1. The 2026 Hinge Year: Deconstructing the Official Narrative

I am convinced that we have reached what I define as a "hinge year"—a fundamental pivot point in global macroeconomics that renders the market playbooks of the last 50 years obsolete. As a strategist, I am observing a violent chasm between the institutional rhetoric and the empirical reality of the markets. While official channels project a choreographed narrative of "everything under control"—insisting that debt levels are manageable, inflation is contained, and the Euro remains a stable refuge—the actions of sovereign actors tell a far more sobering story.

When central banks, such as Poland’s, engage in the massive, aggressive accumulation of gold, they are signaling a total lack of confidence in the very system they represent. This is not the behavior of institutions that believe the monetary architecture is solid; it is the behavior of those preparing for a structural break. We are not merely witnessing a decline; we are diagnosing a silent deterioration where the financial system is cannibalizing its own foundations, hollowing out the middle class, and fracturing the trust required for fiat stability. This decay is ignored by the masses until it is too late, just as it was in 2008. The current cycle has shifted; the "boring" metals are no longer stagnant. Silver has already seen its value multiplied by ten since the COVID-19 era, yet the mainstream remains largely oblivious. This disconnect marks the definitive transition from systemic risk to the absolute necessity of precious metals as the primary defense mechanism for wealth preservation.

2. The Dual-Engine Nature of Silver: Industrial Utility vs. Monetary Hardship

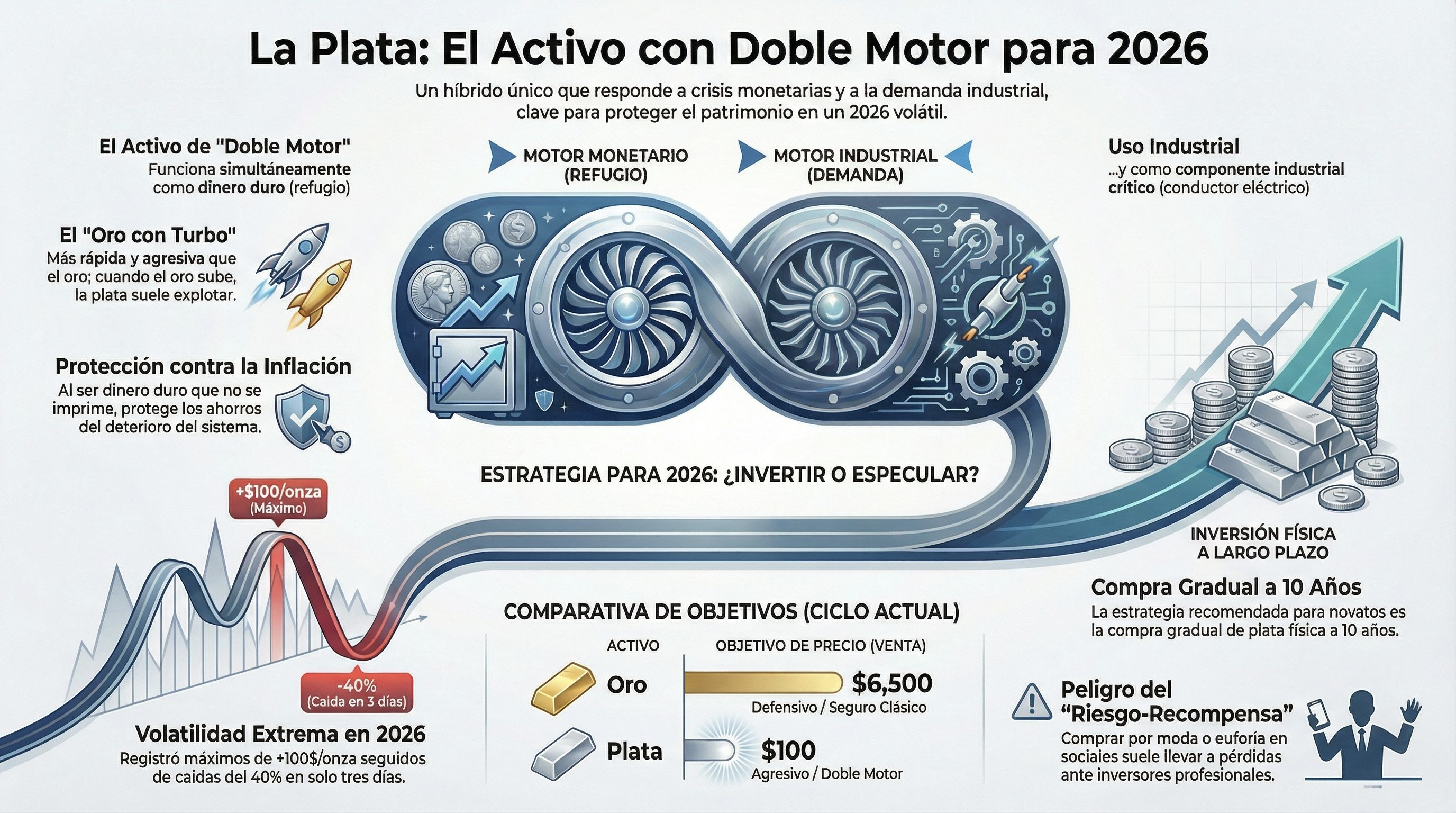

To understand silver, one must discard the misconception that it is simply "cheap gold." Its strategic importance lies in its unique hybrid nature. In the hierarchy of metals, gold acts as the primary locomotive, setting the direction of the market. Silver, however, functions as a high-velocity hybrid that sits between purely monetary assets and purely industrial ones like copper or uranium. While gold is a reserve of safety, silver operates with two distinct "motors" that engage simultaneously, creating a compounding "Turbo" effect on its valuation.

Historically, silver was the financial backbone of the Spanish Empire for centuries—it was the metal that vertebrated world trade, far more effectively than faith or the sword.

The Hybrid Engine: Industrial Tool vs. Monetary Asset

Feature

Industrial Engine

Monetary Engine

Primary Role

The world's premier electrical conductor; non-negotiable for global industry.

Historically recognized "Hard Money"; the original basis of global trade.

Market Driver

Sensitive to economic growth cycles and high-tech industrial demand.

A hedge against fiat devaluation; a physical asset that cannot be printed.

Reactionary Behavior

Responds aggressively when the economic cycle pushes industrial growth.

Responds violently when the monetary system faces systemic tension or inflation.

This duality provides silver with its "Turbo" effect. Because it can receive pressure from both industrial necessity and monetary flight, it does not behave like a standard asset. It can remain in a lateral, "boring" consolidation for years, only to move vertically with extreme violence. This makes silver a faster-moving, more volatile instrument than gold—an insurance policy that accelerates exactly when the system begins to fail.

3. Volatility as a Filter: Interpreting the 2026 Price Action

In the world of high-volatility assets, the greatest risk is not the fluctuating price, but the investor’s emotional response. When a market turns parabolic, psychology becomes the ultimate filter. We saw this clearly in the market event of January 2026: silver reached a historic peak of over $100/oz, only to plummet 40% within a three-day window—marking one of the most savage liquidations since the 1980s.

This was not a collapse of value, but a "shakeout." Such violent movements serve to separate professional strategists from retail speculators who trade on raw emotion. Those who entered out of greed at the peak were liquidated, while professionals recognized the event as a necessary correction within a larger bull market. Based on current trends, my personal strategic objectives remain a pre-crisis target of $100/oz for Silver and $6,500/oz for Gold.

However, a word of caution: these are pre-crisis objectives. I anticipate a grave crisis on the horizon that will eventually cause all assets—including precious metals—to suffer severe corrections. To navigate these vertical movements and the coming turbulence, one must adhere to the Rules of the Game:

Strategy over Luck: Never enter a position without a clear purpose; the market has no mercy for the "lucky."

Discipline over Emotion: Euphoria and panic are the twin thieves of capital preservation.

Acknowledge the Cycle: We are in a major bull market, but short-term liquidations are the "price of admission" for long-term gains.

Filter the Noise: Ignore the social media hype that only appears after the price has already exploded.

4. The 10-Year Structural Custody vs. Short-Term Speculation

There is a fundamental difference between the profession of "speculation" and the objective of "patrimonial safeguard." For the non-professional, short-term technical speculation is a high-probability path to financial ruin. Speculation requires a level of risk management and emotional mastery that most participants simply do not possess. Therefore, I explicitly forbid the recommendation of short-term trading for those who are not professionals; you will be liquidated by those who treat this as a vocation.

Instead, the focus must be on a Physical Custody Framework:

Incremental Purchasing: Utilize a phased entry strategy. Never deploy all capital at once, particularly when the market is "hot."

10-Year Time Horizon: View silver as structural protection. Given the current trajectory of the global economy, the value of silver in a decade will likely dwarf current levels.

Physical Possession: Prioritize physical assets over counterparty-dependent derivatives. In a systemic crisis, "paper" silver is a promise that may never be kept.

In the current environment of high sentiment and social media euphoria, "buying the hype" is a dangerous proposition for new entrants. The risk/reward ratio is currently skewed against the novice. True asset protection is a matter of individual responsibility; it is the mechanism by which family wealth survives a crisis that the "official" alarms will fail to predict until the exits are already blocked.

5. Synthesis: Responsibility and the Path Forward

The ability to think independently is the only true differentiator between those who will suffer during the coming turbulence and those who will successfully protect their legacy. Silver is not merely a commodity; it is a unique, dual-engine asset—an insurance policy with a turbocharger that responds to both industrial necessity and monetary collapse.

When the crisis finally manifests in its full gravity, the masses will predictably claim, "No se podía saber" (No one could have known). They said it in 2008, and they will say it again. But you will know that it was knowable for those who chose to look at the behavior of sovereign states rather than the scripts of television anchors.

The intelligent families are those who prepare now, while the "Everything Under Control" narrative still provides a thin veil of normalcy. Taking responsibility for your own financial sanctuary is not paranoia; it is the hallmark of strategic survival. Do not wait for the official alarms to sound. By then, the opportunity for protection will have vanished. Professionalism, discipline, and physical custody are your only allies in the new paradigm.