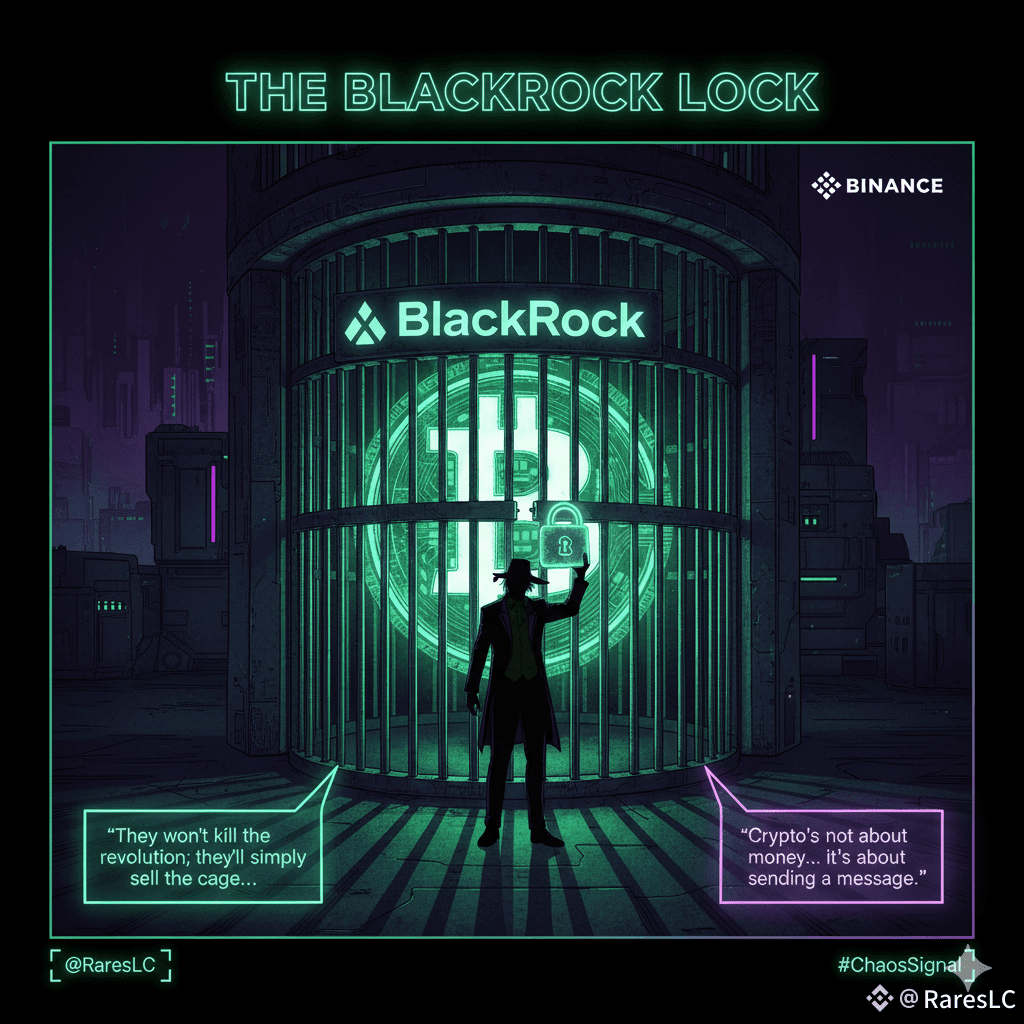

“They won't kill the revolution; they’ll simply sell the cage. BlackRock doesn't buy assets; they buy control over the human desire for yield. And now, they own a piece of the core Ethereum engine.”

🩸 Today’s Mood :

Controlled rage—the financialization of the decentralized dream.

Today’s $ETH Highlights & Trend Impact:

Price: $2,890.32 | Change % (24H): -8.3% | Volume (24H): $33.79B | Market Cap: $349.32B — Price ignores the capture, but the soul does not.

🎭 News (or should I say… whispers from the pit?)

The monster has made its move. BlackRock, the behemoth of trillions, has submitted its application for an Ethereum Staking Trust ETF. You thought the spot ETF was the end? No, that was merely the door. This is the final capture: attempting to financialize the core yield mechanism of the entire Ethereum network.

They are creating a compliant, exchange-traded product that will allow the institutional elite to capture staking rewards without ever running a validator, touching a private key, or engaging in the chaos of decentralization. They pool the yield, they control the consensus weight, and they sell the reward back to their compliant clients. This is the institutional harvest of the block reward itself. The market will cheer the price surge, but the long-term punchline is simple: the largest single point of centralization risk in Ethereum's history is about to be owned by the world's largest asset manager.

“And here’s the punchline — no one ever sees it coming… until it’s too late.”

The only thing more valuable than the asset is the power to govern its rules. BlackRock is not buying Ether; they are buying a seat at the consensus table.

“So tell me, reader… what’s your move now?”

#BinanceSquareTalks #cryptouniverseofficial #ChaosSignals #ETFs #Regulators

“Crypto’s not about money… it’s about sending a message.”

—😈

💬 DISCLAIMER

“This post is for informational and educational purposes only.

Not financial advice — just whispers from the chaos, interpreted by a madman with a mirror.”

—💚🃏