The Day I Realized Vanar Wasn’t Built For Me

I was reading through Vanar documentation at midnight last Tuesday when something clicked that made me uncomfortable.

This chain wasn’t designed to impress me. It wasn’t designed to impress anyone who spends their evenings reading blockchain whitepapers.

It was designed for my sister.

The Phone Call That Changed My Perspective

My sister called me three months ago asking about an NFT some brand was giving away. She tried to claim it. Got stuck on the wallet creation screen. Called me frustrated.

“Why do I need twelve words? Why can’t I just make an account like normal?”

I gave her the standard explanation. Private keys. Self custody. Decentralization. Security.

She hung up and never claimed the NFT.

That conversation kept replaying in my head while I looked at what Vanar actually built.

Fees That Don’t Ambush You

Here’s something I never thought I’d care about. Vanar pegs transaction costs to dollar amounts instead of letting token volatility determine what users pay.

When I first read that, my immediate reaction was: that’s not how blockchains work. Gas markets exist for a reason. Dynamic pricing solves resource allocation.

Then I remembered my sister trying to claim that NFT.

She doesn’t know what gas is. She doesn’t care about resource allocation or fee markets. She just wants to know: will this cost me money? How much?

Vanar answers that question before she asks it. The fee structure adjusts automatically behind the scenes based on token price feeds. Users see predictable costs. The complexity gets handled at the protocol level where it belongs.

There’s even a public endpoint showing real-time gas tiers in VANRY terms. I looked at it. The stability over a week was remarkable compared to what I’m used to seeing on other chains.

That stability isn’t exciting. It’s the opposite of exciting. It’s infrastructure doing its job quietly so users never have to think about it.

Validators You Can Actually Identify

Vanar’s validator approach made me defensive at first.

They start with foundation validators. They expand gradually to reputable operators. Community members stake to specific validators rather than anyone being able to participate immediately.

My knee-jerk reaction: that’s not decentralized enough. That’s not permissionless. That’s not what blockchains are supposed to be.

Then I thought about who’s actually going to use this network.

Gaming studios. Entertainment brands. Companies with legal departments and compliance requirements. They’re not going to build on infrastructure where they can’t identify who’s running the nodes.

Enterprise doesn’t trust anonymous. Enterprise trusts accountability.

I spent a day looking at who’s actually operating validators in Vanar’s ecosystem. Known infrastructure providers. Companies with reputations. Organizations you can contact if something breaks.

That’s not philosophically pure. But it’s pragmatically honest about what mainstream adoption actually requires.

The Token That Doesn’t Want Attention

VANRY is possibly the least exciting token design I’ve studied this year.

It’s the gas token. It’s for staking. It’s bridged to Ethereum and Polygon. There’s a supply cap and emission schedule.

No exotic burning mechanisms. No deflationary hype. No yield farming theatrics. No governance drama.

Just a token that does what it needs to do so the network functions.

I keep comparing this to other projects where the tokenomics presentation is the main event. Complex diagrams showing how value accrues. Projections about price appreciation. Incentive structures designed to create buy pressure.

VANRY’s design document reads like an afterthought. Like they built the network first and added the token because you need one, not because they wanted to create investment theater.

That probably hurts short-term speculation. It might help long-term utility.

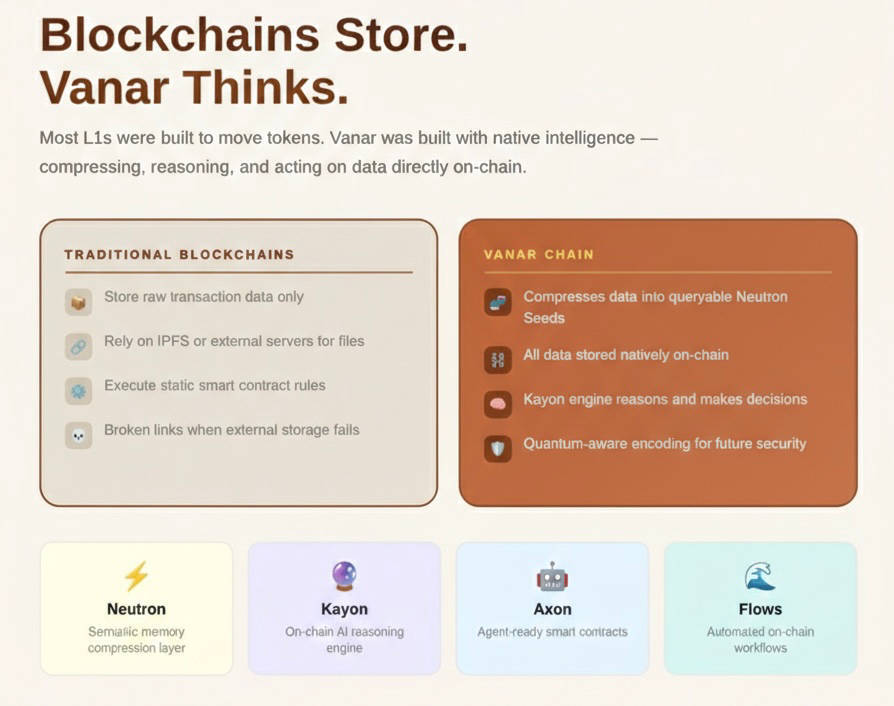

Why the AI Part Isn’t Buzzword Nonsense

Most blockchain projects mentioning AI are obviously just chasing trends. AI is hot so they sprinkle it into presentations.

Vanar’s Neutron documentation describes something specific. Off-chain storage for speed. On-chain anchors when you need proof of ownership or provenance.

I showed this to a developer friend building an AI avatar platform. His immediate response: “Oh, that’s actually useful.”

He wasn’t excited because it was revolutionary. He was excited because it solved a real problem he was facing. How do you prove a generated asset is unique and owned by a specific user without putting massive data on-chain?

Neutron’s approach splits the difference. Fast performance off-chain. Verifiable ownership on-chain when it matters.

That’s not sexy. That’s just good engineering.

The Rebrand Nobody Celebrated

Consolidating from Virtua branding into Vanar happened quietly. I barely saw anyone mention it.

But that simplification matters more than people realize.

I’ve watched projects die because their ecosystem was too confusing to explain. Partners couldn’t articulate what connected to what. Developers picked the wrong platform. Users gave up trying to understand the relationship between different names.

One clear brand. One clear network. One clear story.

That’s not a move that generates headlines. It’s a move that prevents future confusion.

What They’re Actually Building Toward

The more time I spent with Vanar, the more I realized they’re not building for people like me.

They’re building for the next hundred million users who don’t read documentation. Who don’t understand consensus mechanisms. Who don’t care about decentralization philosophy.

They’re building for people who just want the app to work.

My sister doesn’t need to know what a validator is. She needs to click a button and receive her digital collectible without confusion or surprise fees.

That’s the user Vanar is designing for. Not me. Not crypto Twitter. Not the people who argue about client diversity on forums.

Where My Skepticism Lives

I still have serious questions that won’t get answered for months.

What happens to those stable fees when VANRY price gets genuinely volatile? Not 10% swings. Real volatility where the price moves 50% in a day.

Does the validator set actually expand over time into something more distributed? Or does it stay concentrated among a small group indefinitely?

And most importantly: do real users actually show up? Or does Vanar build this invisible infrastructure perfectly and nobody uses it because adoption is always the hardest problem?

Those questions don’t have answers yet. They can only be answered by time and stress.

Why This Approach Might Actually Work

But here’s what makes me take Vanar seriously despite all my instincts telling me to dismiss anything that isn’t sufficiently decentralized or revolutionary.

Every successful technology eventually becomes invisible.

You don’t think about HTTP when you browse the web. You don’t think about SMTP when you send email. You don’t think about TCP/IP when you stream video.

The technology that wins is the technology that disappears into the background and just works.

Blockchain hasn’t done that yet. Every blockchain interaction reminds you that you’re using blockchain. Wallets. Gas. Transaction confirmations. Seed phrases. It’s all visible friction.

Vanar is betting that making blockchain invisible is more important than making it impressive.

And when I think about my sister trying to claim that NFT and giving up, I realize they might be right.

The Uncomfortable Truth

This whole realization made me uncomfortable because it forced me to admit something.

Most of what I care about in blockchain design doesn’t matter to the people who would make blockchain mainstream.

I care about decentralization theory. They care about whether the button works.

I care about novel consensus mechanisms. They care about whether fees are predictable.

I care about permissionless participation. They care about whether someone is accountable if things break.

Vanar isn’t building for what I find interesting. They’re building for what actually matters to mass adoption.

That’s either going to look brilliant in five years or it’s going to look like they compromised everything that makes blockchain valuable.

I honestly don’t know which. But I know I’ll be watching to find out.