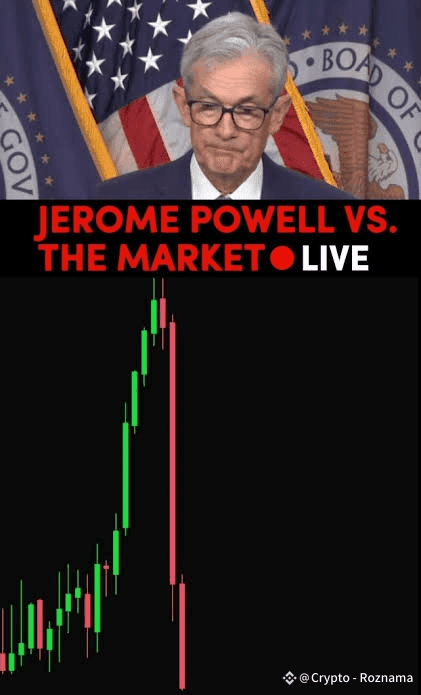

When Jerome Powell stepped onto the stage and hinted at a rate cut lifeline, Wall Street expected fireworks, champagne, and rocket emojis across the charts. 🚀🍾 But instead? The markets collapsed like a sandcastle in high tide. 🌊🏰

So why did a move that should’ve cheered traders instead spooked them? Let’s peel back the curtain:

1️⃣ Too Late, Too Weak 🕰️💔

Investors aren’t buying the “hero Fed” narrative. They see the cut not as stimulus, but as a desperate Band-Aid on a bleeding economy. In market language:

👉 Rate cuts = 🚨 hidden pain behind the curtain.

2️⃣ Recession Fears Whispered in Every Corridor 🏦😨

Powell’s tone wasn’t celebratory. It was cautious, almost cryptic. Traders read between the lines and murmured:

💬 “What’s the Fed really seeing? A slowdown darker than the data shows?”

And when fear creeps in, liquidity runs out the door.

3️⃣ Profit-Takers Strike 💰🗡️

Wall Street never misses a good hype exit. The moment the announcement hit, the sharks cashed out, flipping green candles into bloody red charts. 📉🩸

4️⃣ The Dollar Stays the King 👑💵

Even with rate cuts, the global money tide is still rushing into the U.S. dollar as the “last safe harbor.” That siphons off liquidity from risk assets like stocks, altcoins, and even Bitcoin.

🔥 The Raw Reality: Powell didn’t fuel a bull run… he lit a torch of uncertainty. And markets? They HATE uncertainty more than anything. ⚠️ Until Wall Street sees hard evidence of growth—not just promises—expect the road ahead to stay bumpy, shaky, and unpredictable.

👉 In plain English: This rate cut isn’t a gift to markets. It’s a warning flare in the night sky. 🌌🚨

#FedRateCut25bps #WallStreetWhiplash #PowellSignal #BitcoinStorm ⛈️