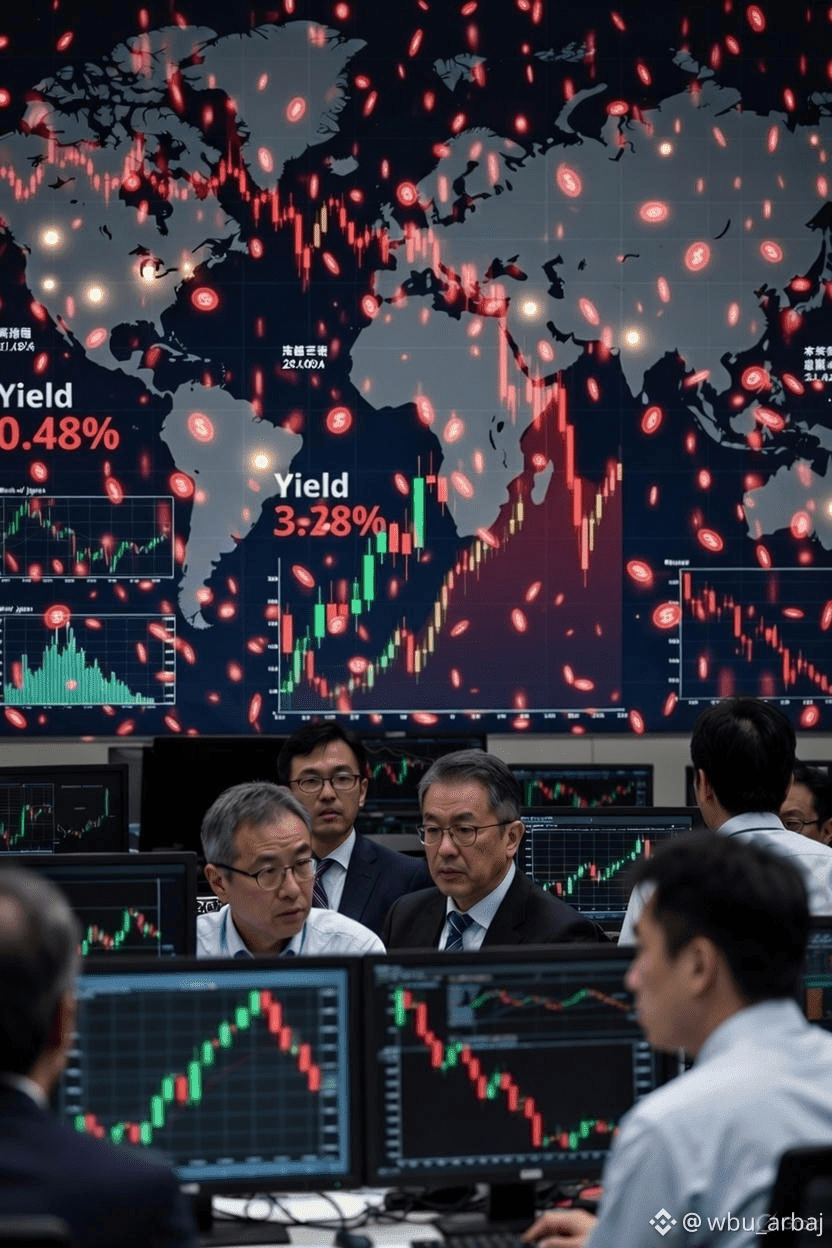

The global financial markets have just experienced a massive seismic shift! 🌍💥 Japan’s 30-year government bond (JGB) yield has spiked to around 3.46%–3.485% as of early January 2026, hitting multi-decade highs and approaching all-time records! 📊🔥

Why This Matters 🤔💡

For decades, Japan has been the global anchor for ultra-low interest rates. 🏦 This sharp rise signals a fundamental shift in the world’s monetary landscape. As Japanese yields climb higher, the era of “cheap money” is ending fast – with huge implications for liquidity everywhere! ⏰🚨

Market Impact & Liquidity 📉🌊

Liquidity Squeeze 😓: Japan is a major source of global capital flows. 💸 Higher domestic yields could pull Japanese investors' money back home, draining liquidity from international stocks and crypto markets! 🌐

Risk Assets Under Pressure ⚠️📉: Tightening liquidity puts high-volatility assets – like cryptocurrencies $JASMY and $ZK – in the hot seat as traders cut risk in this rising-rate world! 🔥🪙

Global Rate Realignment 🌏🔄: This surge shows the Bank of Japan (BOJ) is seriously shifting gears, potentially forcing other central banks to react and sending shockwaves worldwide! 🌊

The Bottom Line 🏁

We’re watching a historic realignment in global interest rates unfold right now. 👀 In a world where liquidity is king 👑, this record-breaking yield spike is a massive wake-up call that investors can’t ignore! ⚡🚀

#Japan 🇯🇵 #BondYield 📈 #BreakingNews 📰 #Finance 💰