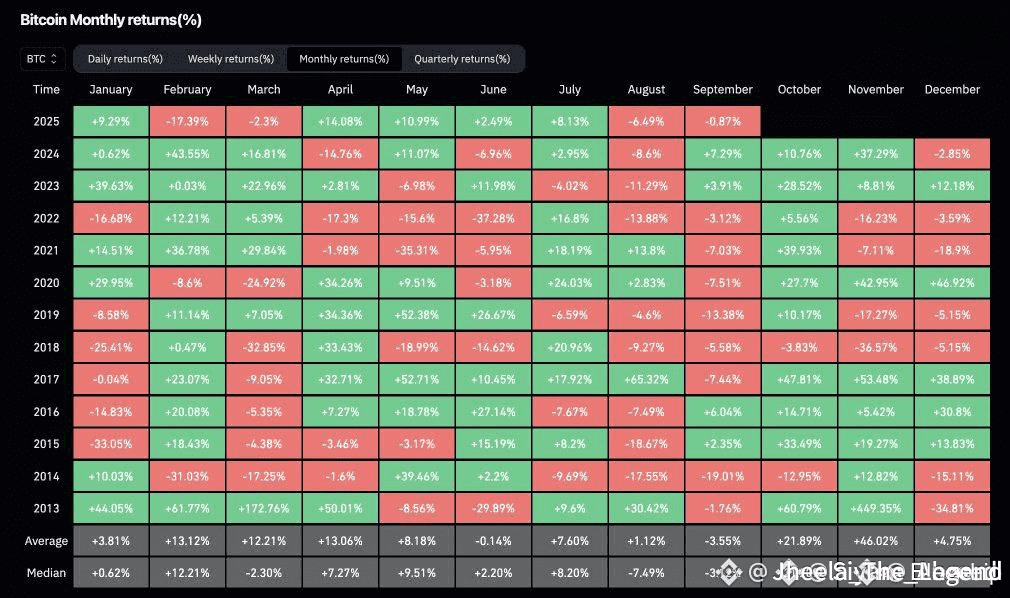

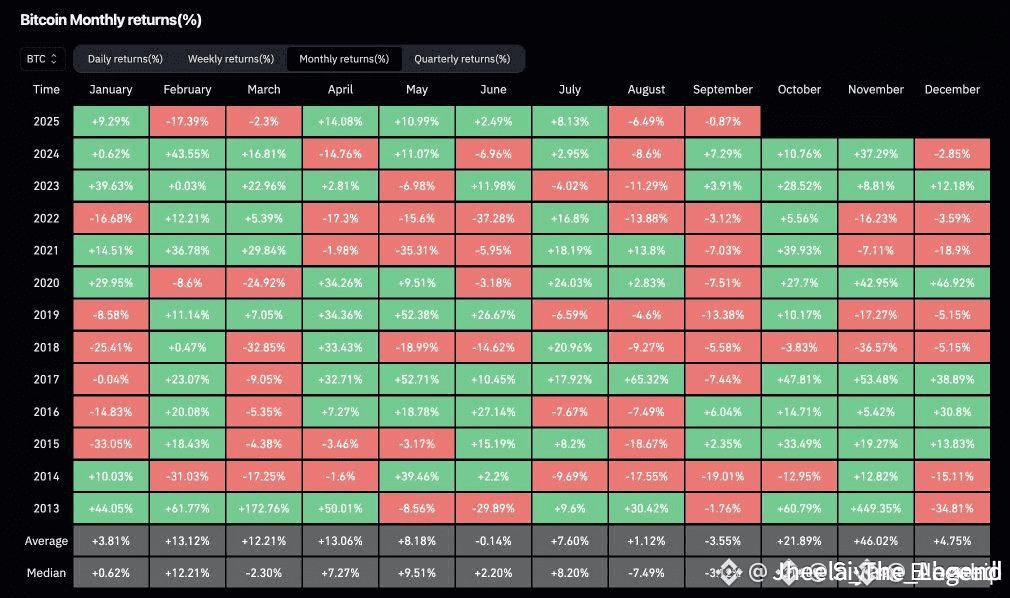

📉 Historically, September = the weakest month for crypto.

Most think rate cuts = 🚀 … but reality often delivers the opposite. Let’s break it down 👇

☞ 1. Curse of Red September

𓁼 September is notorious for sideways action + flash crashes.

𓁼 Even in bull cycles → local drops remain highly probable.

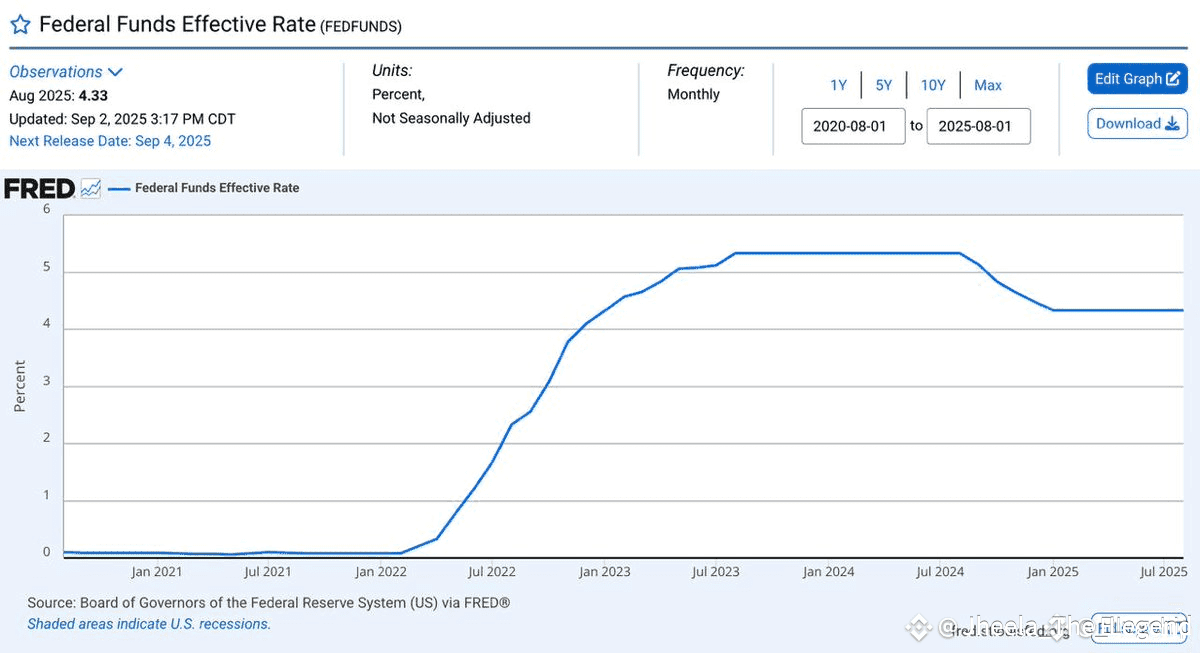

☞ 2. Crowd Expectations

𓁼 Many believe the Fed’s rate cut = instant altseason.

𓁼 Social media pushes “Sept 17 = moon.” 🌕

𓁼 In reality → hype often fuels sharp dumps on the news.

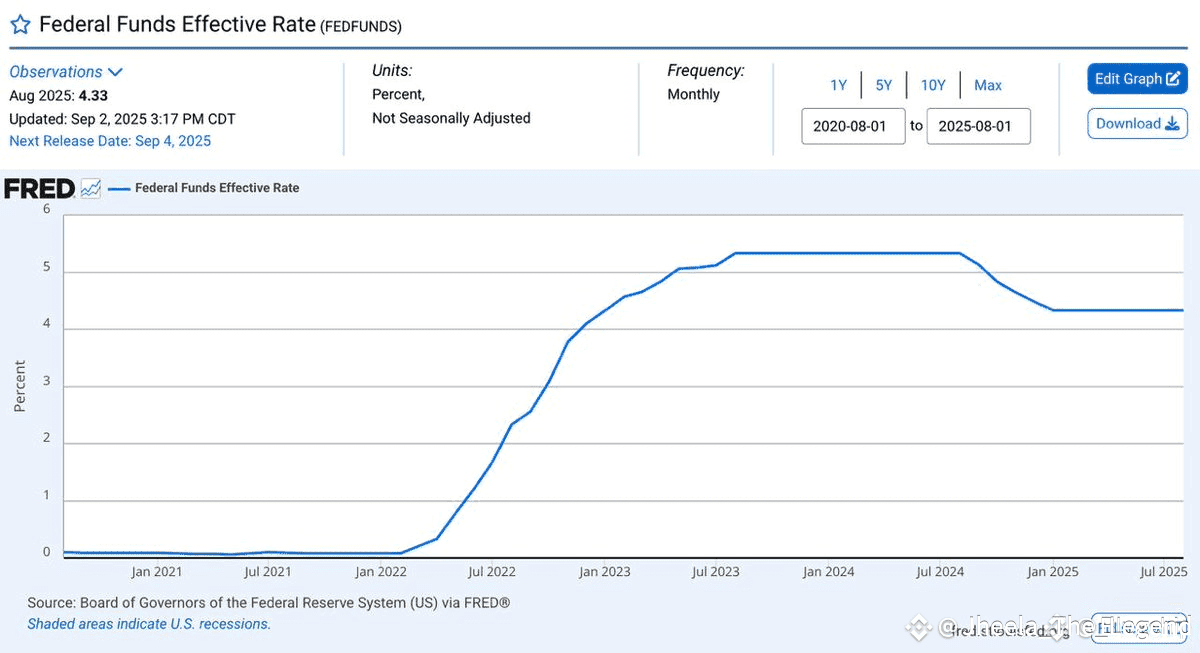

☞ 3. Last Year’s Lesson

𓁼 2024: After Fed cuts → markets dumped instead of pumped.

𓁼 Reason? Prices had already rallied → decision triggered profit-taking.

☞ 4. Seasonal Stats

𓁼 Early September = weak but manageable.

𓁼 Late September = bloodbath zone 🔴 confirmed across stocks + crypto.

☞ 5. Practical Gameplan

𓁼 Expecting instant altseason = unrealistic.

𓁼 More likely: rally on rumors → dump on facts.

𓁼 Smart move = keep liquidity ready for better entry points later.

☞ 6. For Traders

𓁼 Watch Fed dates closely 🗓️

𓁼 Biggest moves = right after announcements ⚡

𓁼 Always use stops + hedges to survive volatility.

☞ 7. For Long-Term Investors

𓁼 Corrections = golden chances to accumulate BTC & ETH.

𓁼 Avoid FOMO all-ins → best buys come during panic late-September.

☞ 8. Altcoins Impact

𓁼 Alts bleed harder than BTC 😬

𓁼 Bottom-catching = dangerous. Patience = profit.

𓁼 Risk is higher, but so is long-term upside.

✅ Final Takeaway

Red September isn’t a myth — it’s a data-backed recurring pattern.

Crowd hype = wrong direction short term.

Calm, disciplined strategy = profits long term.

Always DYOR. NFA.