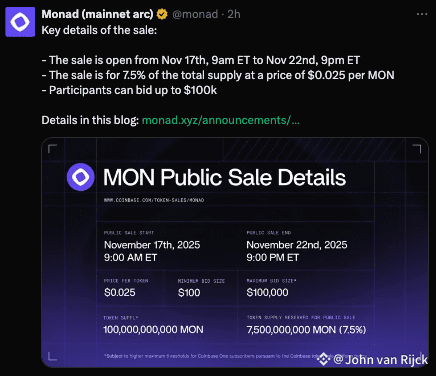

Monad will launch its public mainnet on 24 November 2025 alongside its native token, MON, with a fixed total supply of 100 billion tokens. Of that, up to 7.5 billion MON (7.5 %) will be offered through a public sale on Coinbase’s token-sale platform at US $0.025 per token.

A further 3.3 billion MON (3.3 %) is reserved for an airdrop to early community participants. In total, about 10.8 % of the supply will be unlocked and circulating when mainnet goes live.

Beyond the initial distribution, the model allocates:

- roughly 38.5 % to ecosystem development, unlocked from day one for grants, incentives and validator delegation,

- 27 % to the core team under multi-year vesting,

- 19.7 % to investors with similar long-term lock-ups, and

- 3.95 % to the treasury of the protocol’s engineering arm.

At launch, just over 50 % of the total supply remains locked, unavailable for staking or circulation. Tokens held by insiders and investors cannot be staked initially, meaning that early staking rewards will be earned solely from the unlocked portion.

Utility, inflation and burn mechanics

MON functions as the network’s gas and staking token, underpinning both transaction execution and network security. Each block will mint a small number of new MON—around 25 per block—amounting to an estimated 2 % annual inflation rate. In contrast, the base portion of transaction fees will be burned, creating a counter-inflationary force that could reduce net supply growth as network activity rises.

The design balances token issuance for validator rewards against scarcity from fee burns, seeking a steady long-term equilibrium between security incentives and token value.

Strategic implications and caveats

Monad’s tokenomics are engineered to foster early ecosystem momentum while maintaining tight supply control. The large locked share tempers immediate market pressure and promotes long-term alignment among core stakeholders. Excluding locked tokens from staking at first decentralises reward distribution and delays concentration of staking power.

Still, the model faces typical risks: market dynamics around a limited initial float, dependence on high transaction volume to offset inflation, and potential concentration of ecosystem funds if grants and delegation are not widely distributed.

Bottom line

MON’s economic architecture is designed for sustainability: a defined 100 billion-token supply, over half locked at launch, controlled inflation, and deflationary burns. The structure ties network security, validator incentives, and ecosystem growth into one system meant to scale while preserving value.