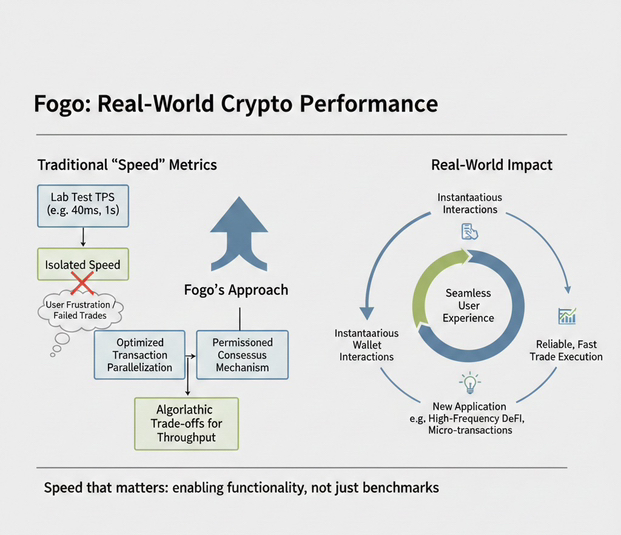

Speed sells in crypto because it’s the simplest flex. You can throw a number at people—40 milliseconds, 1-something seconds—and it sounds like progress. Most of the time, though, those numbers sit on top of the same old truth: chains don’t win because they’re quick in a lab test. They win when the speed changes what you can actually do without cursing at your wallet or watching a trade die in slow motion.

That’s why Fogo is worth a closer look. Not because it claims it can run faster than everyone else—plenty of projects have tried that. What’s unusual is how it tries to get there, and what it’s willing to trade for that kind of performance.

The basic pitch is pretty clear in the public material: very short block/slot times (often described as around 40ms) and fast deterministic finality (often cited around 1.3 seconds). If those numbers hold up under real load, it’s not just trivia. It changes the rhythm of using the chain. Things stop feeling like “send a transaction, wait, hope.” They start feeling more like a stream.

But here’s the part people miss when they get hypnotized by the stats: Fogo doesn’t really present itself as a magical new invention. It’s closer to an engineering stance that says, “If you want on-chain markets to behave like markets, you have to treat the chain like serious infrastructure.”

That leads to its most distinctive move: geography. Fogo’s own architecture docs talk about validators being grouped into “zones,” with the idea that validators are close enough—sometimes literally colocated—that network delays shrink dramatically. This is basically borrowing from the playbook of traditional trading infrastructure, where proximity is everything. The crypto world often talks like we can ignore physics. Fogo is saying: physics is the whole game, so let’s design around it.

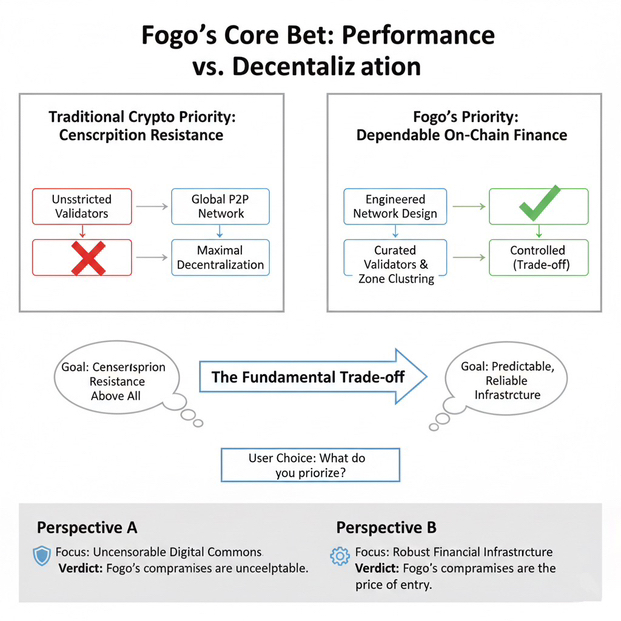

Now, if you’re already feeling uneasy, that’s the correct reaction. Because colocation and tight clustering come with a shadow: centralization risk. If too much of the chain’s heartbeat lives in one place, it’s easier to pressure, disrupt, or capture.

Fogo’s answer—at least on paper—is rotation. The docs describe moving those zones across epochs through an on-chain process, so the “center” of the network isn’t stuck forever in one jurisdiction or one facility. In the most generous reading, that’s an attempt to balance performance with resilience. In the most skeptical reading, it’s a system that still depends on coordinated infrastructure and will always have a weak spot somewhere.

Then there’s the validator model, which is where the conversation stops being academic. Fogo’s architecture materials describe a curated validator set with requirements and a “social layer” that can enforce behavior—meaning validators can be removed for underperformance or harmful conduct.

If you’re building a network aimed at high-throughput trading, that sounds practical. Nobody wants the chain to wobble because a validator is running on bargain hardware or operating like it’s a weekend project.

But there’s no way around the other side of it: curation means gatekeeping. Someone decides who qualifies, what “harmful” means, and how enforcement works. That doesn’t automatically make it bad. It just means you’re no longer living in the fantasy version of crypto where decentralization is purely mechanical. You’re in the real version, where governance and coordination matter.

Fogo’s client story reinforces that it’s not trying to pretend everything is invented from scratch. The project is openly tied to the Firedancer lineage; the foundation’s codebase is described as a fork of Firedancer. The docs also talk about a canonical Firedancer-based client direction.

A cynic could summarize that as: “Solana-style execution model plus Firedancer-style performance work, repackaged with new branding.” And if you’re hunting for “repackaged concepts,” that’s not a crazy place to look.

But here’s the reason that critique isn’t the whole story. In crypto, the difference between “we’re compatible with X” and “we enforce X as the operating standard” is huge. Turning a high-performance client approach into a rulebook—building the network around it, setting validator expectations around it—can produce a very different system in practice. Not necessarily a better one for every use case, but different.

Where it gets more human is in the UX layer. Fogo talks about “Sessions,” basically a session key standard meant to let apps do certain actions without forcing the user to sign every single step. If you’ve ever tried to do anything more complex than a simple swap on-chain—especially under time pressure—you already know why this matters. Wallet prompts are the silent tax on everything.

Sessions can make trading apps feel less like a ritual and more like a tool. They can also become a security mess if teams treat them as “growth feature first, safety later.” The idea isn’t new. The difference is whether the ecosystem implements it with discipline.

So what’s the honest read on Fogo right now?

It looks like a project built by people who are more interested in operational reality than storytelling. There’s public coverage of mainnet launch and the token sale that leans into the speed narrative, like every other launch story does. But Fogo’s own materials focus more on the machinery: how validators are organized, how the client is shaped, what assumptions the network is making about performance. That’s a sign the team expects scrutiny, not just applause.

Still, the biggest unanswered question isn’t whether it can run fast. It’s whether the speed becomes something real people care about.

A chain can be technically impressive and still irrelevant if nothing meaningful gets built on it, or if the only action comes from short-term speculation. On the flip side, a chain can be imperfect on ideology and still become important if it solves a painful problem better than everyone else.

If Fogo is building real utility, you’ll see it in a few places:

You’ll see trading apps that actually hold up when things get messy, not just when markets are quiet. You’ll see fewer failed trades and fewer moments where the UI says one thing and the chain does another. You’ll see sessions used carefully—scoped permissions, short expiries, safe defaults—so “convenient” doesn’t turn into “dangerous.” And you’ll see the validator curation process handled in a way that doesn’t feel like a private club: clear criteria, transparent decisions, and some kind of credible path for new operators.

If it’s mostly repackaging, the pattern will be familiar too. The messaging will drift harder into “fastest” because it’s the easiest thing to repeat. The validator layer will get murky or political. The ecosystem will stay thin while attention focuses on the token instead of the tooling.

Fogo’s real bet is simple: people will accept a tighter, more engineered network if it makes on-chain markets feel dependable. Whether that’s the right trade depends on what you want crypto to be.

If you want censorship resistance above everything, you’ll look at zone clustering and curated validators and feel the air go out of the room. If you want on-chain finance that behaves more like infrastructure—predictable, responsive, hard to break—you may decide those compromises are the price of entry.

Either way, Fogo isn’t interesting because it says “we’re fast.” It’s interesting because it’s trying to make a public chain behave like market plumbing—and that forces you to confront the part of crypto that most projects prefer to keep blurry: performance always comes from choices, and choices always come with consequences.