Most Layer-1s leave core trading infrastructure to dApps and external middleware. Fogo’s differentiator is that it’s being designed around market structure itself: it integrates an “anchored” order bookconcept and native oracle infrastructure at the protocol level to reduce fragmentation and dependence on third-party services.

Why that’s a big deal: in on-chain markets, latency and data integrity aren’t just performance metrics, they decide execution quality. If price feeds are delayed or fragmented across multiple oracle providers, traders can face inconsistent mark prices, wider spreads, and higher liquidation risk. By making oracle and trading-centric components more “first-class,” Fogo is signaling that it wants to be a chain where order-book DeFi and real-time settlement feel closer to professional trading systems than typical on-chain UX.

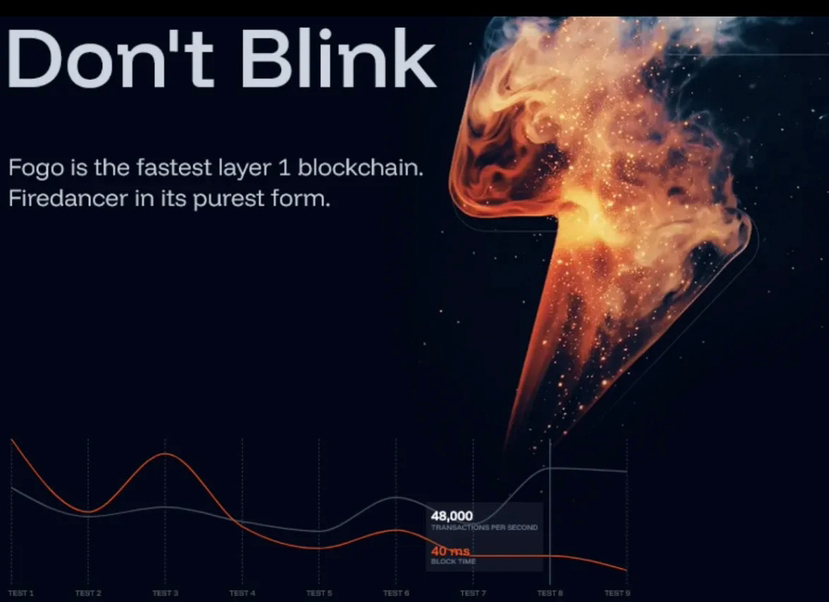

This direction aligns with Fogo’s broader positioning as a high-speed SVM-based Layer-1 targeting sub-40ms block times and near-instant finality optimizations that matter most when apps are sensitive to milliseconds (perps, spot order books, market making).

And with Binance listing it under a Seed Tag, the project is clearly early-stage but already drawing attention because it’s optimizing for a specific high-value use case: serious on-chain trading.