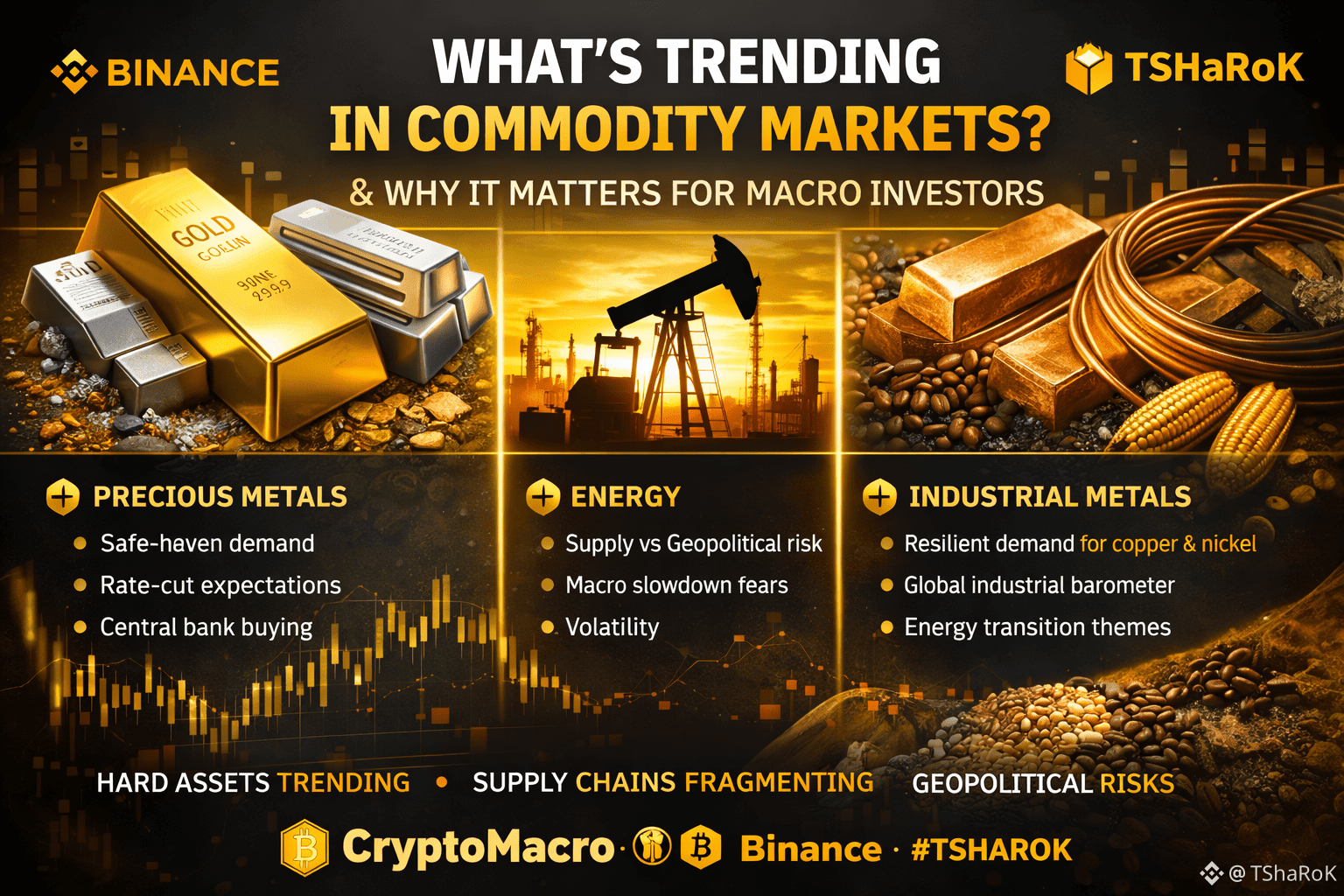

Commodity markets are sending clear macro signals right now — and smart investors are paying attention.

🔶 Precious Metals Leading

Gold and silver are trending higher as safe-haven demand stays strong. Markets are pricing in:

Ongoing geopolitical risk

Rate-cut expectations

Central bank accumulation

👉 When uncertainty rises, capital moves to protection.

🔩 Industrial Metals Gaining Momentum

Copper, aluminum, and nickel are showing strength — a sign of:

Resilient industrial demand

Strategic stockpiling

Long-term infrastructure & energy transition themes

Copper especially continues to act as a global growth barometer.

🛢️ Energy at a Crossroads

Oil prices remain mixed:

Supply remains ample

Demand expectations are cautious

Geopolitical headlines keep volatility elevated

Energy markets are stuck between macro slowdown fears and geopolitical risk premiums.

🌾 Agriculture Still Diverging

Soft commodities are moving independently:

Coffee & select softs supported

Grains pressured by supply dynamics

No broad ag rally — it’s a product-by-product market.

🧠 Macro Takeaway

Commodities are reflecting a world of:

Fragmented supply chains

Geopolitical uncertainty

Inflation risks beneath the surface

And historically, when hard assets trend, investors also reassess digital scarcity.

📌 Bottom line:

Hard assets are waking up.

Macro volatility is rising.

And markets are quietly positioning for what comes next.

#Commodities #Macro #GOLD #Oil #Copper $XAU $XAN $BTC #Inflation #GlobalMarkets #CryptoMacro #BinanceSquare #TSHAROK