The European Union has drawn a hard line in the sand — a full ban on Russian LNG imports by January 1, 2027. What was once penciled in for 2028 has been fast-tracked under pressure, with Washington’s voice echoing loudly in the background.

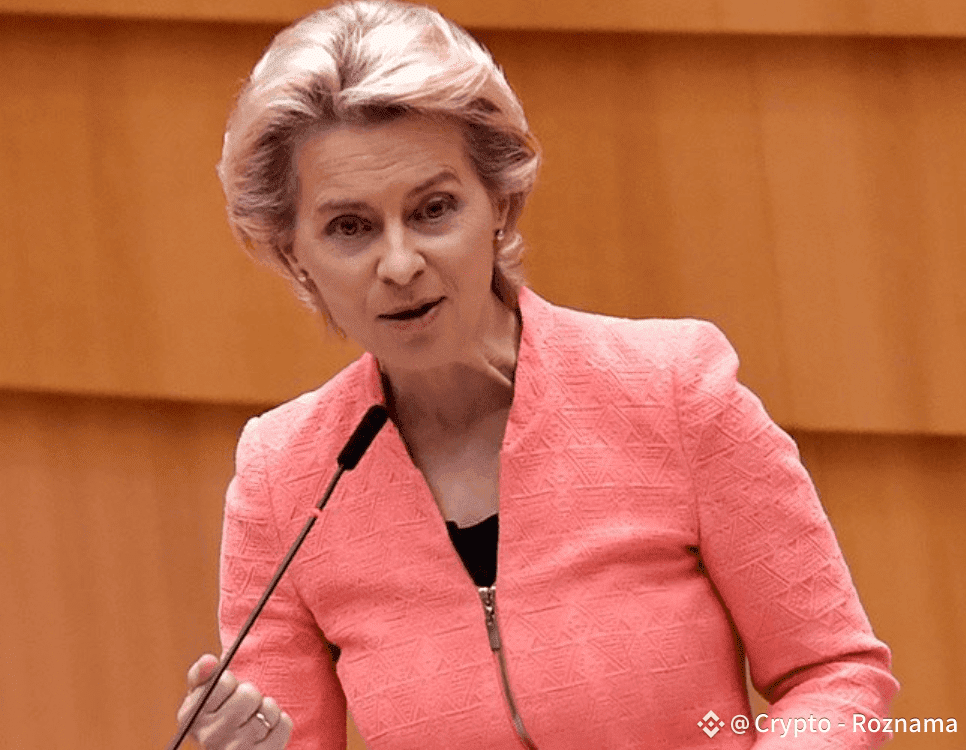

European Commission President Ursula von der Leyen didn’t mince words:

👉 “The revenues from fossil fuels sustain Russia’s war economy. We want to cut these revenues. It is time to turn off the tap.”

But make no mistake — this isn’t just about Russia. This move fires a triple shot:

1️⃣ Russia — starved of LNG revenue that fuels the war machine.

2️⃣ China — called out for buying discounted Russian energy.

3️⃣ India — pressured for its refinery exports into Europe that recycle Russian oil into “legal” flows.

💡 Yet here lies the paradox: Moscow shrugs. Kremlin spokesperson Dmitry Peskov insists the status quo remains unchanged — that Russia will simply pivot further to Asian markets.

So who truly benefits?

✅ The U.S. LNG industry. With Europe scrambling to secure alternatives, American gas exports are poised to surge — cementing Washington as Europe’s new energy lifeline.

✅ Norway & Qatar. Already expanding capacity, both stand to capture Europe’s redirected demand.

✅ Energy traders & infrastructure builders. Billions in contracts for LNG terminals, tankers, and pipelines are on the horizon.

🌍 Europe is betting on a future without Russian energy, but in doing so, it deepens its reliance on transatlantic partners and a volatile global LNG market.

This is more than an energy shift — it’s a geopolitical reshuffle, where the pipelines of yesterday give way to the shipping lanes of tomorrow. 🚢⚡

#UkraineCrisis #EnergyWar #Geopolitics