You know what this means, right?

From historical data across sources (CoinGlass, CryptoRank, Newhedge heatmaps, and various analyses):

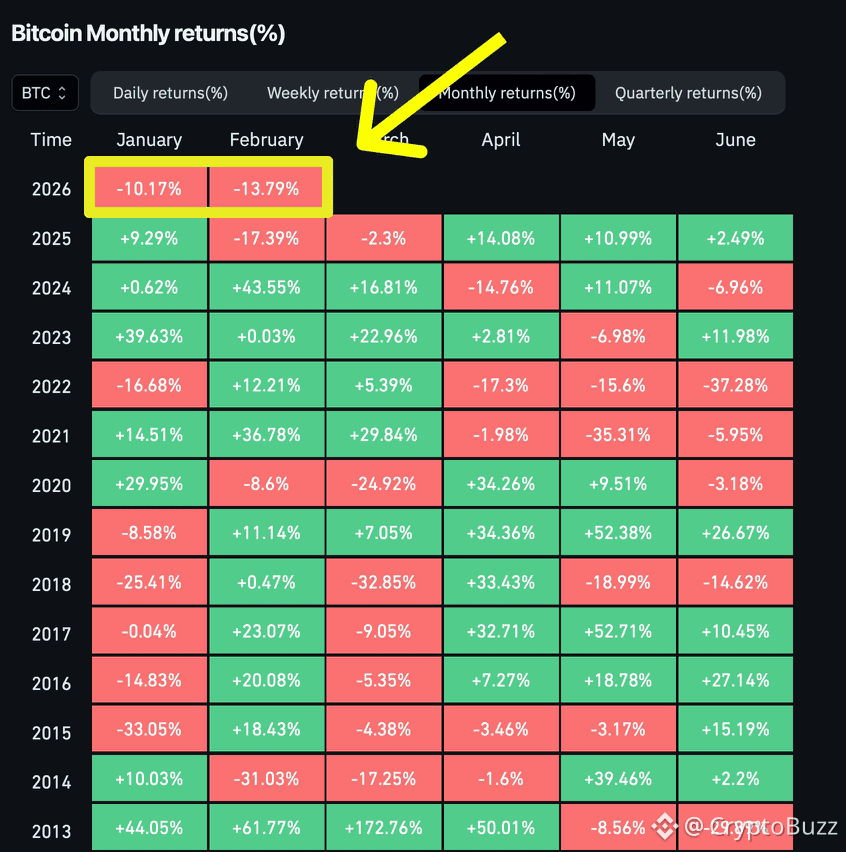

• In prior years where January was negative (e.g., 2015, 2018, 2019, 2022, and others), February typically delivered positive returns, often acting as a rebound month.

• This “never both red” streak held from Bitcoin’s tradable history (roughly 2011/2013 onward through 2025).

• 2026 marks the first time both opening months have closed negative, breaking that long-standing seasonal pattern.

Current context (as of mid/late February 2026):

• Bitcoin is trading around $66,900–$69,000 (down significantly from late-2025 highs, with YTD returns around -22%).

• This makes 2026’s start one of the weakest on record (weakest Q1 opening since 2018 in some metrics).

• February’s decline ranks among the larger historical February drops.

What this means in the crypto/TA community context (especially on X, where such stats get hyped):

It’s classic “this time it’s different” vs. “history rhymes” debate.

Many bullish posters use the old pattern to signal “buy the dip” — implying February should have bounced after a red January, so a double-red setup is “extremely rare/bullish reversal incoming” (FOMO fuel: “the streak breaking means epic pump next”).

But bears/counterpoints highlight:

• Patterns break, especially as Bitcoin matures (post-ETF era, more correlated to macro/rates, institutional flows turning negative recently).

• This could signal deeper weakness: longest monthly losing streak in years if March continues down, macro headwinds (e.g., liquidity, risk-off), or cycle dynamics shifting.

• No guarantee of reversal — stats are backward-looking, and 2026 already shattered the “never both red” rule.

In short: It means the old seasonal “safety net” for early-year dips is gone for the first time. Whether that’s bullish capitulation fuel or bearish confirmation depends on your bias — but it’s definitely notable and sparking a lot of discussion right now. If March turns green and reclaims $80k+, the narrative flips hard to “pattern broken = new bull leg.” Otherwise, more pain possible.

HODL strong, or whatever your strategy is. 🚀📉 What’s your take — reversal soon or more downside?

#MarketRebound #BTCFellBelow$69,000Again