Philadelphia just became ground zero for a seismic Fed shift.

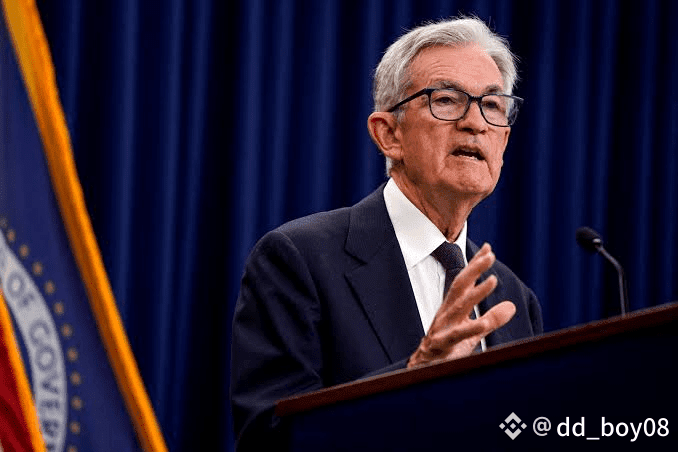

At the NABE summit, Jerome Powell didn’t whisper — he detonated:

> “The labor market has weakened — layoffs are rising, hiring is slowing, and confidence is slipping.”

Wall Street didn’t blink. It roared.

📉 Two rate cuts now locked in — October and December — each 25 bps.

The Fed’s war on inflation is giving way to a rescue mission for employment.

---

🧠 BEHIND THE CURTAIN: THE REAL SIGNAL

Powell’s composed delivery masked a deeper unraveling:

- 📉 Layoffs accelerating while job openings evaporate.

- 🏭 Hiring is easier — not because talent is abundant, but because demand is vanishing.

- ⚙️ AI sectors surge, but the broader economy feels gutted.

- 🕸️ Federal data delays mean Powell’s flying blind — intuition over metrics.

This isn’t just a pivot. It’s a recalibration under pressure.

---

🔥 INFLATION: STILL STICKY, BUT LOSING GRIP

Powell admitted inflation’s grip remains tight — above the 2% target.

Trade tensions with China and lingering tariffs keep prices elevated.

But the Fed sees light ahead:

> “Temporary price pressures fade.”

Translation: The inflation dragon 🐉 is wounded — and the Fed’s sword is ready.

---

🥊 MARKET PRICING: DOVISH DOUBLE STRIKE

Traders are no longer guessing — they’re betting:

- ✅ October: 25 bps cut

- ✅ December: 25 bps cut

The Fed’s new mantra?

> “Act as needed to support employment.”

Even if inflation hasn’t cooled, the labor market takes priority.

This is the 2025 inflection point — from inflation hawks to job saviors.

---

🌪️ THE TAKEAWAY: THE FED’S TIGHTROPE WALK

Powell’s tone? Calm. His message? Explosive.

He’s threading the needle between economic fragility and market stability.

- 📆 Two cuts ahead

- 💼 Labor force weakening

- 🔥 Recovery on edge

The era of “higher-for-longer” is over.

Welcome to “easing-for-survival.