The U.S. economy is about to drop three data bombs this week — and every single one of them has the power to flip the entire market mood overnight. If you trade forex, crypto, gold, indices, or commodities, this is the week you do NOT blink. 👀💣

Let’s dive into the firestorm ahead… 🔥👇

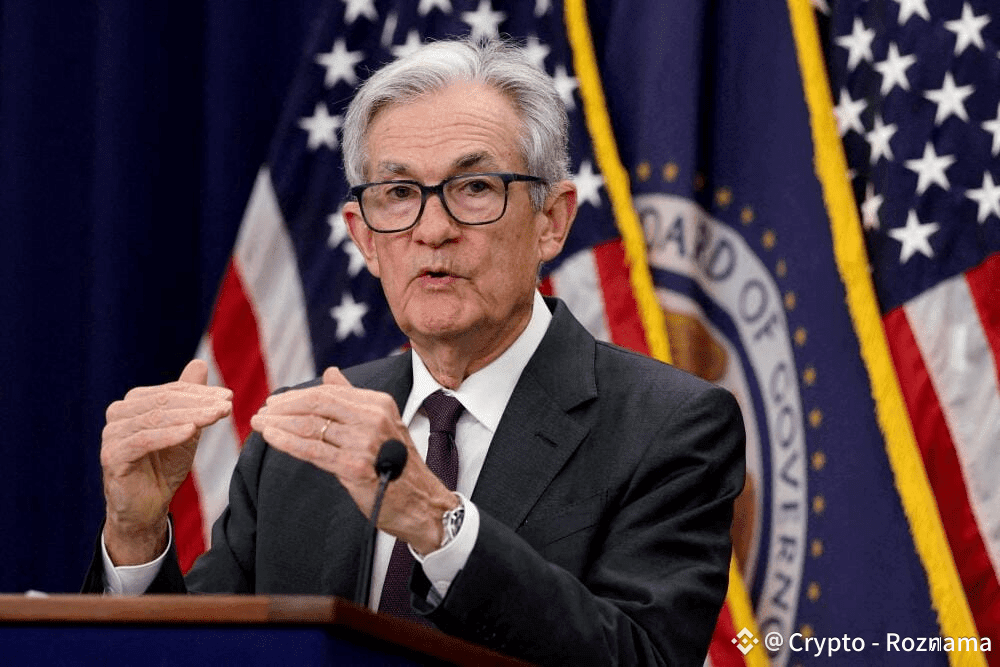

**1️⃣ FOMC MINUTES — NOV 19

THE MARKET-MOVER… THE TREND-SHIFTER… THE KING EVENT 👑📊**

This one event can redirect the USD, shake gold, rattle crypto, and reset rate-cut expectations in minutes.

💥 If the tone stays “higher for longer”:

➡ Stronger USD 💪

➡ Stock pressure 📉

➡ Gold & crypto take a hit 😬

🌈 If there’s even a whisper of easing:

➡ Risk-on explosion 💥

➡ Crypto + stocks ignite

➡ USD weakens

All eyes. All ears. All screens.

This is the moment. ⚡

**2️⃣ PHILADELPHIA FED & HOME SALES — NOV 20

THE FIRST SIGNAL OF STRENGTH 🧭🏡**

📌 Philly Fed expected: -1.4 — better than before, a sign of slow, steady recovery.

📌 Home sales steady → Housing holding strong even under high rates.

That’s not normal — that’s resilience. 🏠🛡️

If these climb higher… the “recession coming” narrative takes a direct punch.

**3️⃣ PMI MANUFACTURING & SERVICES — NOV 21

THE “HEARTBEAT” REPORTS OF THE ECONOMY ❤️📈**

Forecast: Both above 50

That means → Expansion. Strength. Momentum.

🔥 If PMI comes in strong:

➡ Fed stays tough

➡ USD flies

➡ Crypto & gold face resistance

🌬 If PMI collapses below 50:

➡ Recession fears return

➡ Early easing becomes real

➡ Gold & crypto shine

💡 BOTTOM LINE — THE WEEK OF TRUTH ⚠️

👉 Everything revolves around the FOMC.

👉 Only weak PMI can force the Fed toward early easing.

👉 Traders must stay laser-focused — this week decides the next 30 days of market direction.

🔥 Volatility is loading… stay ready.

Would you like this in tweet format, a YouTube script, or a short viral caption too? 🚀📱

#StrategyBTCPurchase #MarketPullback #AmericaAIActionPlan #TrumpTariffs #AITokensRally