I have been studying Fogo very closely and the more I explore it the more I feel this chain is not competing with any Layer 1. It is operating in a design space that very few people even understand. Fogo is not trying to be a general purpose ecosystem. It is not trying to host every type of application. It is not trying to become a social chain or a meme chain. The project is built with one clear vision and that is extreme performance for trading. Every design choice exists for this single purpose and the results are already reshaping how professional capital will interact with on chain markets.

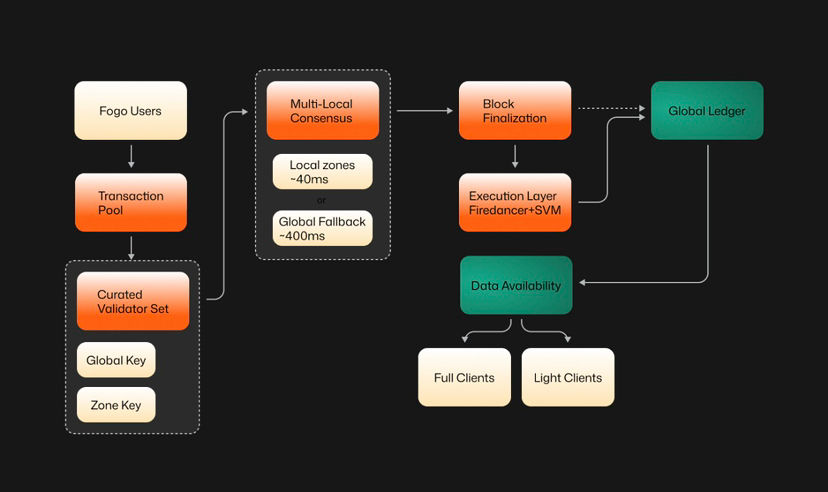

Fogo is a high performance Layer 1 that uses the Solana Virtual Machine. It executes a custom Firedancer client built by the same engineering lineage that developed Pyth. The client is optimized purely for speed and consistency. What makes Fogo interesting is how it reduces all randomness. In most blockchains validators rely heavily on luck. Geography network distance and hardware differences create so much variance that even strong implementations cannot show their full power. Everyone misses blocks. Everyone wins blocks sometimes. Performance becomes an average not an advantage. Fogo breaks this by compressing the system and removing noise. The result is a chain where validator performance becomes visible measurable and economically impactful.

This is where the design becomes different from every other Layer 1. Fogo uses multi local consensus and extremely tight execution conditions which means block production and block finalization are predictable. When performance becomes predictable traders can finally rely on deterministic execution. A market maker or high frequency strategy cannot tolerate random delays. A one second delay can destroy a profitable trade. Most chains cannot give this type of reliability even if they advertise high TPS. The issue is not throughput. The issue is time to finality. Fogo delivers final confirmation within milliseconds which changes how trading works. Instead of adapting strategies to blockchain limitations the blockchain finally adapts to professional strategies.

This is where the next concept comes in. On centralized exchanges the key advantage is consistency. You always know how fast you can execute. If the market is moving you rely on the matching engine being stable. Fogo tries to bring that feeling to decentralized finance. It is not trying to rebuild a general purpose smart contract ecosystem. It is building a trading environment that behaves like a real time execution engine while still being permissionless. This is the difference that institutions care about. They do not want blockchains that are unpredictable. They want blockchains that behave like financial infrastructure.

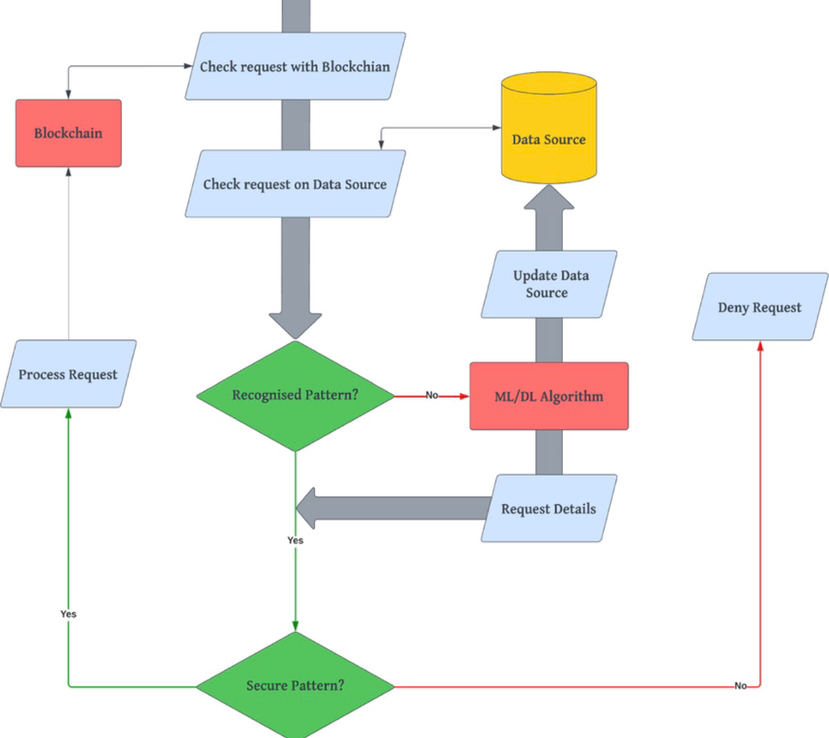

Another area where Fogo stands apart is its approach to resource markets. The chain makes performance a survival mechanism. Validators cannot hide behind randomness. If they are slow they will fall behind. If they are optimized they will earn more. This creates an environment where the best engineering wins. It transforms validator performance from a background detail into a core part of network economics. When the network punishes inefficiency and rewards optimization the entire ecosystem becomes more stable over time. This is something no other chain has successfully enforced.

What is even more interesting is how Fogo is fully compatible with the Solana Virtual Machine. This allows developers to migrate applications or build new order book systems without rewriting everything from zero. The difference is the environment underneath. Solana is already extremely fast. But Solana also runs many applications and many client types which introduce natural limits. Fogo is purposely narrow. It allows maximum optimization because it focuses only on trading and capital markets. This specialisation is what creates space for professional liquidity. Traders want execution. Arbitrageurs want deterministic speed. Perp protocols want consistency for liquidations. Market makers want no delays during volatility. Fogo structures the entire chain around these needs.

One of the most overlooked but powerful parts of Fogo is its block time. The chain can produce blocks in around 40 milliseconds with instant finality. This is not just for marketing. These numbers matter for real trading strategies. Liquidations trigger faster. Arbitrage cycles complete before price gaps widen. Auctions settle without lag. When everything becomes real time new categories of applications appear. You can build on chain dark pools low latency auctions professional AMM hybrids and high frequency perp markets. These are things that simply do not work on slower chains.

The token economy of Fogo also reflects this narrow focus. The FOGO token captures value from a network that is optimized for throughput and capital flows instead of generalized activity. A network designed for market makers and traders naturally generates more real fee volume. These fees feed back into the chain and strengthen validator incentives. The whole network becomes more sustainable because the demand for blockspace is directly tied to trading activity which is far more stable than hype driven use cases. When a chain specializes instead of trying to be everything the quality of its ecosystem increases.

Fogo also stands out in terms of reliability. Many blockchains fail when activity peaks. Some freeze. Some degrade. Some restart. Fogo avoids this by designing for the worst conditions not the best. The entire chain is meant to withstand the exact type of traffic that destroys other networks. High throughput liquidations massive trading surges arbitrage pressure and rapid block production. These conditions are not exceptions for Fogo. They are the default environment. When a chain builds for the hardest possible scenario it becomes naturally stable during regular operation.

The more I study Fogo the clearer it becomes that this is not another Layer 1. It is a precision engineered trading machine. It takes the Solana architecture the Firedancer performance philosophy and a fully specialized validator model to create a chain that is built for speed stability and institutional adoption. This is why so many traders and builders are paying attention. The chain is not trying to impress everyone. It is trying to impress the people who move real volume. And that is exactly the audience that defines long term value.

Fogo is still early but the architecture already proves its direction. Builders who understand latency will move here. Traders who understand the difference between fast and deterministic will move here. Capital that cannot tolerate execution risk will move here. The next evolution of DeFi will not be about high TPS marketing. It will be about systems that behave like reliable financial infrastructure. Fogo is one of the few chains trying to become that.

This is why I think Fogo will play a major role in the next cycle. When institutions look for a home chain for real time trading they will prioritise reliability over hype. They will choose environments where speed is structural not situational. They will choose systems where engineering quality decides outcomes. Everything Fogo has built so far shows that it understands this gap better than most projects in the market. And that is why this chain stands out for me as one of the most serious performance focused Layer 1 networks in the industry.