The time I saw a transaction go through in, under two seconds I did not feel impressed. I felt calm. That surprised me. When you deal with crypto you get used to feeling tense waiting around and wondering if the price will change before everything is settled. When I first looked at FOGOs block times which're about 40 milliseconds and finality which is roughly 1.3 seconds what really caught my attention was not how fast it was. It was how that speed affects the way people make decisions. FOGOs speed does something to the way people behave with money.

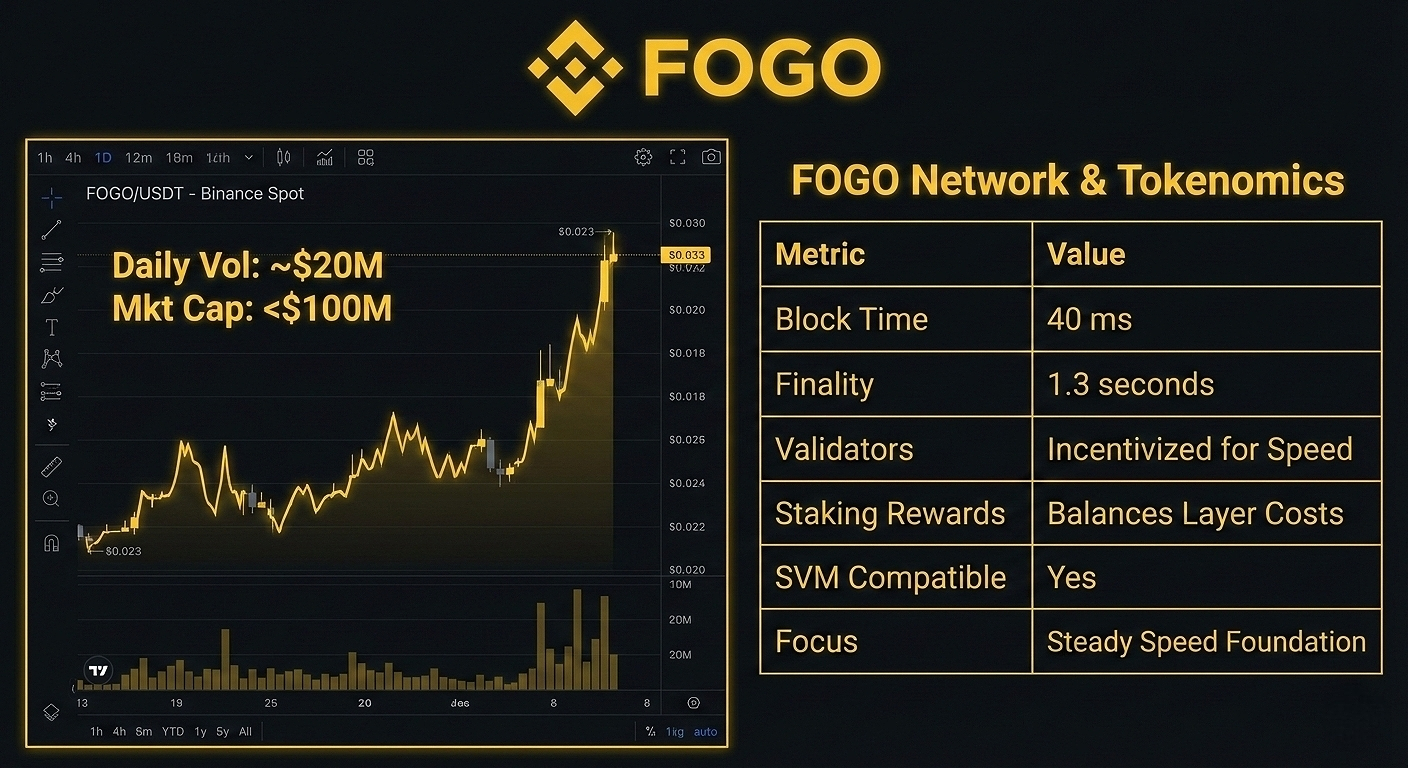

Now the $FOGO token is trading at around $0.023 on the Binance exchange. The daily volume of the FOGO token is fluctuating near $20 million.

For the FOGO project, which's still under a $100 million market cap this level of liquidity is really something. The FOGO project is not a ghost chain because it has turnover.

At the time the FOGO project is not yet saturated with people speculating about it. This middle ground is a testing phase for the FOGO project.

In this testing phase the infrastructure of the FOGO project and the design of the FOGO token are more important than the headlines, about the FOGO project.

So when we talk about forty milliseconds per block that is like twenty five blocks per second. This means that transactions get added fast.. What this really does is make the time that traders have to make a decision a lot shorter. If you send an order on the blockchain and it gets there in like a fraction of a second you do not have to worry much about the price changing. In markets that're all over the place a difference of two hundred milliseconds can really affect how well your transaction goes through. When you think about thousands of transactions you can see how waiting a little bit can cost you money and that is why latency is a big deal for transactions, for blockchain transactions.

So finality is really important it is more important than how many blocks are produced. It takes 1.3 seconds for finality. Confirmation is one thing. Finality is another thing. When we have finality our money is not stuck in a state of uncertainty. This creates another effect. People who provide liquidity can use their money again faster. People who do arbitrage can make their deals tighter. Developers can make applications that work with settlements that're almost instant. Finality is what makes this all possible it is what makes capital move freely and finality is what makes developers design applications with settlement in mind and finality is really important, for this.

So speed is not the thing that keeps a network going. The important thing is the economics of the people who validate transactions. When you are making blocks fast you need super powerful computers and a network that is really fast too.. That costs money. So you need to give the validators a reason to do it. FOGOs system for handling its tokens, which they talked about in their blog posts tries to make sure that the people who validate transactions get rewards that will keep them working with the network for a time instead of just trying to make a quick profit, with FOGOs tokenomics and FOGOs system.

On the surface staking rewards are really good for validators.. What is really important is that they also pay for the basic layer that makes it possible to have blocks that are only 40 milliseconds. If the rewards are too high it can cause problems with the price because of inflation. If the rewards are too low then validators do not want to participate. @Fogo Official is a company with a valuation of less, than 100 million dollars. So when new tokens are added to the system it has an impact. This is the problem that tokenomics has to deal with. It has to do it in a way that is not noticeable.

The thing that helps us understand why the current market metrics are important is that they show us what is going on. The daily volume of the market is around twenty million dollars, which means there is money moving around to make big trades without the price moving too much. The price of the thing is zero point zero two three dollars so if more people start using the network the price could still go up a lot. Some people are starting to pay attention to this. They are not getting too excited. This feels like a thing that is happening, rather, than something that is being pushed on people. The market metrics of the market matter because they give us an idea of what is going on with the current market.

The Solana Virtual Machine is also compatible with this system. This means that developers who already know how to use Solana can just use it without having to change everything. This is really helpful because it saves them a lot of work. When it is easy to switch more people will actually try out FOGO. If some of the DeFi protocols that can handle a lot of transactions decide to use FOGO then people might start using it for real things instead of just buying and selling. The Solana Virtual Machine compatibility is a deal because it makes it easy for developers who, like Solana to use FOGO. This can help FOGO become a place where people use it for applications not just for trading.

The big problem with this is decentralization. When we make the validators work fast we often have to choose what is important or put them in the same area to make things happen quickly. People will say that this means we do not have many validators in different places and that can be bad for the whole system. This is a concern. If a network prioritizes speed much over having validators, in many different places it might have trouble staying strong when things go wrong. Decentralization is what makes the network strong so we have to be careful not to lose that when we try to make it faster.

People who buy and sell things on markets usually show what is important to them. Traders want to know that their transactions will go through for sure. Developers want to know when their transactions will be added to the system and when they will be settled. If FOGO can make sure that blocks are processed in, than 50 milliseconds even when the system is busy and if the people who validate transactions get paid fairly then more and more people who use FOGO will think that the way it works is okay. FOGO has to deliver this performance all the time. The users of FOGO will like it if FOGO can do what it promises.

The crypto market is changing. At first people talked about crypto. How it was decentralized. Then they started talking about how many transactions could happen at the time. Now people are looking at how crypto actually works. They want to know how quickly a crypto transaction is completed. They also want to know if it always gets finalized.. They are looking at how much money is just sitting there waiting for confirmation. The crypto market is looking at execution quality and microstructure of crypto. How fast does a crypto transaction land. How consistently does a crypto transaction finalize. How much capital remains idle, during crypto confirmation.

FOGO is right in the middle of that shift. This asset is worth about $0.023. It has around $20 million in daily trades. It is not making news but it is really part of the money moving around. FOGO has a market value of, than $100 million so its worth can change a lot if more people start using it. If more people start using FOGO and the fees that come with it go up the FOGO token might become more valuable.. If people stop using FOGO it could get harder to predict what will happen to the price and it might even go down.

We have to wait and see which path is going to be the best. The competition, between the players is really tough. Solana is still working on making its system better. The bigger ecosystems have money moving around and more developers who are already working with them. FOGO needs to show that it is actually better and not just a bit different.

When I take a step back I see the importance of discipline. The way that the system works is that blocks are produced every 40 milliseconds and then it takes 1.3 seconds for everything to be finalized. The way that tokens are given out is also very structured. This all comes together to create a plan for the economy. Speed is not something that happens on its own it is actually helped by the economics of the system. The rewards that validators get are used to pay for hardware. This hardware is what makes it possible to have low latency. When latency is low it attracts applications. These applications then generate fees. The fees that are generated help reduce the need, for emissions. The discipline of the system is what makes all of this work together. The blockchain and its token incentives are a part of this discipline.

If this is true FOGO is not really about being the chain it is more about being a chain where the speed feels steady. The difference, between these two things is not that big. When something is really fast it can get a lot of attention.. When something has a steady speed it can hold things together and make ecosystems stronger. FOGO is steady speed, which is what can really anchor ecosystems and make them work well.

And in markets, it’s often the steady foundations that outlast the noise.