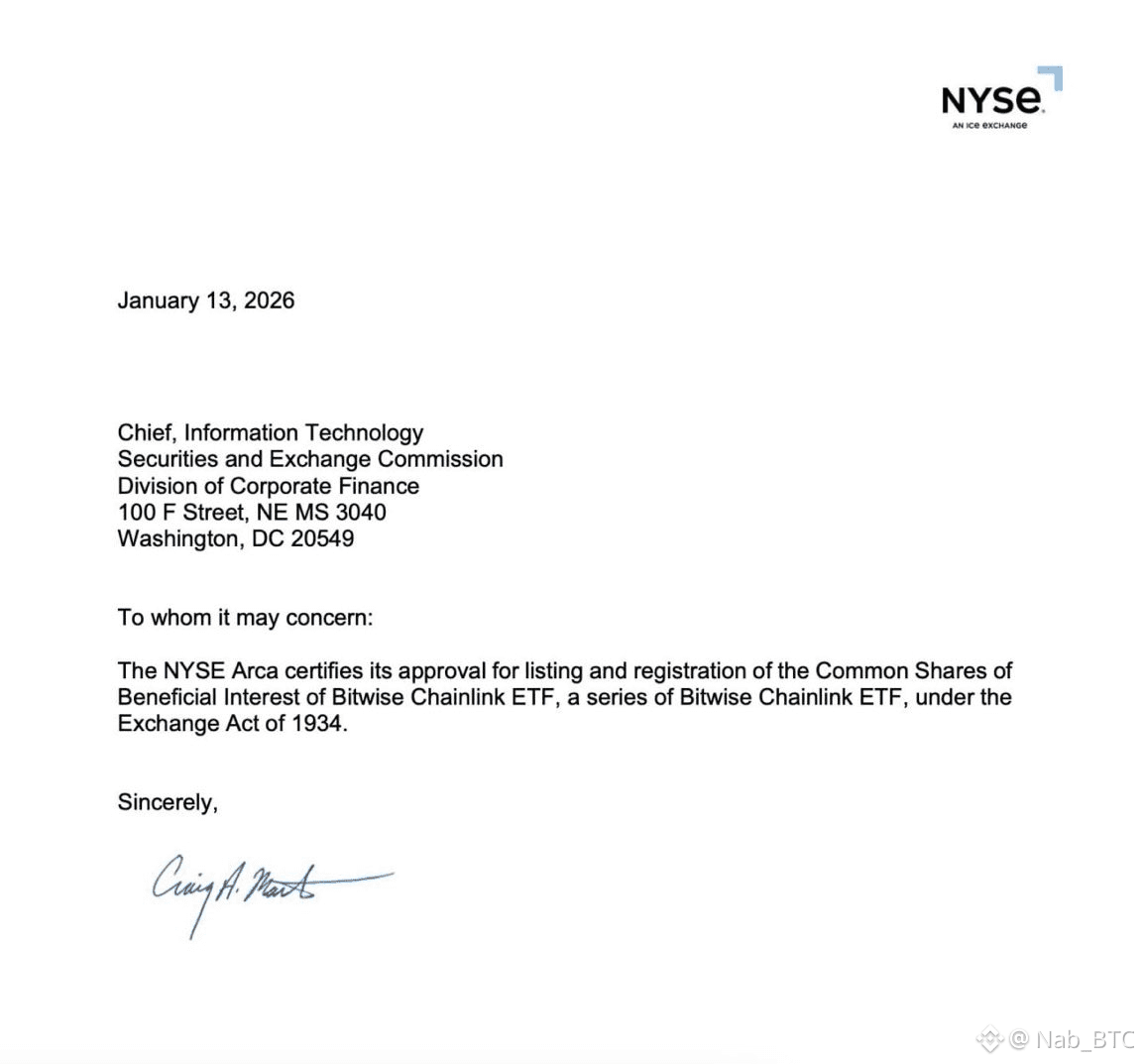

In a landmark development for the U.S. crypto market, the Bitwise Spot Chainlink ETF ticker:

CLNK) has received final approval from both the U.S. Securities and Exchange Commission (SEC) and NYSE Arca. Trading is scheduled to begin January 15, 2026, making it one of the first regulated U.S. spot exchange-traded funds to offer direct exposure to a major altcoin beyond Bitcoin and Ethereum.

The ETF will directly hold Chainlink $LINK tokens, with custody services provided by Coinbase Custody and BNY Mellon. While the product will not include staking at launch, Bitwise has indicated it plans to pursue regulatory approval for staking in the future, which could introduce yield opportunities.

This approval significantly lowers the barrier for institutional and traditional investors to gain exposure to Chainlink, allowing access through standard brokerage accounts without the need to manage wallets, private keys, or direct crypto custody.

Chainlink is widely regarded as the leading decentralized oracle network, playing a critical role in supplying real-world data to blockchains across DeFi, real-world assets (RWAs), and broader blockchain infrastructure. Market participants view the ETF’s approval as strong regulatory validation of Chainlink’s real-world utility and long-term relevance.

Market Impact and Broader Implica tions

tions

Following the news, $LINK rose approximately 5–6%, trading near $14.20, according to recent market data. Analysts are watching the $15 resistance level, noting that while ETF launches are not instant price catalysts, sustained inflows over time have historically supported higher valuations and reduced volatility in assets such as Bitcoin and Ethereum.

Beyond Chainlink, the approval is seen as a bullish signal for the broader altcoin market. It suggests regulators may be increasingly open to utility-driven crypto assets, potentially paving the way for spot ETFs tied to other infrastructure, oracle, or RWA-focused tokens.

With trading set to begin tomorrow, investors are closely monitoring volume and early inflows to assess whether the CLNK ETF could become a catalyst for the next phase of institutional adoption—and possibly the next leg of altcoin momentum.