The quieter BTC gets, the louder the next move will be.

Right now, Bitcoin is doing something that makes experienced traders lean forward in their chairs it’s compressing.

Price isn’t trending.

It isn’t impulsing.

It’s coiling.

And in markets, compression leads to expansion.

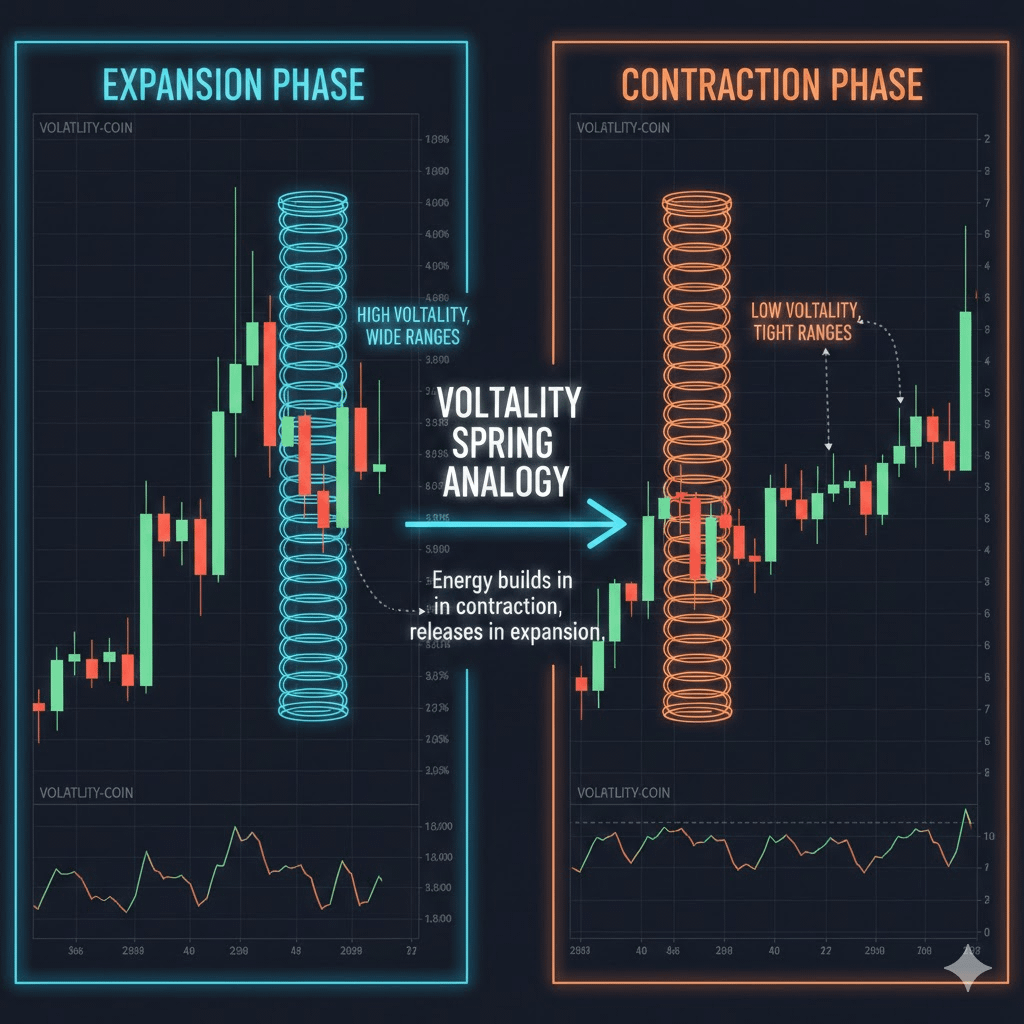

The Volatility Contraction → Expansion Thesis

Markets move in cycles:

Expansion (strong trend, wide candles, emotional moves)

Contraction (tight range, low volatility, indecision)

We’re currently in contraction.

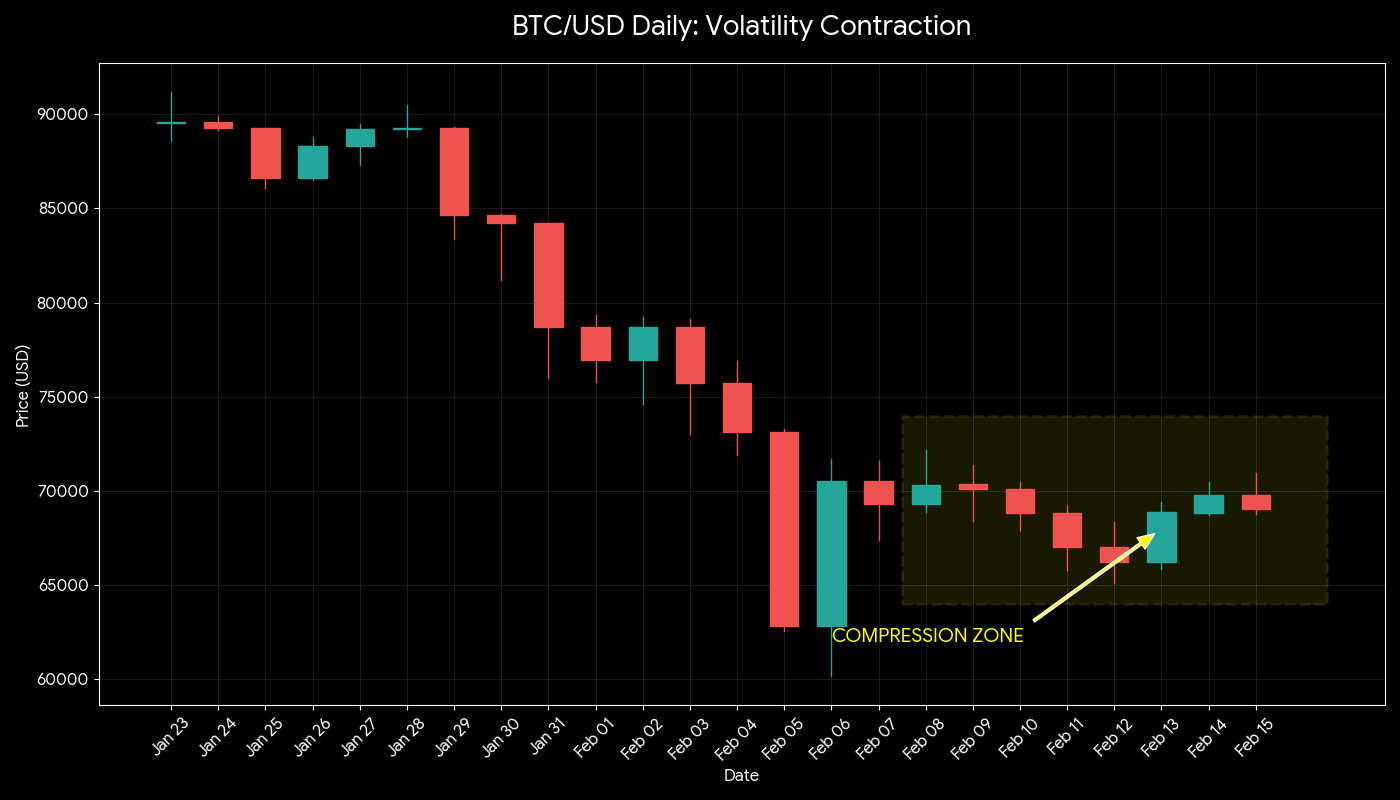

You can see it clearly:

Lower highs pressing down

Higher lows squeezing up

Smaller daily ranges

Volume gradually declining

This creates a volatility squeeze like a spring being compressed.

The longer the compression lasts,

the more violent the release tends to be.

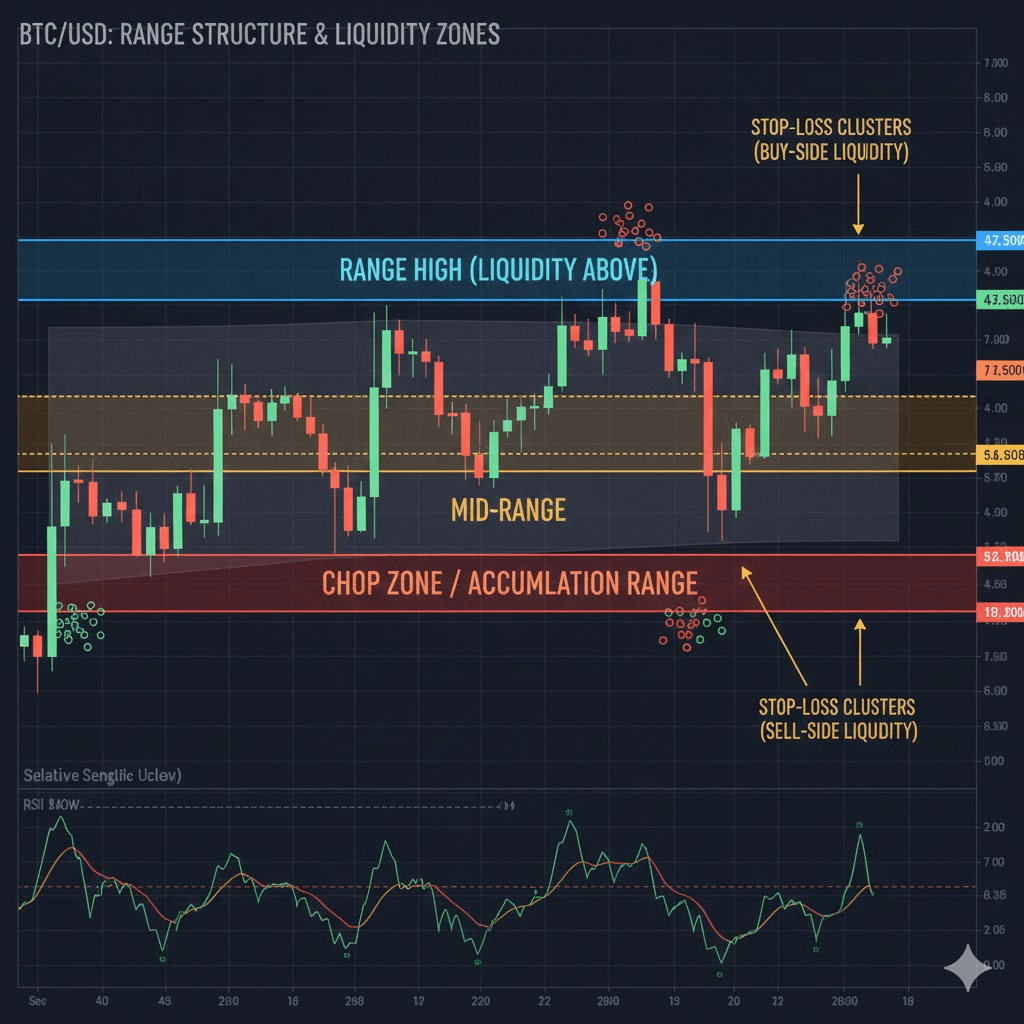

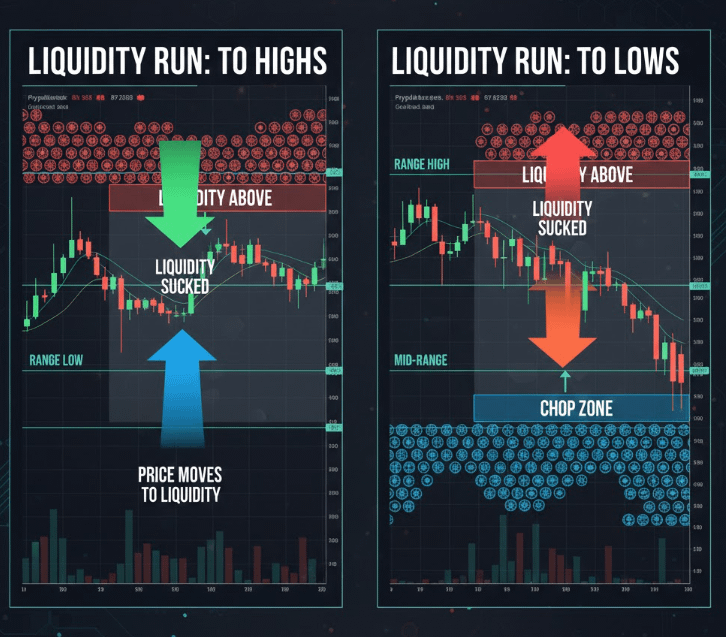

The Range Everyone Is Watching

BTC is trading inside a clearly defined structure:

Range High: The area where price repeatedly rejects

Range Low: The area where buyers step in

Mid-range: Chop zone (where traders get destroyed)

This structure matters because:

Stops are building above the highs

Stops are building below the lows

Liquidity is stacking on both sides

And markets are liquidity-seeking machines.

Where the Liquidity Sits

Above the range:

Breakout buyers waiting

Short stops clustered

Momentum traders ready to pile in

Below the range:

Long stops

Late buyers trapped

Panic sellers waiting

This is why the breakout won’t be polite.

It will be engineered to hurt the most participants possible.

Scenario Planning (This Is Where Traders Win)

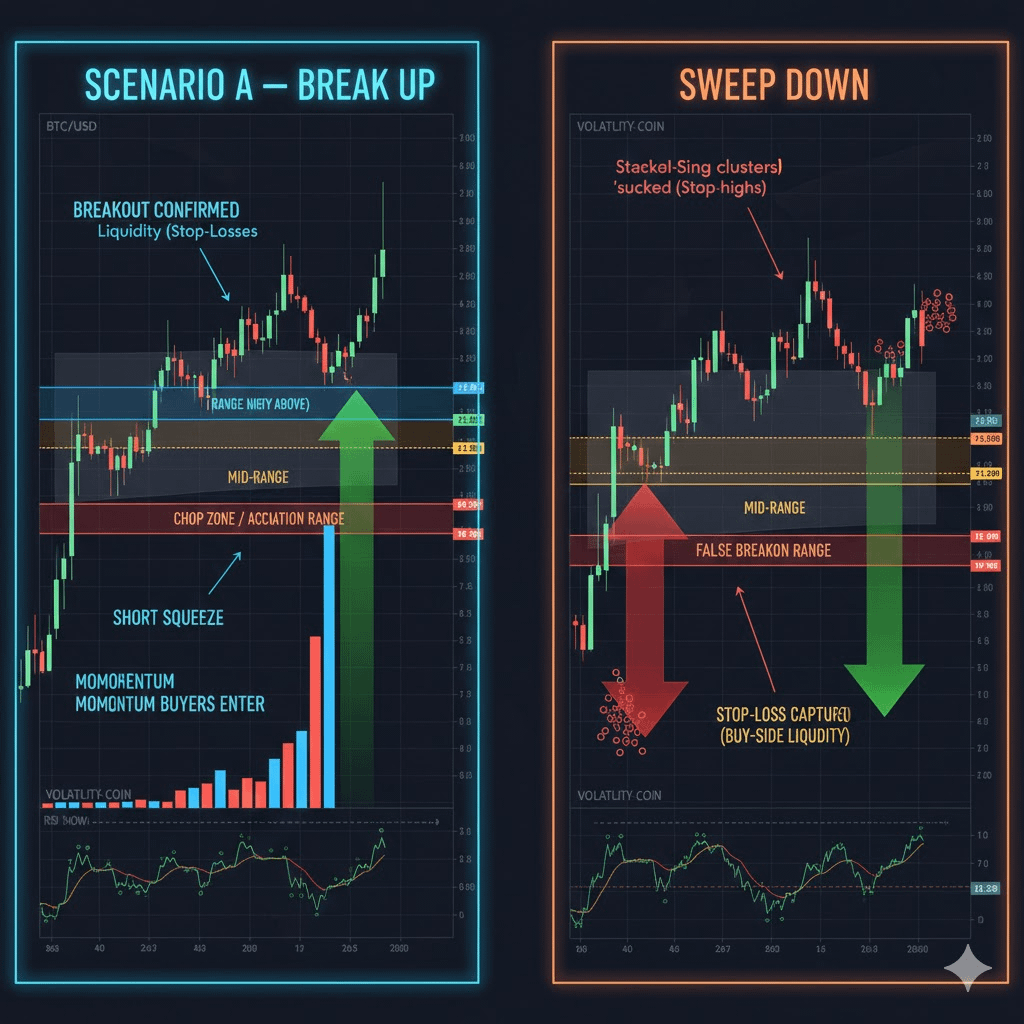

🟢 Scenario A: Clean Break Up

If BTC breaks and holds above range high:

Shorts get squeezed

Momentum algorithms activate

Volume expands aggressively

This can lead to a fast impulsive leg higher.

In this scenario:

Pullbacks become buying opportunities

Market structure shifts bullish

You don’t chase blindly.

You wait for confirmation and structure.

🔴 Scenario B: Liquidity Sweep Down First

This is the more painful path.

Price could:

Fake a breakdown

Sweep the range low

Trigger long stops

Induce panic

Then reverse violently upward.

This is classic market behavior.

Weak hands sell the bottom.

Strong hands absorb liquidity.

If this happens, the reversal will likely be sharp and emotional.

Why This Setup Matters

When volatility compresses:

Risk becomes definable

Invalidation levels are clear

Reward-to-risk improves

Breakout environments are where trends are born.

But prediction is dangerous.

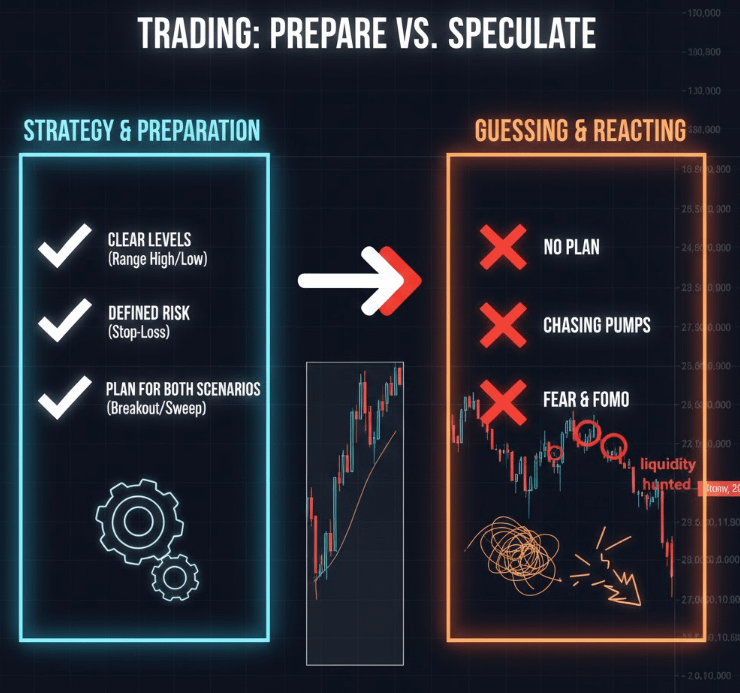

Positioning > Prediction

You don’t need to guess direction.

You need:

Clear levels

Clear invalidation

Predefined risk

A plan for both outcomes

Because when Bitcoin expands out of this range,

it won’t ask for permission.

It will move fast.

It will punish hesitation.

And it will reward preparation.

The quieter BTC gets…

The louder the next move will be.