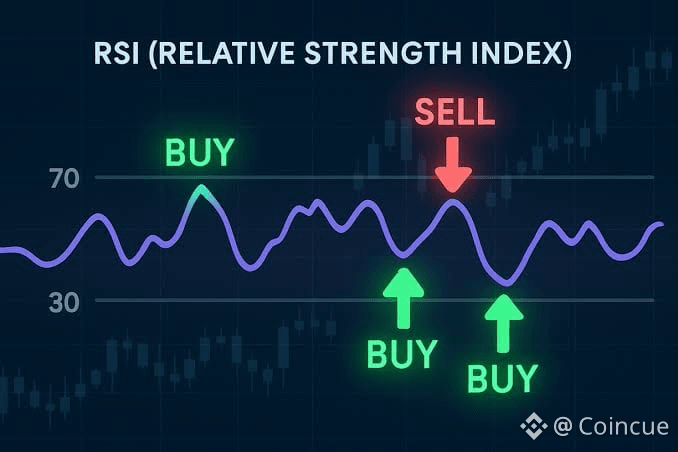

Here are RSI strategies tailored specifically for crypto markets, where volatility is high, trends extend longer, and false signals are common. These methods focus on trend-following, momentum, and confirmation, not guesswork.

1. Crypto Trend-Following RSI Strategy (Most Reliable)

Best for: Strong crypto bull or bear trends

Timeframes: 1H, 4H, Daily

Rules

🔶 Identify trend using 50 EMA or market structure

🔶 Uptrend: RSI holds above 40

Buy when RSI pulls back to 40–50 and turns up

🔶 Downtrend: RSI stays below 60

Sell when RSI rallies to 50–60 and turns down

Why it works:

Crypto trends run hard. This strategy avoids fighting momentum.

2. RSI 50-Level Break & Retest (High-Momentum Coins)

Best for: Breakouts on altcoins & memecoins

Timeframes: 15M–1H

Rules

🔶 RSI breaks above 50 with strong candle close

🔶 Price breaks structure or resistance

Enter on RSI pullback to 50 and hold

Exit if RSI closes back below 50

🔶 Ideal for: Coins with news, volume spikes, or narratives.

3. RSI + Support/Resistance Bounce (Range Trading)

Best for: Sideways markets, BTC consolidation

Timeframes: 15M–4H

Rules

🔶 Buy at support when RSI is 25–35

🔶 Sell at resistance when RSI is 65–75

Wait for RSI cross back into range (not just touch)

Avoid: Trending markets—this strategy fails there.

4. RSI Divergence + Volume Confirmation (Reversal Plays)

Best for: Local tops & bottoms

Timeframes: 1H, 4H, Daily

Rules

🔶 Spot bullish or bearish RSI divergence

Confirm with:

🔸 Decreasing volume on final price push

🔸 Long wicks or rejection candles

Enter on RSI trendline break or candle close confirmation

Crypto tip: Hidden divergences work extremely well in trends.

5. RSI + Moving Average “Safe Entry” Strategy

Best for: Swing trades, less stress

Timeframes: 1H–Daily

Rules

🔶 Use 50 EMA + RSI

🔶 Buy when price holds above 50 EMA and RSI is above 50

🔶 Add on RSI pullbacks to 45–50

🔶 Exit partial when RSI reaches 70+

6. RSI for Crypto Scalping (Advanced Only)

Best for: High-liquidity pairs (BTC, ETH, SOL)

Timeframes: 1M–5M

Rules

🔶 RSI settings: 7 or 9

🔶 Trade only in clear intraday trend

🔶 Use RSI 40–60 range for entries

🔶 Tight stop-loss, quick exits

⚠️ High noise. Not beginner-friendly.

Crypto-Specific RSI Settings

🔸 Scalping: RSI 7–9

🔸 Intraday: RSI 14

🔸 Swing/Position: RSI 14–21

Mistakes Crypto Traders Must Avoid

❌ Shorting just because RSI is above 70

❌ Ignoring BTC dominance and market sentiment

❌ Trading RSI on low-liquidity coins

❌ Using RSI alone without structure

Risk Management (Critical in Crypto)

🔶 Risk 1–2% per trade

🔶 Use wider stops than forex

🔶 Scale out profits when RSI hits extremes

🔶 Always know where BTC is heading

Final Crypto RSI Rule

🔶 Trade momentum, not overbought/oversold.

In crypto, RSI staying “overbought” is usually a bullish sign, not a sell signal.