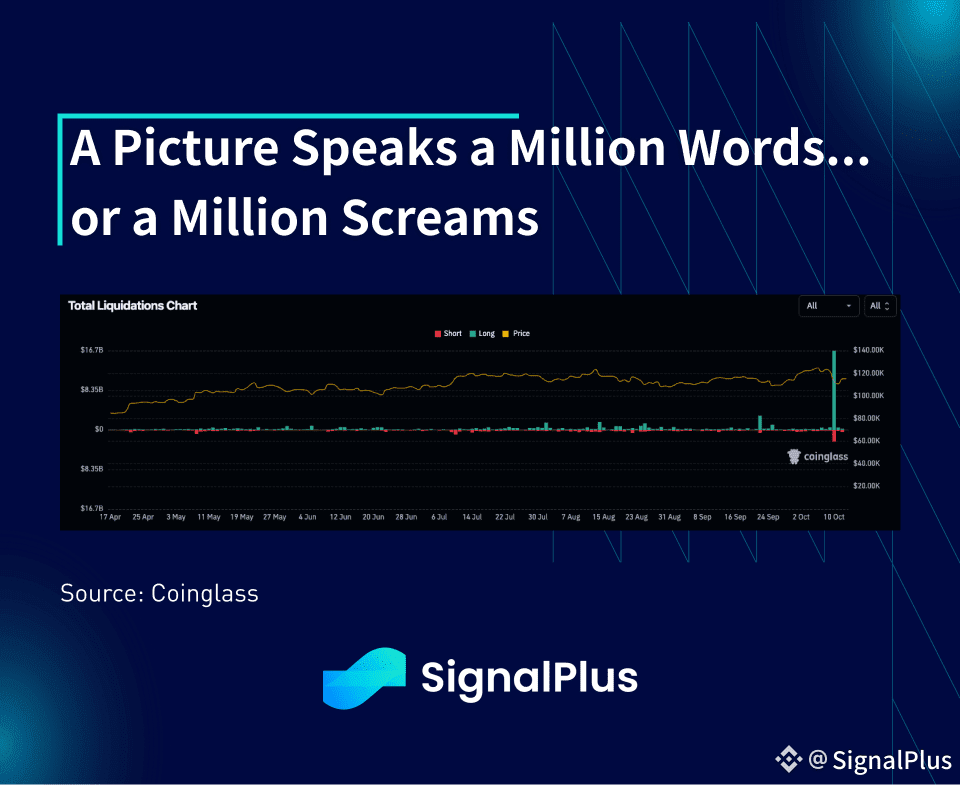

Worst liquidation day since FTX.. $19bln (or much more) in PNL wiped out from ADL (auto-deleveraging) algorithms across CEXs… altcoins touching zero as market-maker support evaporated… There’s probably no need for us to regurgitate on what was a brutal Friday close for crypto traders and macro investors alike.

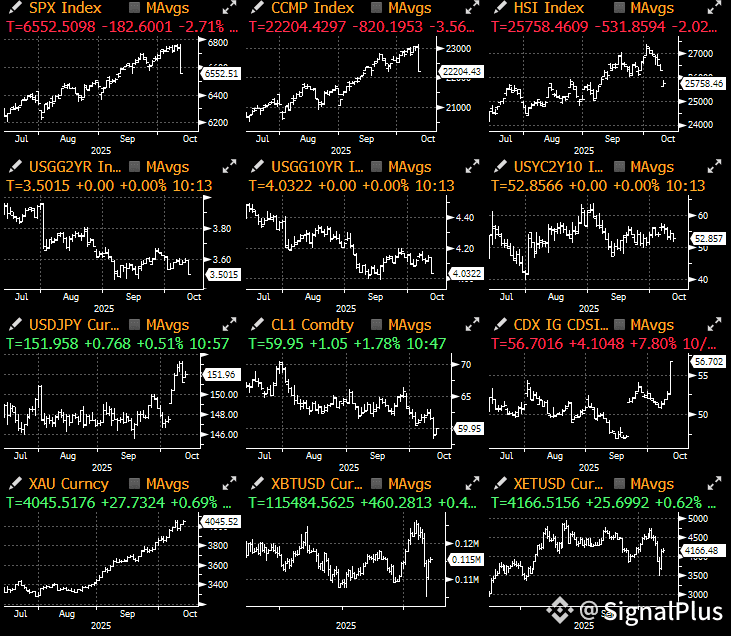

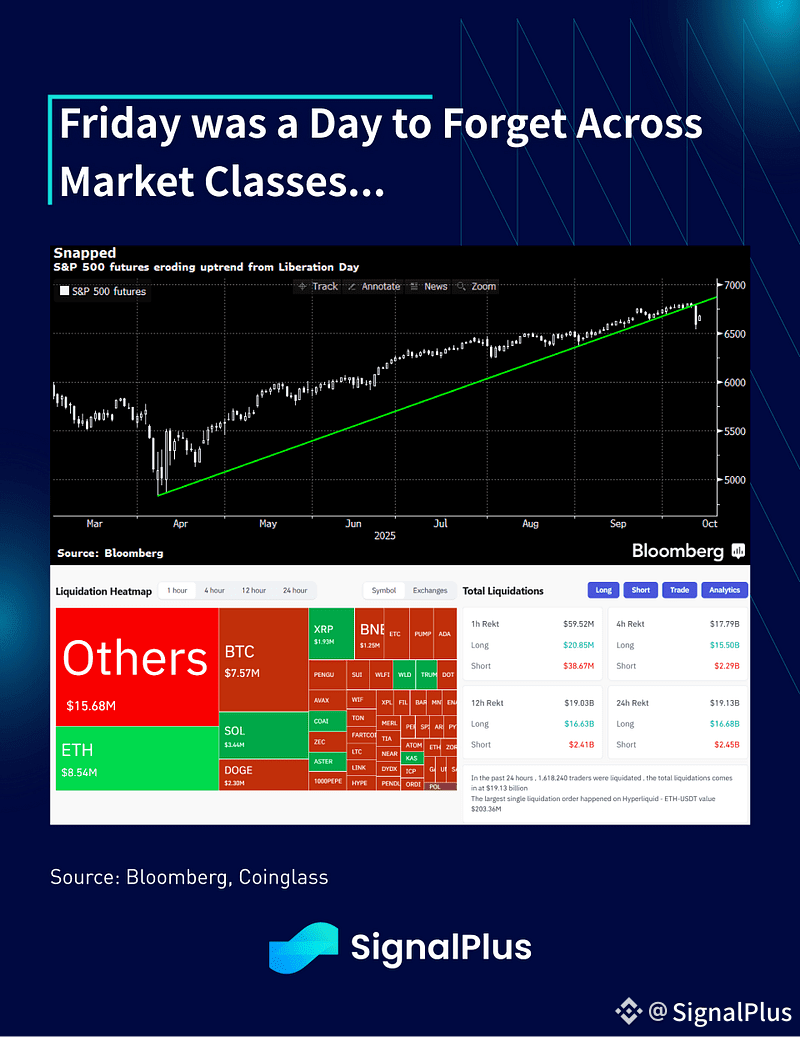

The China-US trade truce came to a sudden end as President Trump unended the calm with an exasperated response to the Chinese renewed export controls, which is unprecedented in its complexity and comprehensiveness. A US/Japan long-holiday weekend provided unfortunate timing as markets flash crashed into the Friday close, leading to a -4% drop in the Nasdaq and an instant wipeout across many altcoins.

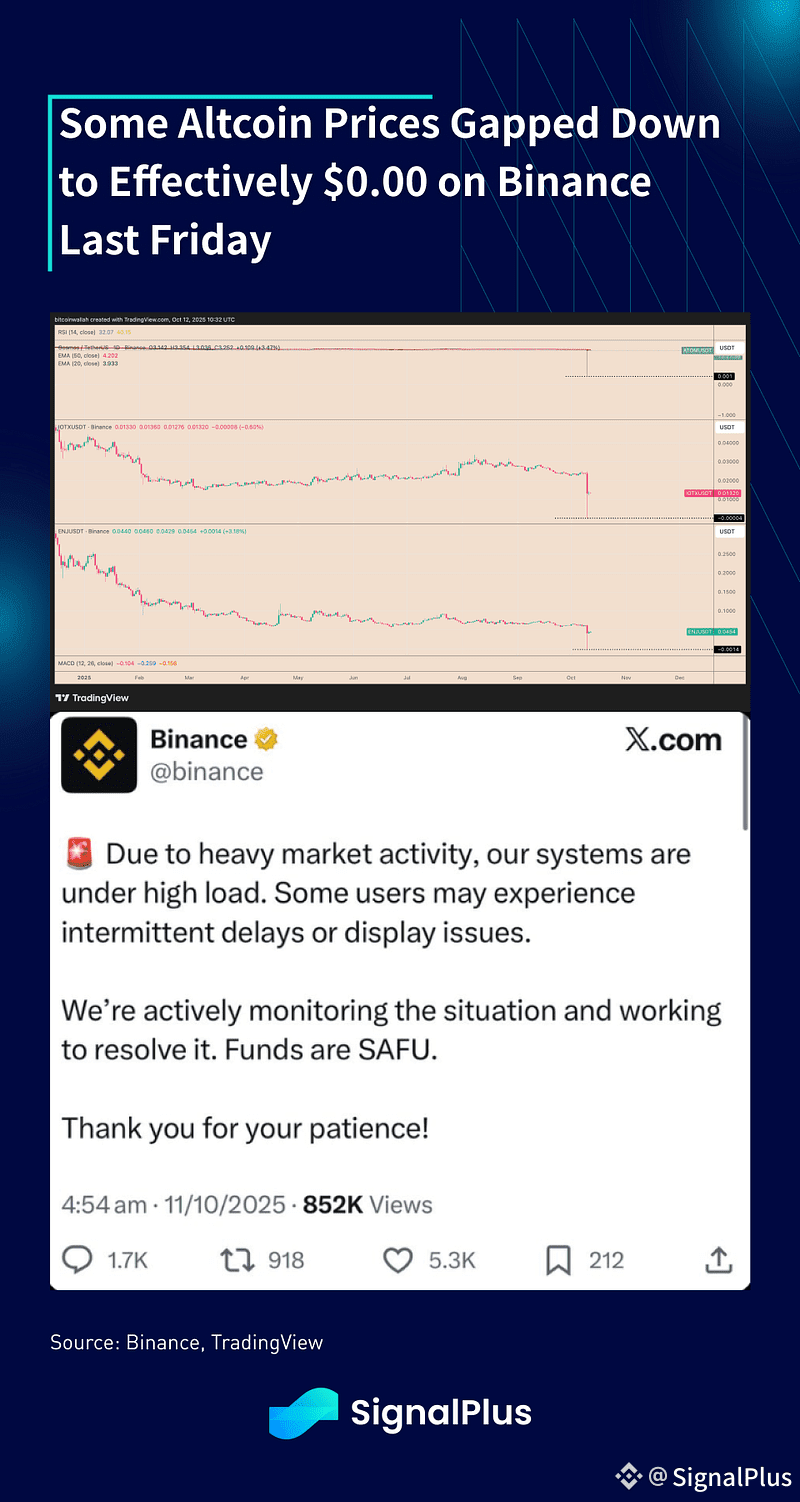

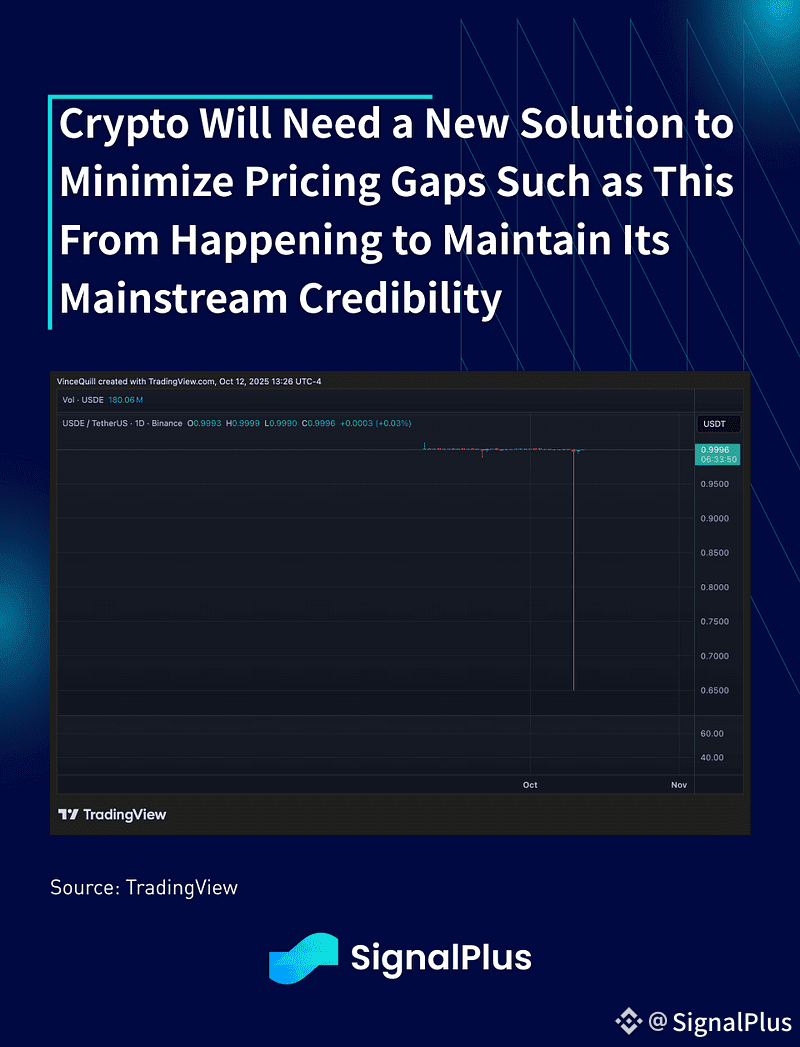

In response, the crypto community was quickly introduced to the ‘ADL’ mechanism, aka Auto Deleveraging or ‘maintenance margin’ in the TradFi world. While logical in theory, auto stop-losses do not work well in gap-down markets when liquidity becomes discontinuous and prices ‘gap down to zero’ in an order-book vacuum. Traders often forget that market makers disappear in one-way markets as price discovery evaporates, and the auto-develeveraging ends up ‘hitting the first’ bid regardless of how low it is, creating negative “reflexivity” (or convexity) as prices accelerate to the downside.

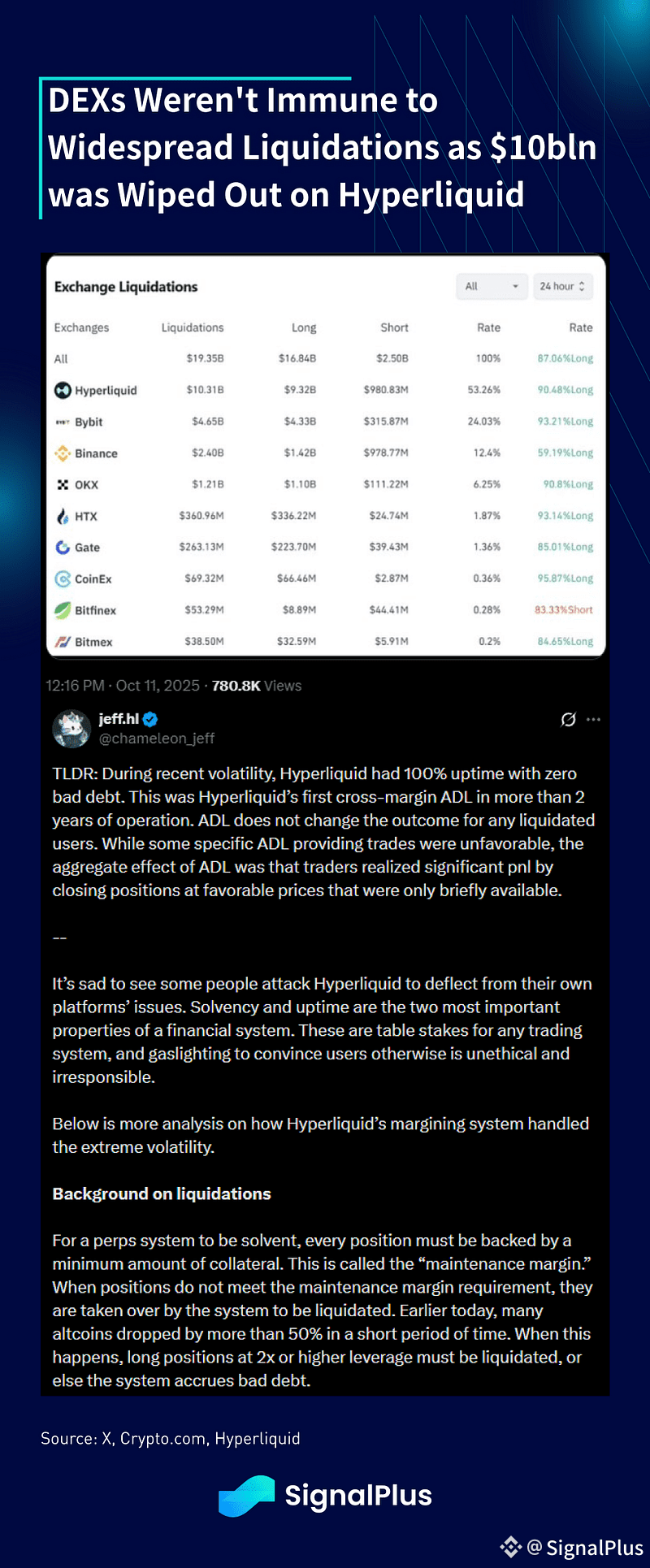

To make matters worse, a significant jump in data traffic overloaded exchange infrastructure, which further confounded the auto-liquidation mechanisms with delayed data feeds and congested orders. However, this problem wasn’t limited to just the major CEXs, but was also seen in leading DEXs such as Hyperliquid, which ‘led’ the liquidation leaderboard with over $10bln of capital wiped out on-chain on a 24-hour basis. Liquidity vacuums are agnostic to whether your capital is on-chain or not, unfortunately.

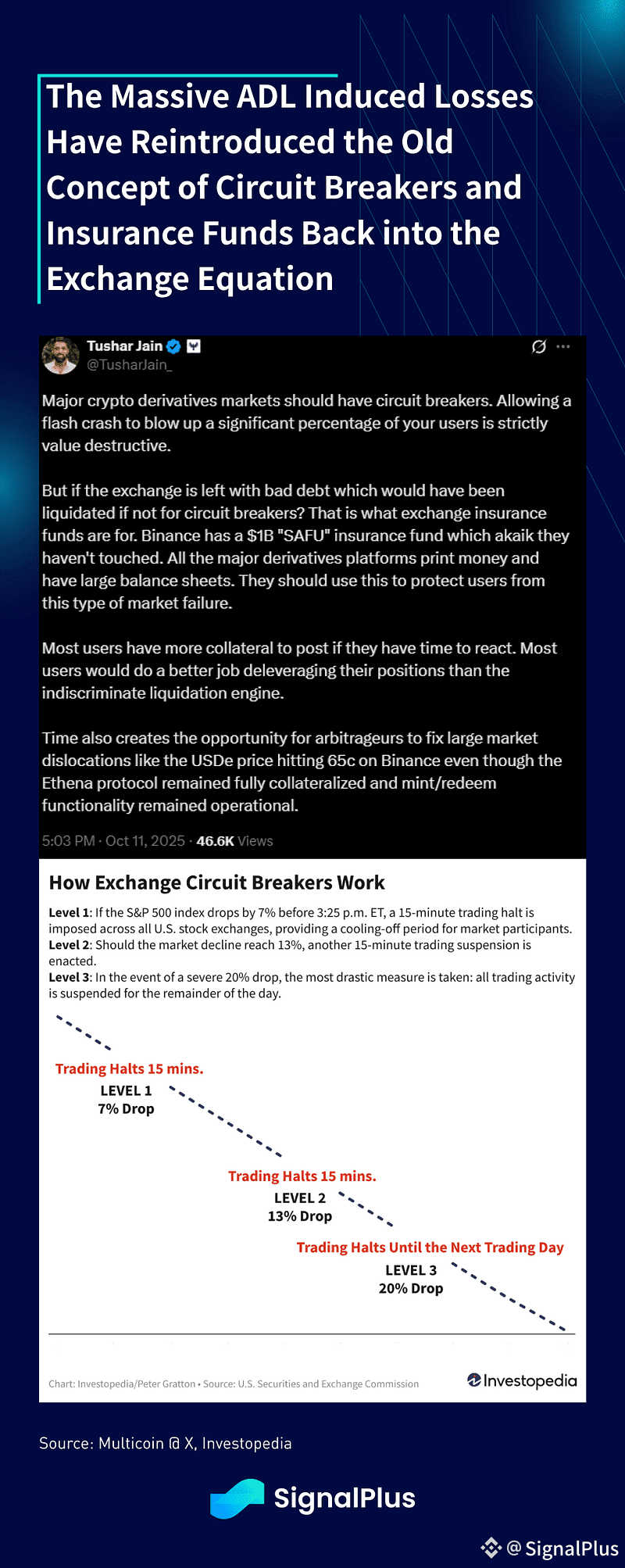

In the TradFi world, this is mitigated somewhat by the presence of circuit breakers, which would have shifted some of the pain buy asset holders onto the exchange operators, which would require a reserve / insurance fund similar to FDIC for banks. However, that would lead to less leverage available to CEX traders as costs of trading increases (which is one reason why crypto exchanges can offer more trading leverage than say, CME), and also goes against the ‘24/7’ continuous markets that crypto traders value highly.

As with all things though, all decisions come with a trade-off, but we imagine that this wipe-out will lead to a lot of renewed discussions on infrastructure investments if crypto were to continue to be institutionalized.

Looking ahead, markets have bounced a bit on Monday due to a lack of further escalation from both the US and China sides, and also due to long-weekend holidays in Japan and US markets. While the overriding view is that the recent escalation is a mere bargaining chip ahead of the Trump-Xi meeting (now in question), we believe that the longer term impact is for the macro decoupling theme to have massively accelerated. The enhanced rare metals ban is a non-trivial escalation, and highlights the declining effectiveness of any US tariff retaliation.

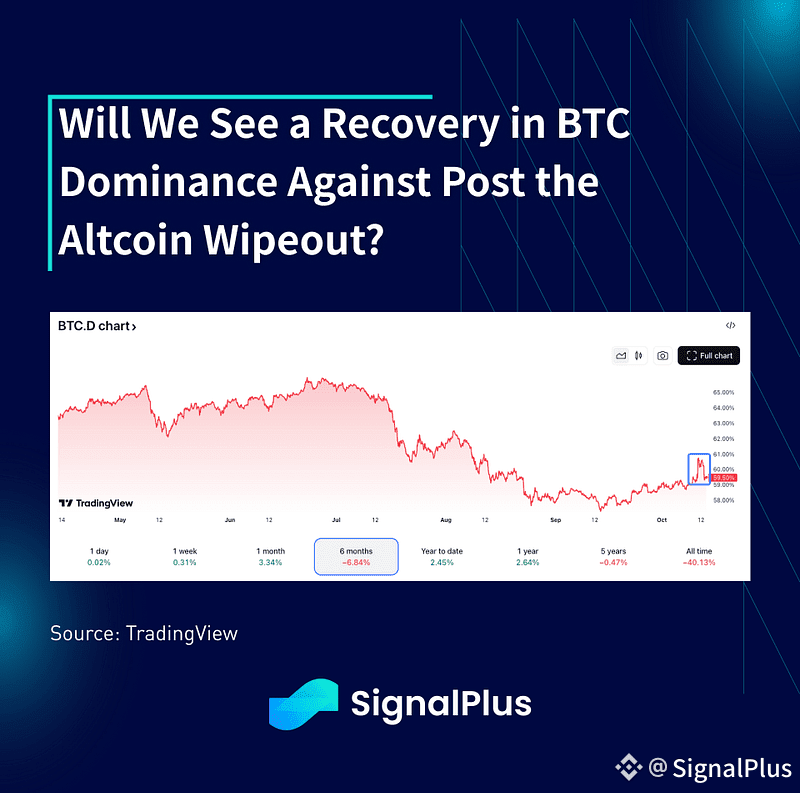

In the short-run, the consensus view is for both sides to dial down the temperature (as they have over the weekend), and asset prices to see a short-term repreieve. Nevertheless, we are concerned over any significant altcoin recoveries this time around, given the deep critical PNL damage, and BTC-focused rally YTD which has left many native investors behind.

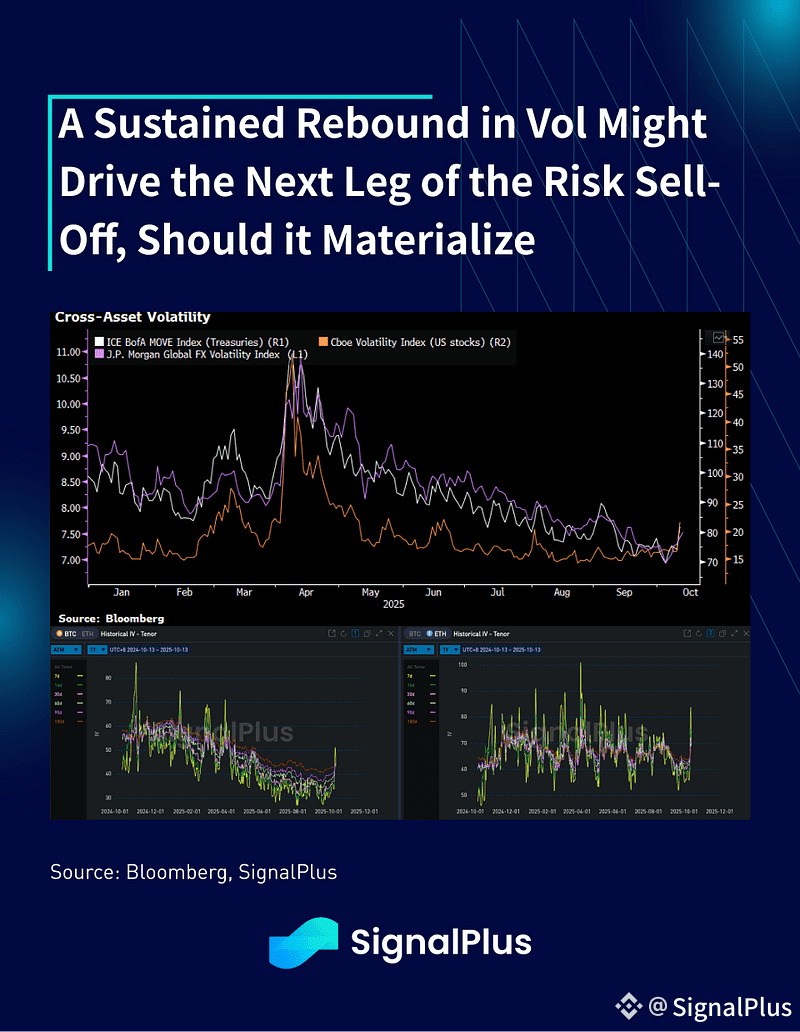

With the US government still shut and US economic data in a semi-blackout phase, markets are expected to remain extremely choppy this week with views subject to change on a whim. With systematic and momentum funds still highly invested, we would keep an eye out on any sustained rise in IVs to drive derisking flows from that community. Of course, any sudden tweets or announcements from either administration could turn the situation 180 at any time, so it’s probably best to keep risk as light as possible over the next few days.

Stay safe everyone.