[A Stabilizing Market]

After undergoing a -48% correction between October and February, Bitcoin has stabilized, suggesting a market transition from sharp repricing to consolidation. In this steadier environment, Nexo clients are withdrawing more credit than during previous months.

[Nexo Retail Credit Withdrawals Escalating in January]

While the Nexo client withdrawals declined through 2025, reflecting a broad risk-off behavior, the leveling off in late 2025 / early 2026 suggests retail participants have largely completed balance-sheet tightening. At the same time, CryptoQuant’s Estimated Leverage Ratio (ELR) has been resetting to healthier levels.

From December 2025 to January 2026, the weekly retail withdrawals of Nexo users grew from 6.73 to 13.92 million, representing a ~107% growth.

This new confidence among the Nexo investors reflects improved sentiment, and mirrors a weakening bitcoin-related selling pressure, as the leading cryptocurrency paves its way towards consolidation.

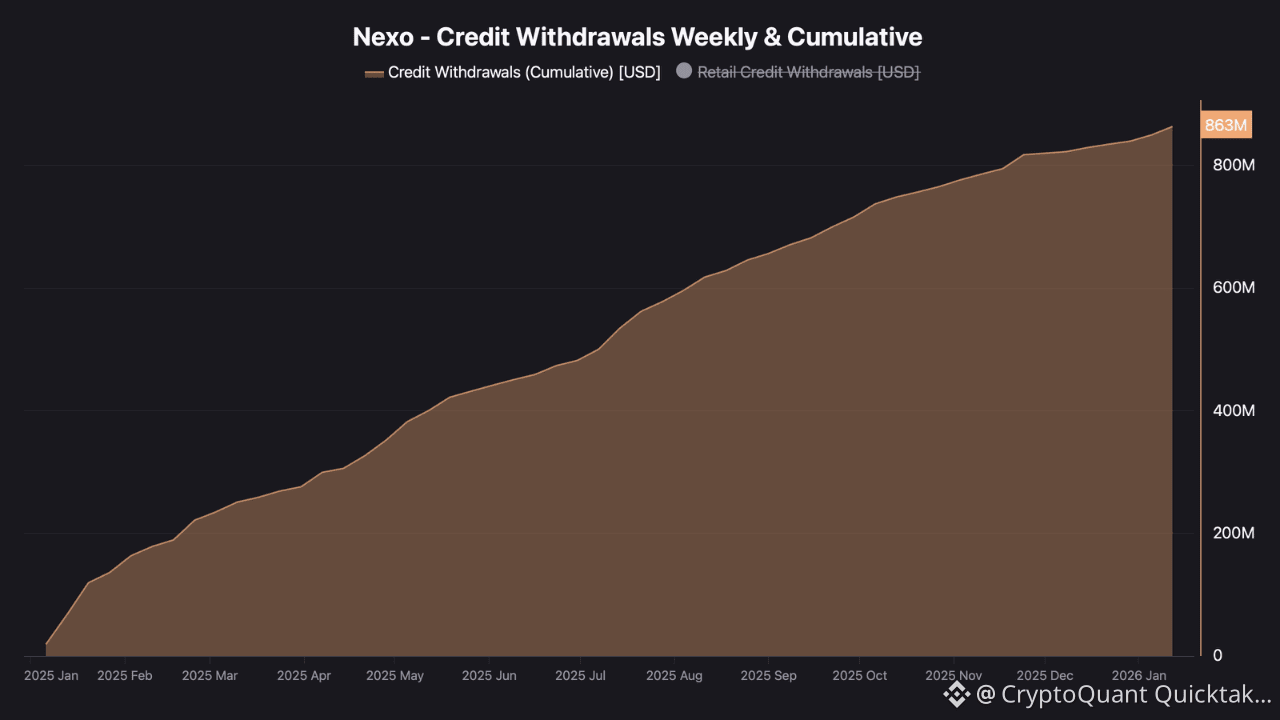

[Cumulative Credit Withdrawals Reach an All-Time High]

Nexo users' cumulative credit withdrawals have reached $863 million between 2025 and 2026. This figure reflects robust borrowing activity across market cycles, indicating ongoing demand for crypto-backed liquidity solutions.

Recent data signals the end of deleveraging and emerging signs of renewed confidence and borrowing demand as the crypto market reaches a new equilibrium.

[Looking Forward]

The recent crypto deleveraging phase appears largely absorbed, with open interest declining from prior highs, funding rates normalizing, and liquidation volumes subsiding. This potentially creates room for renewed borrowing activity should sentiment and liquidity conditions improve. Meanwhile, Bitcoin is consolidating and stabilizing near $67K, building a firm base after the recent volatility surge.

Written by oinonen_t