🚨Something historic is unfolding right before our eyes—yet most of the world hasn’t connected the dots.

Yesterday: Michael Saylor sat down with Congress to discuss Bitcoin as a strategic reserve asset.

Today: The Federal Reserve cuts interest rates.

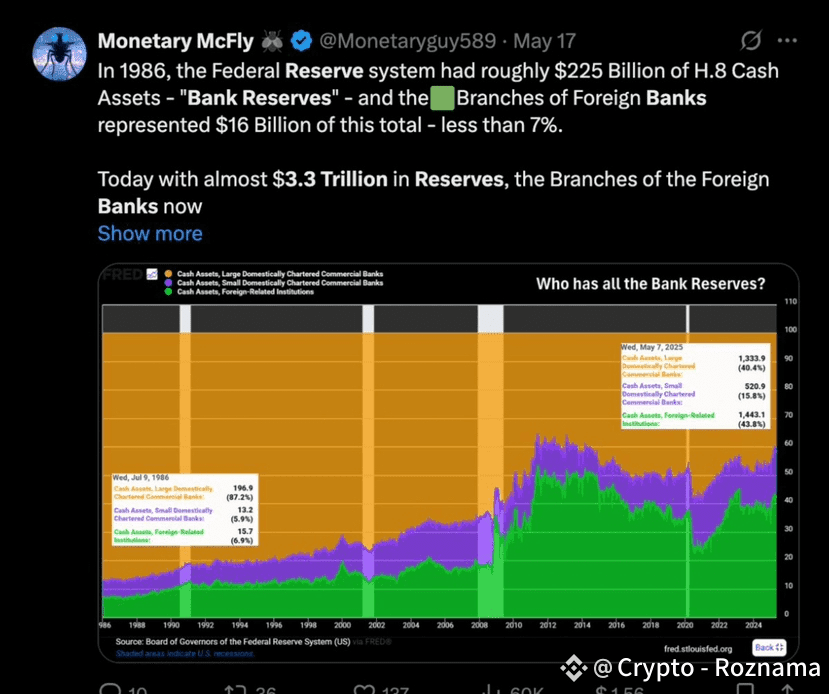

In the background: $3.3 trillion in sterilized bank reserves sit frozen, waiting to be unleashed.

Coincidence? No.

This looks like a synchronized move in a $36 trillion escape plan to rescue the U.S. financial system.

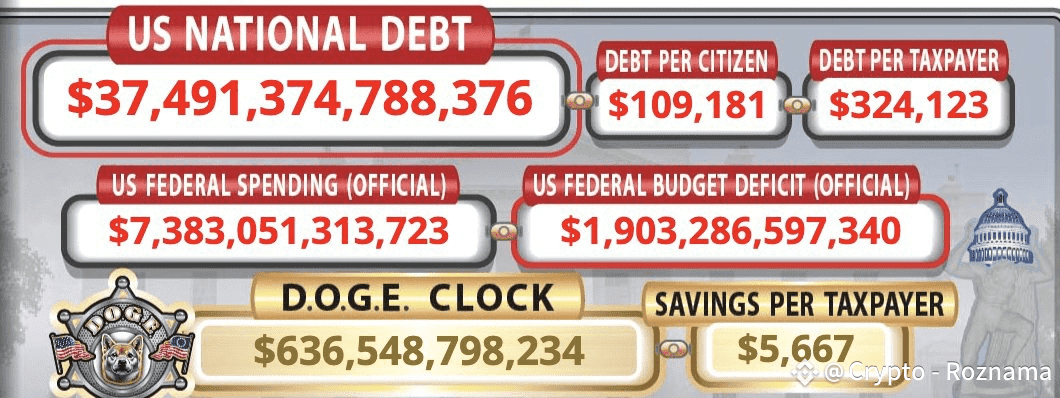

America’s Debt Spiral 🚨

U.S. debt-to-GDP: 123% (an all-time red zone).

The government is struggling to cover just the interest payments.

Traditional tools—tax hikes, spending cuts, even QE—are no longer enough.

The system is cornered. But Trump’s team has identified a backdoor solution:

Not to pay down the debt… but to inflate it away while keeping the dollar dominant.

The Hidden Weapon: Bitcoin as a Liquidity Sponge 🧽

Here’s how the plan unfolds:

1. Sterilized Reserves: Banks are sitting on $3.3T in reserves from past QE. Until now, they were banned from releasing them to avoid hyperinflation.

2. Stablecoin Legislation: The new proposals allow banks to mint stablecoins backed by these reserves. Suddenly, trillions in trapped money hit the real economy.

3. Inflation On Purpose: This floods the system with liquidity, boosting GDP via inflation. Debt-to-GDP falls, even if nominal debt rises.

4. The Political Problem: Inflation makes life unbearable—higher gas, groceries, and housing. Historically, this topples governments.

5. The Masterstroke: Use Bitcoin as the release valve.

Why Bitcoin, Not Gold? ⚡

Gold absorbs liquidity at 1.4x sensitivity.

Bitcoin absorbs liquidity at 8.9x sensitivity.

In plain words: every dollar of excess money printing finds its way into Bitcoin almost 9x more efficiently than gold.

This means:

Instead of driving housing or food prices into chaos…

Trillions can be soaked up by Bitcoin’s open, borderless, and infinitely divisible market.

People don’t riot because of inflation.

Instead, they feel richer as their Bitcoin holdings explode.

The Endgame 🎯

This isn’t about making Bitcoiners wealthy.

It’s about extending American financial dominance for another generation.

$3.3 trillion in sterilized reserves becomes liquid.

Bitcoin acts as a global liquidity sink.

The U.S. stabilizes its debt spiral without default.

Inflation is “hidden” inside the Bitcoin supercycle.

Mark Moss and others are now connecting the dots:

Bitcoin isn’t just a hedge. It’s the keystone of America’s 21st-century monetary strategy.

Final Word 🌊

The Fed’s rate cut and Saylor’s Congress meeting aren’t random.

They are signals of a new financial architecture being born.

What comes next?

A $36 trillion tsunami of liquidity—and Bitcoin is at the epicenter. 🚀

#FedRateCut #Bitcoin #LiquidityFlood #CryptoDominance #GoldVsBitcoin