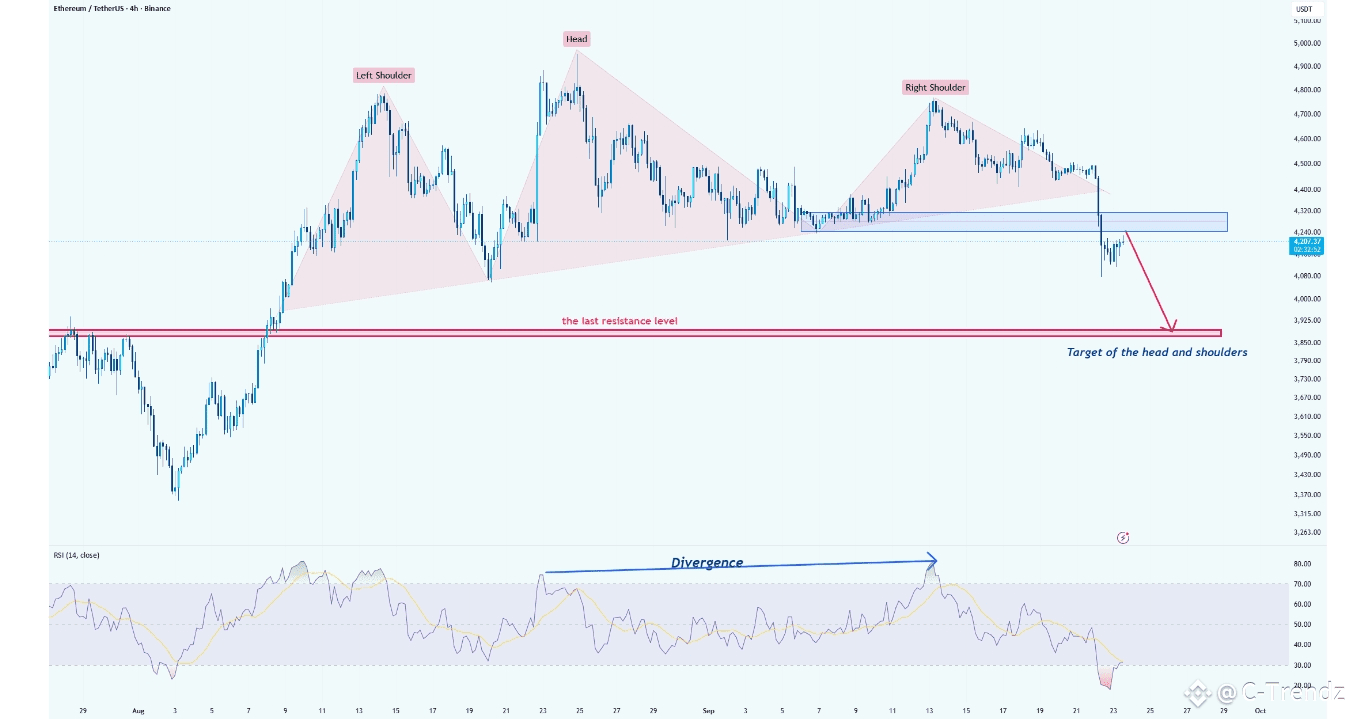

Pattern: obvious Head & Shoulders on the 4-hour. The neckline was taken out by a large bearish candle, which is a good confirmation of the breakdown.

Retest: price is testing the broken neckline/supply zone (blue box). The current action is a classic retest → if it gets rejected here again, probability favors more downside.

Target: the measured move projects into the red box; roughly ~$3,850 (range $3.7k–$3.9k depending on where you measure the neckline/head). This level also lines up with the last major resistance zone, so it’s a natural magnet.

Momentum: RSI showed divergence around the head and has dropped into oversold territory with a small relief bounce.

Invalidation: a clean, sustained reclaim and close back above the blue supply zone (above ~4.32–4.40k with conviction) would invalidate the immediate H&S bearish thesis and open the door for a deeper retrace.

-----------------------

A simple trade idea:

Short on a failed retest of the blue box (4.20–4.32k) after a bearish price candle.

Stop: just above the supply zone / last swing high.

Targets: scale profits into 3.9k then 3.8k (final target ~3.7–3.9k). Trail if price action turns constructive.

Manage risk: keep position sizing sensible.

#BinanceHODLerHEMI #DogecoinETFProgress #AltcoinStrategicReserves #MarketPullback #BNBBreaksATH $BTC $ETH $ASTER