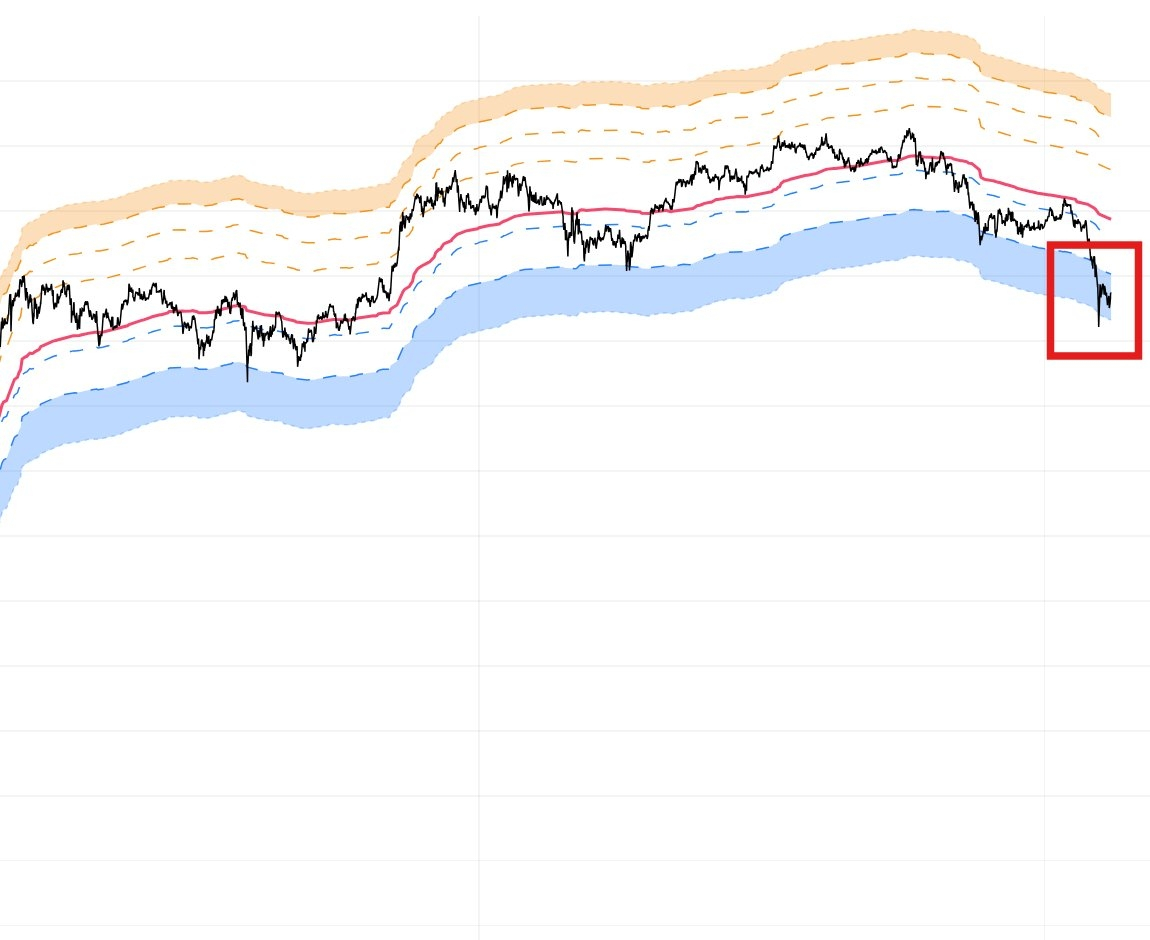

⬆️ The chart shows BTC short-term holder cost basis std dev bands , Price dropped to -1.5SD (blue zone) & bounced Notably, price hadn’t been this low in 3 yrs – a statistical outlier for STHs

This doesn’t guarantee a structural bottom though ,If volatility spikes or selling persists, further drop below -2SD is possible

Today’s market has unique factors (ETF flows, institutional involvement, macro liquidity) ≠ past cycles, so relying solely on history is tricky

In short: -1.5SD suggests oversold territory, but best to pair with other indicators & market structure before calling a support/trend shift. Caution advised

BTC market shift: price dropped to levels unseen in a while. Some analysts hint this could be the end of fear & start of a new rise

Causes of drop ⬇️

- Global economic downturn: rising rates + liquidity squeeze fears

- ~$3B outflow from BTC ETFs

- Risk asset sell-off: investors pivoting to safer havens

Recovery signals ⬇️

- Funding rates hit 3-yr lows – possible buy signal?

- Institutional buys: BlackRock & co. accumulating

- Political backing: Nigel Farage & others backing BTC

#MarketRebound #Bitcoin❗ #MarketCorrection