The current difficulties facing Bitcoin and the broader crypto market continue to weigh on several major assets. Ethereum is still trading roughly 60% below its most recent all-time high and remains locked in a short-term consolidation range between $2,150 and $1,900.

Spot ETH ETFs are also contributing to these unfavorable conditions. On February 19 alone, approximately 66,000 ETH in outflows were recorded, equivalent to nearly $130 million. This marks one of the largest single-day outflows observed since the beginning of the year.

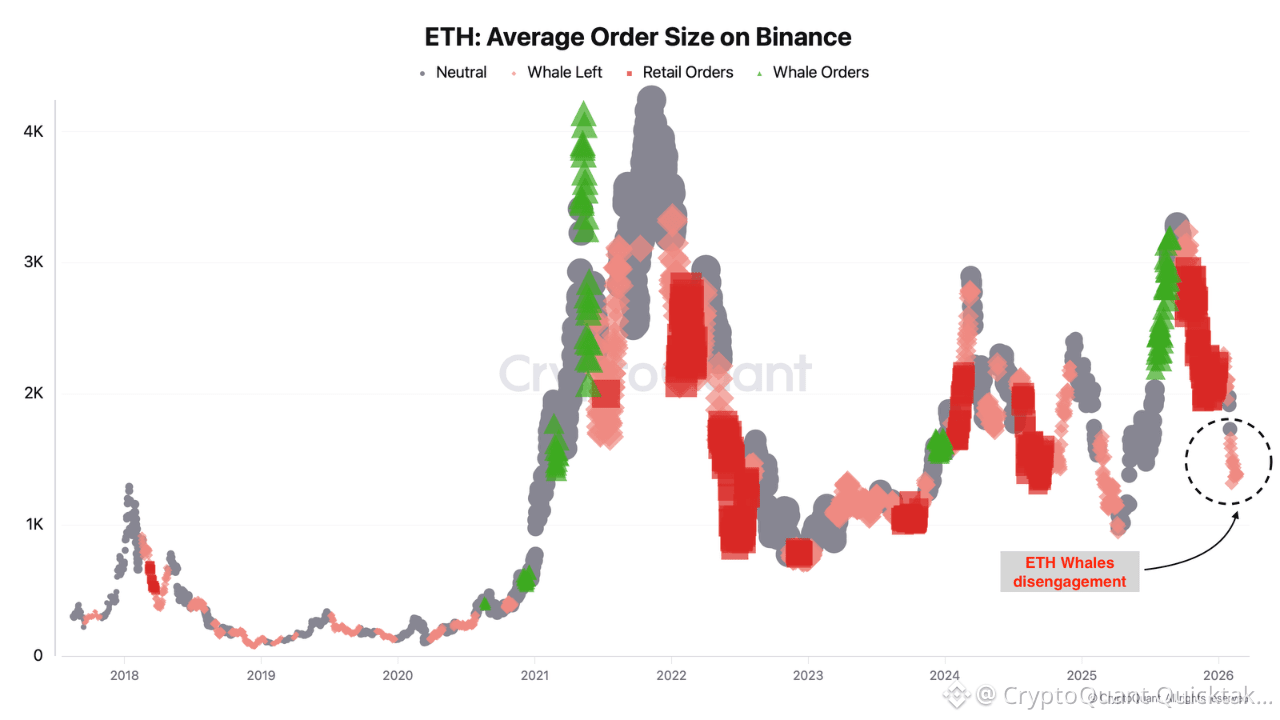

Beyond this already challenging backdrop, an analysis of the average order size on Binance for ETH suggests a gradual disengagement from whale participants. Since the start of the year, the average order size has been consistently declining, indicating that large market participants may be reducing their exposure and stepping back from actively interacting with order books.

This dynamic points to a temporary loss of market depth and liquidity, which could structurally weaken ETH’s ability to absorb sudden imbalances in trading flows.

Notably, overall trading volumes appear to remain relatively stable, implying that activity from smaller participants has not materially declined. At the same time, price action has held within a defined range, suggesting that selling pressure may have eased in the near term.

Such a configuration has the potential to set the stage for a volatility expansion. On one hand, a return of whale activity could provide the necessary liquidity and directional conviction to support an upward breakout.

On the other, a sudden resurgence in selling pressure, in the absence of sufficiently large buy-side orders, could further expose ETH to downside risk.

In that regard, the next moves from large market participants may prove decisive for Ethereum’s short-term trajectory.

Written by Darkfost