My bot was always second.

It was only one slot, about 40 milliseconds, but it happened every time.

Profitable liquidations visible. Transactions submitted. Executions confirmed. But someone else always cleared the position first.

For two weeks I assumed they had faster infrastructure. Better RPC. Lower latency.

They didn't.

They had earlier information.

FOGO is a high-performance L1 built on Solana Virtual Machine (SVM) targeting 40ms block times with approximately 1.3s finality. Across testnet the network maintains stable cadence. Blocks land consistently. Oracle updates propagate cleanly.

At 40ms cadence, detection timing stops being a performance detail and becomes competitive structure.

I was running standard liquidation monitoring. Query collateral ratios every 50ms. Compare against threshold. If underwater submit transaction immediately.

This works on 400ms chains. Detection lag of 50ms is negligible when blocks take ten times longer.

On FOGO it makes you systematically late.

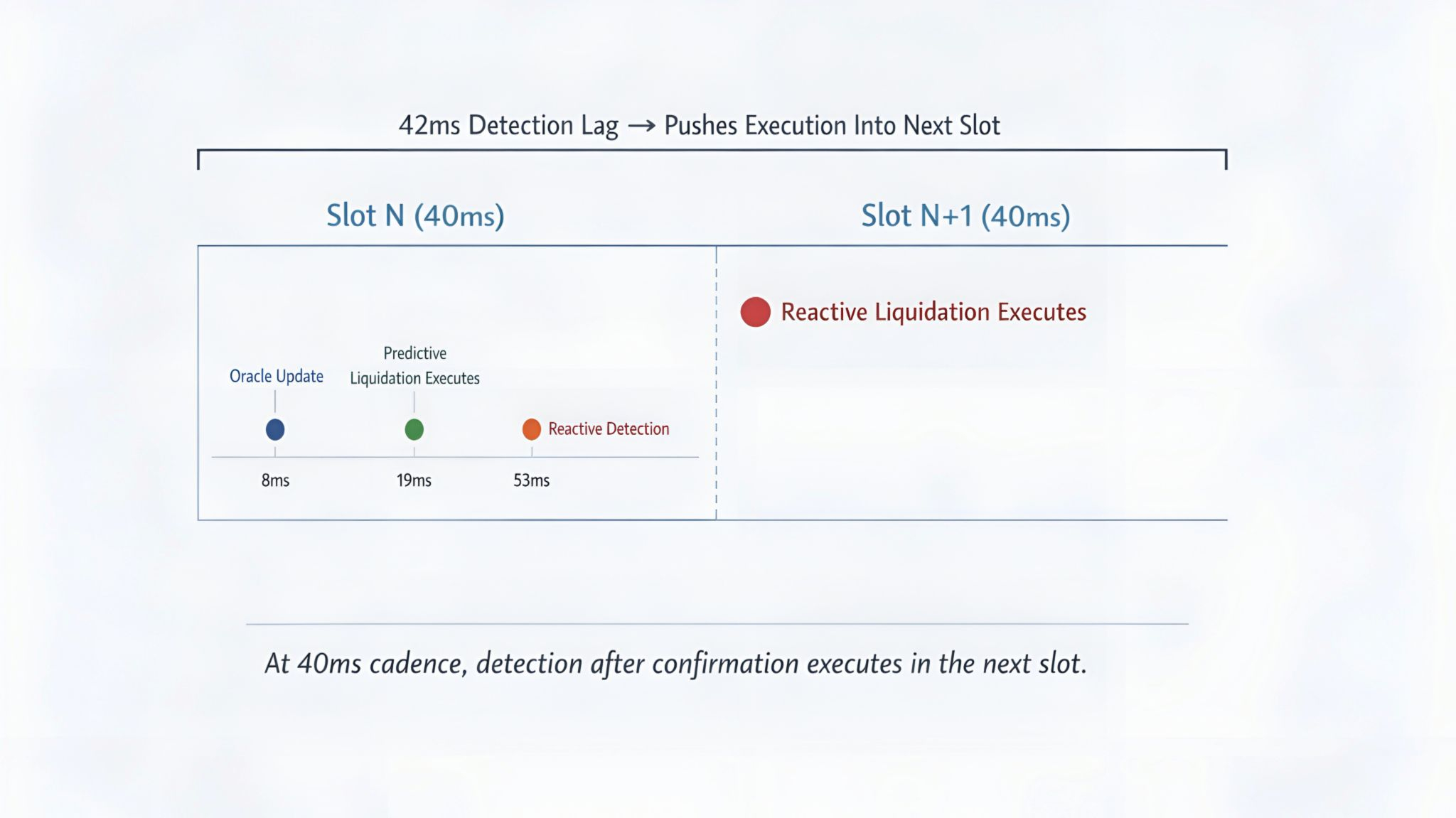

First clear example: Oracle confirmed 8 milliseconds into the slot. My polling hit at 53 milliseconds. Transaction submitted at 61 milliseconds.

That landed in the next slot.

Liquidation already cleared in the current slot by a different transaction at 19 milliseconds.

Timing delta: 42 milliseconds. More than one full slot.

Not a close race. Structural gap.

Over the next week: fourteen liquidation opportunities. My bot detected all fourteen. Submitted transactions for all fourteen.

Executions won: zero.

Every liquidation cleared before my transaction confirmed. Pattern consistent: competitor transactions in current slot. My transactions in next slot or two slots later.

I was behind by a bit over a slot on average, something like 50–60ms. On a 40ms chain that’s massive.

FOGO performed exactly as designed. My detection model was built for the wrong cadence.

The issue is detection architecture not execution speed.

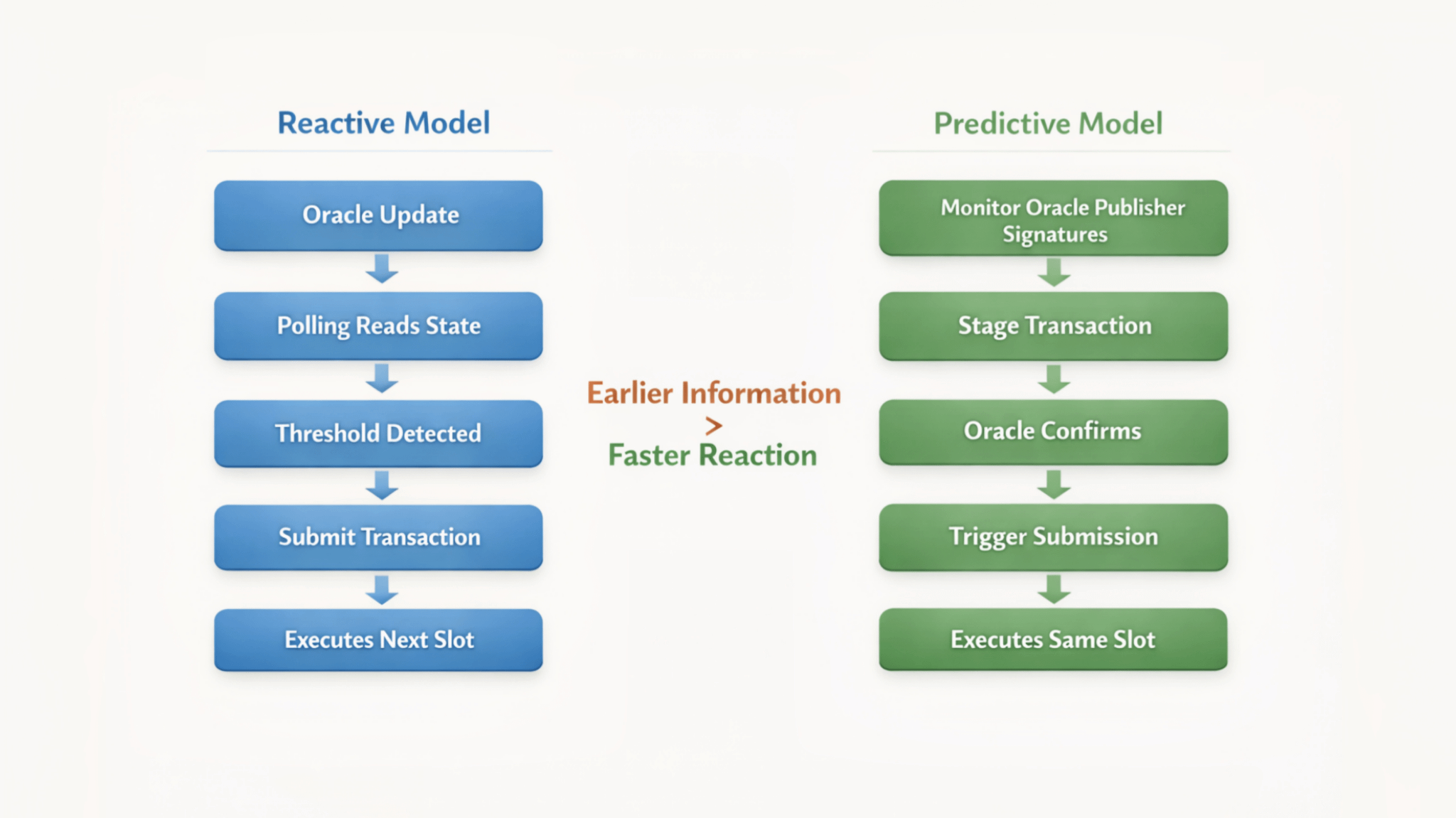

My flow: Oracle updates. Polling reads update after 40-plus milliseconds. Detection completes. Transaction constructs. Submission happens next slot at earliest.

Competitor flow: Pre-position transaction before oracle update. Monitor publisher signatures. Trigger submission when oracle confirms. Execute in same slot.

Oracle updates land at predictable slot boundaries. Monitoring publisher signatures reveals the update before on-chain confirmation, allowing a staged liquidation to trigger the moment confirmation lands.

A bot polling ratios will always read after the update lands. Detection lag plus construction means earliest execution is next slot.

On 400ms chains the gap between current and next slot is less than half a block. On FOGO it is an entire competitive window.

They were not detecting faster. They were detecting earlier by not waiting to detect.

I rebuilt detection to monitor oracle publisher signatures instead of polling ratios.

Old model: Threshold crossed, submit.

New model: Threshold likely based on pre-confirmation data, stage transaction, trigger when confirmed.

Detection lag collapsed from 50ms average to under 10ms.

Transaction submission moved from next slot to current slot.

Next week: fourteen opportunities. Executed first on nine. Tied on three. Late on two.

Same network. Same oracle. Different timing model.

On 40ms systems reaction time is no longer a performance metric. It is a liability.

On longer block times you detect after state changes and still execute competitively because the next block absorbs reaction time. On FOGO detecting after means executing next slot and next slot is already late.

Competitive advantage moves from faster reaction to earlier prediction.

At 40ms cadence current versus next slot is not close. It is first versus irrelevant.

The faster the chain, the more expensive it becomes to wait for confirmation.

This applies beyond liquidations. Every automated system on FOGO—stop-loss, take-profit, rebalancing, limit orders—faces the same constraint. React after state changes and you execute when opportunity is gone.

MEV searchers monitoring DEX state for arbitrage. Traders running automated exit strategies. Portfolio managers rebalancing based on price triggers.

If the logic is detect then react the reaction lands next slot or later. If the logic is predict then position the execution happens current slot. And on a 40ms chain current slot is when value exists.

FOGO testnet has processed over 18 million slots maintaining 40ms production and approximately 1.3s finality. The architecture works as designed.

As FOGO approaches mainnet understanding how 40ms cadence changes competitive timing becomes critical not just for specialized operators but for anyone running automated strategies.

For liquidation operators detection lag determines first or miss. For traders automated exits execute one slot late during volatile moves. For anyone building time-sensitive automation reactive logic works on 400ms chains but on FOGO it guarantees late.

For two weeks I detected liquidations correctly and executed them one slot too late.

Detection was accurate. Submission was fast. Infrastructure optimized.

The timing model was built for a world where you detect after state changes and still have time to react.

On FOGO state change and competitive execution happen in the same 40ms window.

Detect after and you are in the next window. By then prediction already executed.

The fastest reaction is already late.

On FOGO, if you wait for confirmation, you’re probably already too late.