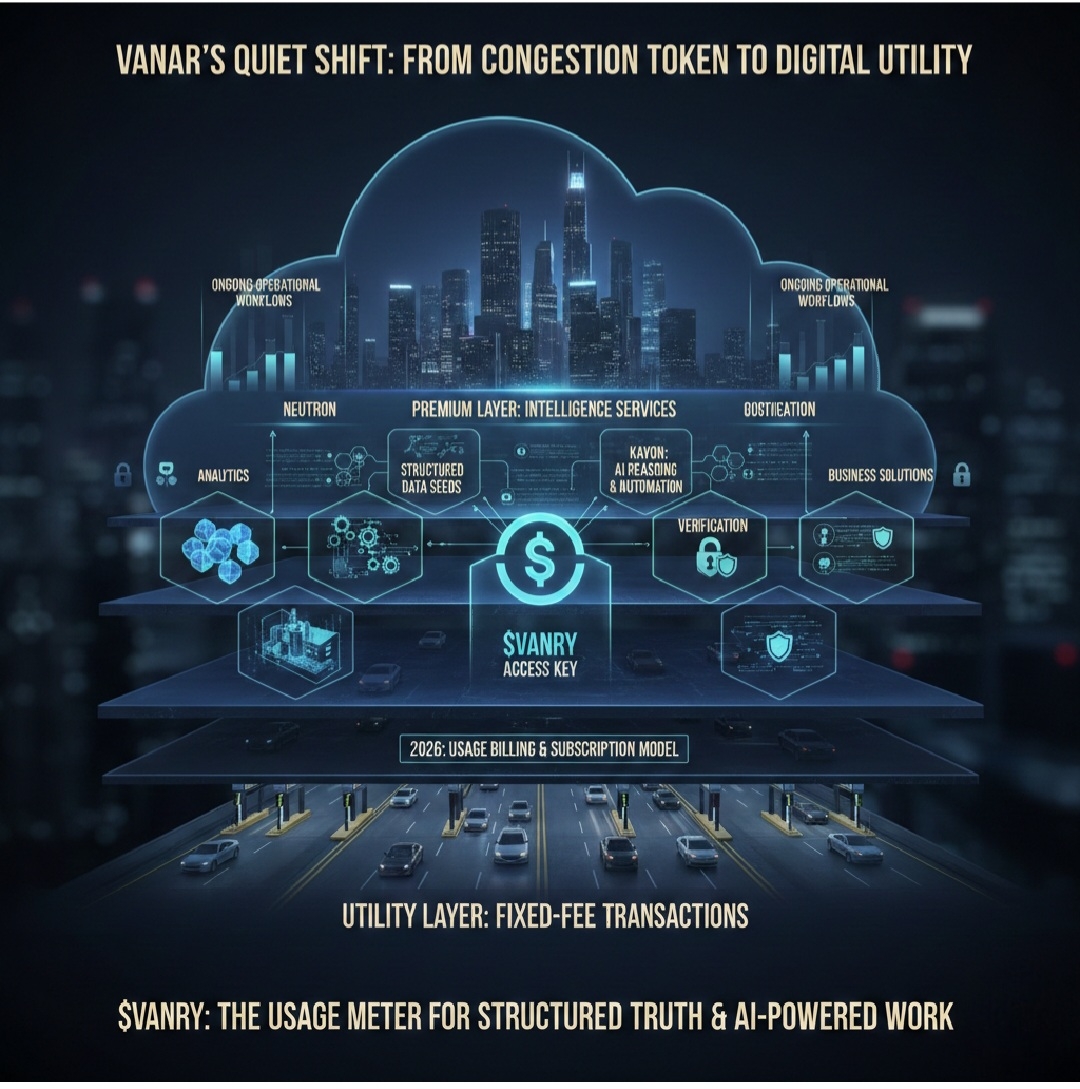

The part most people miss about fixed fees

Vanar’s fixed-fee approach is often discussed as a user-experience improvement. And yes, predictable costs absolutely help builders sleep better at night.

But to me, fixed fees are just the foundation, not the main story.

They solve chaos at the base layer.

They do not, by themselves, answer the bigger token question:

> If the network runs smoothly and cheaply… where does sustained token demand actually come from?

That’s where Vanar starts to look different.

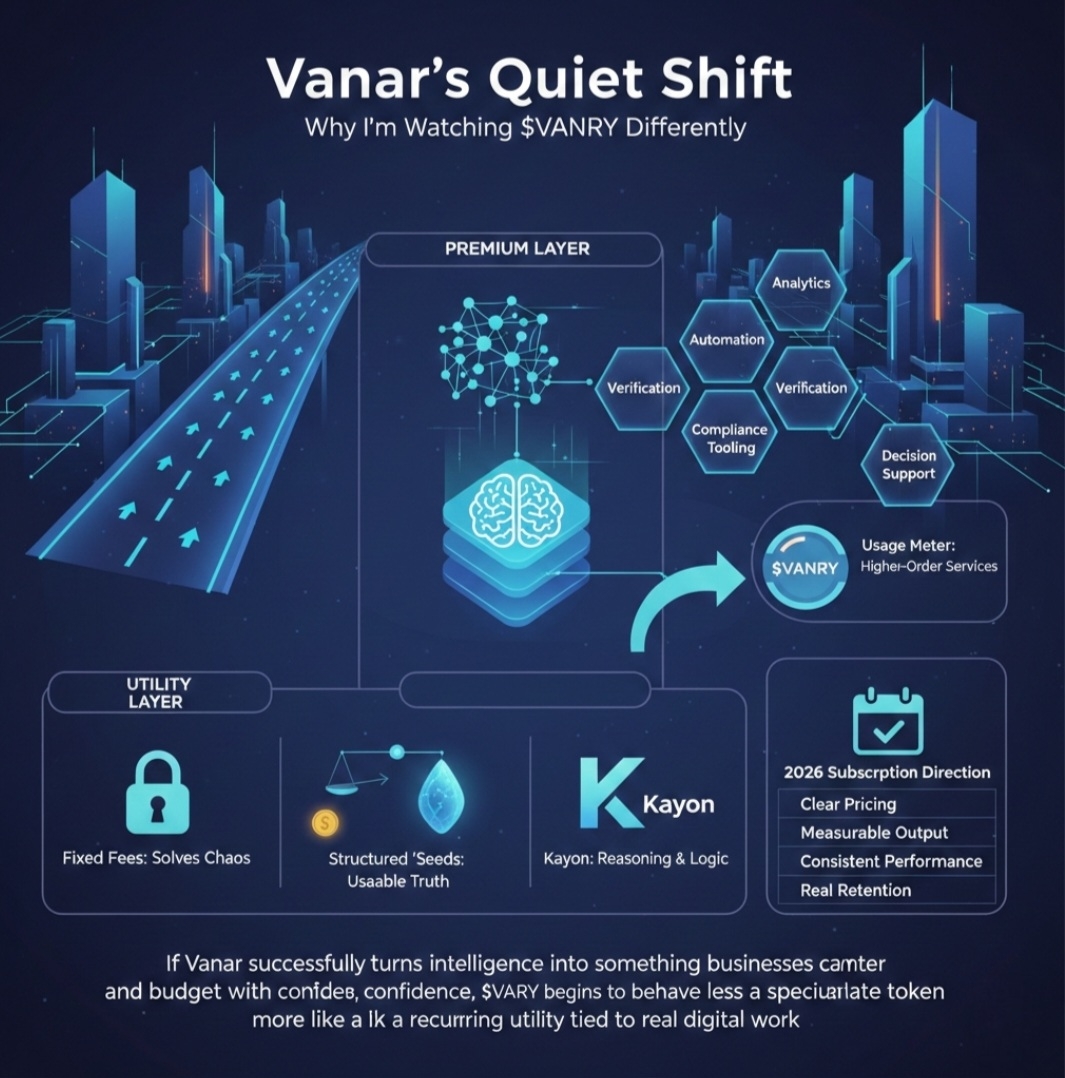

The mental model that made it click for me

The way I now think about Vanar is simple:

Transactions are the utility layer — necessary, but low margin.

Intelligence services are the premium layer — where real monetization can live.

In other words:

You don’t pay much to move.

You pay more when the network helps you understand, verify, or automate something valuable.

This is much closer to how cloud platforms make money in the real world. Basic access is cheap and predictable. Advanced capabilities are metered and billed based on usage.

If Vanar executes this properly, VANRY starts behaving less like a congestion token and more like a usage meter for higher-order services.

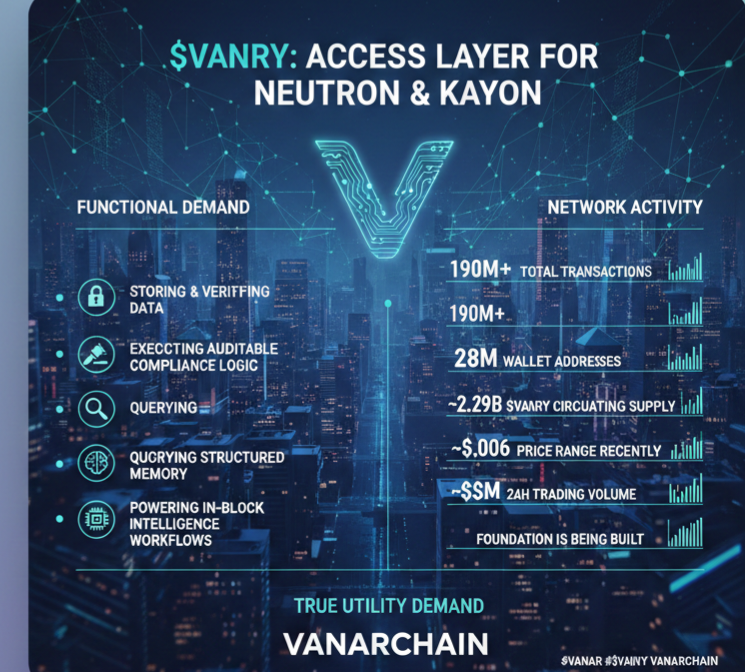

Why Neutron matters more than “storage narratives”

I’ve watched many storage narratives in crypto struggle because storage alone is easy to commoditize.

What’s more interesting in Vanar’s framing is the idea of turning raw data into structured “Seeds” that preserve meaning and can be queried efficiently.

From a business perspective, this is important.

Companies don’t really pay premium prices just to store bytes.

They pay to retrieve, verify, and use information reliably.

If Seeds truly become small, verifiable proof objects that applications and agents can work with directly, then the network is no longer monetizing raw storage. It is monetizing usable, structured truth.

That is a much higher-quality surface for value capture.

Kayon is where the real monetization battle will happen

If Neutron is about preparing structured memory, Kayon appears positioned as the layer that actually does something with it — reasoning, querying, compliance-style logic, and natural-language interaction.

This is the moment where the story becomes less “crypto native” and more familiar to traditional software buyers.

Because businesses already understand paying for:

analytics

automation

verification

compliance tooling

decision support systems

If Kayon can reliably sit in that category, then VANRY demand is no longer tied only to trading activity or DeFi cycles. It becomes tied to ongoing operational workflows.

That is a very different demand profile.

The 2026 subscription direction is the real signal

Recent ecosystem discussions around paid tooling and potential subscription-style access in the 2026 window are, in my view, more important than most headline metrics.

Why?

Because subscriptions force discipline.

Once you move toward usage billing and recurring payment models, the market stops rewarding pure narrative and starts demanding:

clear pricing

measurable output

consistent performance

real retention

It pushes the project closer to behaving like infrastructure rather than just another chain competing on throughput charts.

Where the model could still fail

I’m optimistic about the direction, but this path is not automatic.

Metered intelligence only works if developers can clearly see:

what they used

what it cost

and why it delivered value

If pricing feels fuzzy, adoption will stall.

If usage is hard to forecast, finance teams will hesitate.

If performance is inconsistent, trust erodes quickly.

In short, the cloud analogy only holds if the billing experience feels just as clean.

Execution, not architecture slides, will decide this.

Why I’m personally watching this closely

What makes Vanar interesting to me is not a single feature or metric. It’s the economic direction.

The project appears to be moving toward a world where:

fixed fees make base activity predictable

structured Seeds make data usable and measurable

Kayon creates a surface businesses might actually pay for

and VANRY sits in the middle as the access key to all of it

If that loop tightens over time, demand doesn’t have to depend purely on hype cycles or congestion spikes.

It can come from something much quieter — and historically much more durable — routine usage.

Strong takeaway:

If Vanar successfully turns intelligence into something businesses can meter and budget with confidence, $VANRY begins to behave less like a speculative token and more like a recurring utility tied to real digital work.