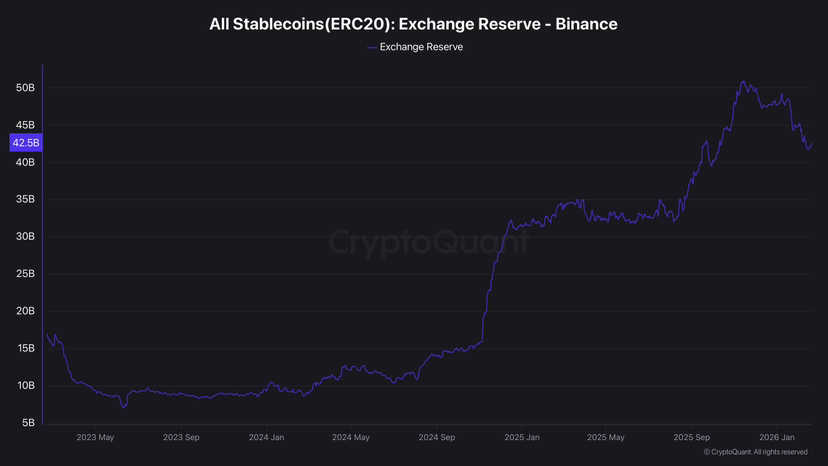

Let’s get straight to the point: Binance has now crossed into an unbelievable reserve of stables in excess of 45 (billion) dollars- a milestone that is not a headline. It is an actual game-changer of the way liquidity flows throughout the whole cryptocurrency ecosystem at the moment.

Still more impressive: Binance is estimated to be containing approximately 65 percent of the total number of stablecoins on centralized exchanges (CEXs). That is not a lead, that is a fortune to be split among the possessions of most other big exchanges.

In easily understandable terms, that is, should stablecoins be the gasoline that makes crypto markets run, in terms of trading, hedging, arbitrage, and institutional distribution, then Binance is currently one of the largest gas stations in the world.

What Are Stablecoins A Primer

Before we unpack about the significance of this, we should have a good idea of the existence of stablecoins:

Stablecoins are cryptocurrencies that are tied to real-world currencies, the most common one being the US Dollar. Their primary goal is not to increase the price, as it is in the case of Bitcoin or Ethereum, but to maintain the value constant and facilitate frictionless payment in the crypto ecosystem.

Examples of popular stablecoins are:

USDT, Tether, historically the largest by market cap

USDC, Circle's USD Coin, widely used in regulated markets

Others exist but USDT and USDC together form the lion's share

There are other ones, though USDT and USDC have the lion share.

These tokens are considered to be digital money: merchants and financial institutions can put money in them to avoid volatility or transfer money between exchanges without necessarily converting them into physical money.

Why then is Binance Holding So Much?

The size of the Binance stablecoin bucket did not occur as luck. Here’s the logic:

Binance remains the biggest CEX in terms of Usage.

Despite recessions, and regulator backlash, Binance continues to host the crypto activity of the world. Millions of users buy, hold, and trade assets on the platform, which inherently concentrates stablecoins where traders having idle dollars await the right time.

Liquidity Begets More Liquidity

The market depth and price efficiency are caused by stablecoin reserves.

1. More stablecoins enable an exchange to match orders better.

2. Even lower spreads and quicker execution will bring in even more volume.

3. The positive feedback loop reinforces the position of Binance on a daily basis.

Capital has been centred by market Conditions.

At the end of 2025 and the beginning of 2026, crypto markets have been in a bear or mixed stage. With the process of consolidation, large players such as Binance will gain liquidity and smaller players will experience liquidity outflow or stagnation. Statistics indicate that the stablecoin pool of Binance has been on the rise, despite other ones reducing in size.

Is This a Good Thing or a Risk? My Take

This pre-eminence is a two-sided sword:

Benefits

There is enhanced liquidity which enhances price discovery and reduces slippage.

Traders possess a vast pool of entering and leaving positions fast.

It portends trust in the institutions and large holders who appreciate the infrastructure of Binance.

Risks and Concentration

Centralized exchange stablecoin reserves: The concentration of the market is a consequence of holding 65 percent of the overall reserves.

Any operational pressure, regulatory pressure, or systemic problems at Binance have the potential to spill over into the global crypto liquidity.

The market of stablecoins is as strong as the supporting infrastructure and its support, its huge size is an advantage, but only under the condition that the assets and management are stable.

To be honest, this is a very impressive milestone but it is a reminder that centralized risk has a role to play in an industry that might be described as decentralized.

The Broader Implications

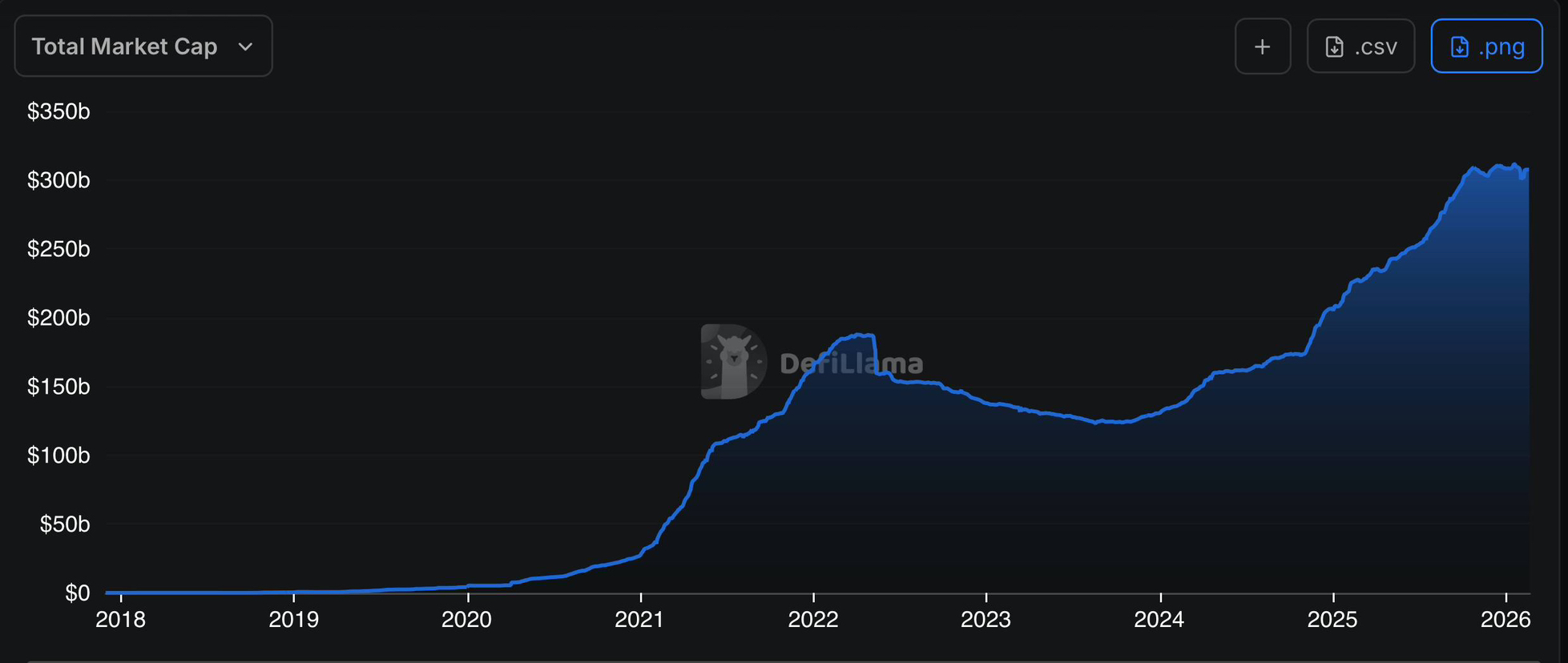

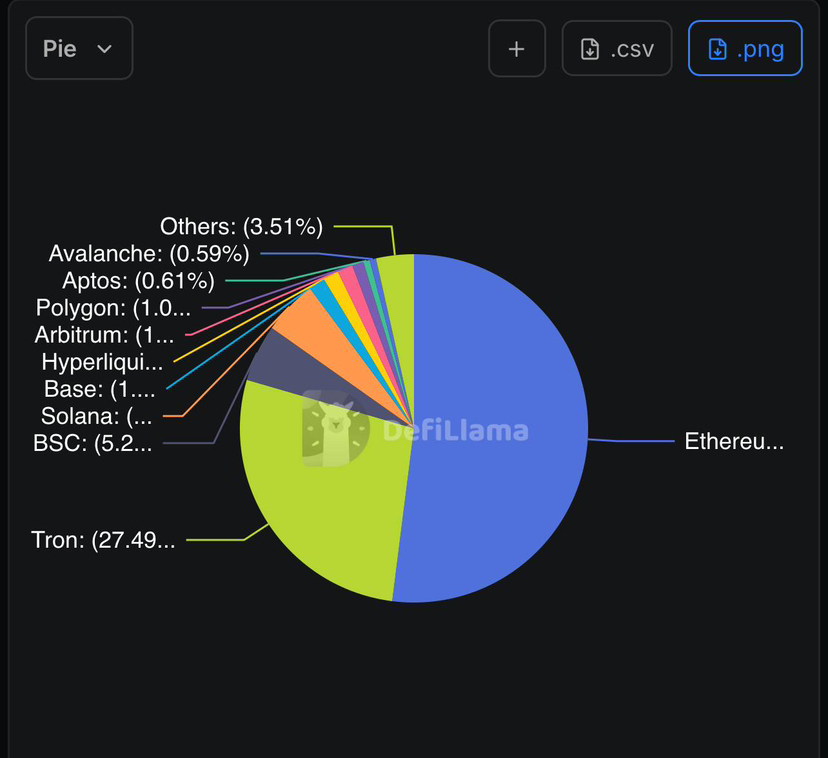

Stablecoins are no longer a niche asset that trades in digital assets but the foundation of the modern ecosystem of digital-assets. The market capital of all stablecoins, even when you look further than Binance, is already far out of reach of many financial instruments.

That’s huge because it means:

Digital cash is now international digital dollars.

They are used to make payments, save, arbitrage, hedge and so on. Their very size affects the way the institutions and regulators conceptualize the future finance.

In that regard, Binance does not accumulate in isolation, but it forms a bigger structural change of money circulation in the digital markets.

At the moment I originally heard the news that Binance reserves stabilized at over 45 billion and that the company controls 65 percent of CEX, my first thought was not just surprise, but an eye-opener that the world of crypto liquidity is actually much more centralized than a majority would assume.

This is the trend that will affect traders, regulators, and anyone who is keenly looking where crypto markets are taking.

As a stock market investor or an amateur, you must inquire:

1- What is the effect of this concentration on market risk?

2- Does greater liquidity really mean greater trading performance?

3- What will occur in case the pressure on large exchanges increases in regulation?

These are no abstract questions- these are practical considerations that are based on real numbers. And the evidence shows that at present, Binance is not merely taking part: it is creating the principles of crypto liquidity.