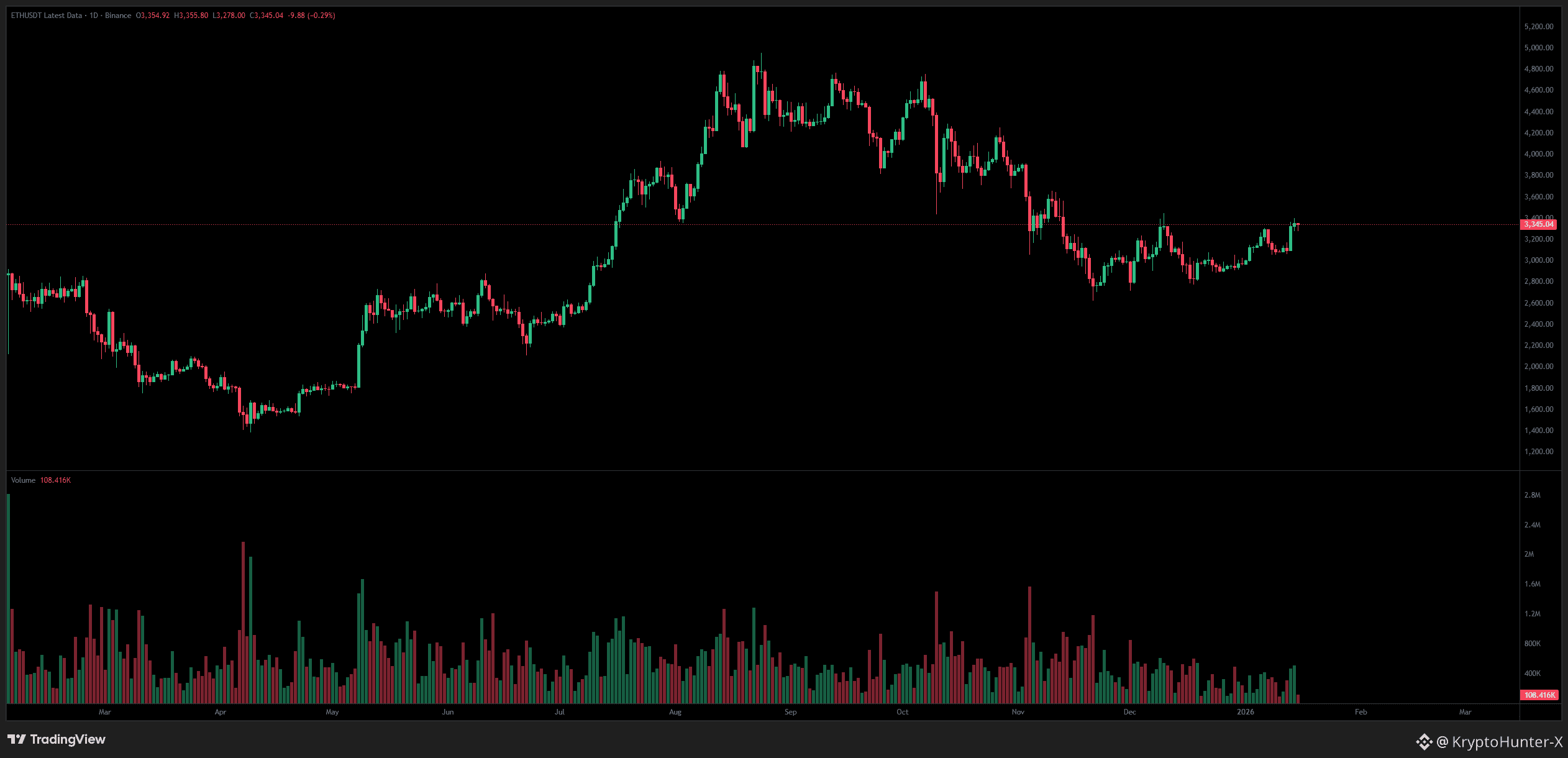

As of January 2026, $ETH is positioned as a cornerstone of the global digital financial infrastructure. With a current price of approximately $3,285, the network is entering a transformative phase characterized by massive institutional adoption and critical technical upgrades.

Massive Institutional Conviction

Ethereum is no longer just an experimental platform; it is becoming the preferred settlement layer for Wall Street.

Corporate Treasuries: Major players like BitMine have aggressively accumulated over 4.1 million ETH, signaling deep institutional confidence in long term value.

Asset Tokenization: Giants like BlackRock, JPMorgan, and Fidelity are actively deploying Ethereum-based products. Experts forecast a 5x rise in tokenized assets on-chain by the end of 2026.

ETF Inflows: Following the record-breaking $130 billion in crypto fund inflows in 2025, analysts at JPMorgan expect institutional participation to accelerate throughout 2026.

Strategic 2026 Network Upgrades

The 2026 roadmap features two pivotal milestones designed to scale the network to global industrial standards:

Glamsterdam Upgrade (H1 2026): Targets a leap to 10,000 TPS by introducing parallel transaction processing and increasing the gas limit from 60 million to 200 million.

Hegota Upgrade (H2 2026): Focuses on long-term sustainability by integrating Verkle Trees, which reduce node storage requirements and enhance censorship resistance.

Strengthening Supply Scarcity

Deflationary Pressure: The combination of the EIP-1559 burn mechanism and a low annual inflation rate continues to tighten available supply as network activity increases.

Staking Rewards: Over 29.8% of all ETH is currently locked in staking, with institutional "staking-by-default" strategies further reducing liquid market supply.

Professional Price Outlook

Short-Term Targets: Technical indicators suggest a bullish trend with immediate targets ranging from $3,400 to $3,945 by the end of January.

Long-Term Potential: Major financial institutions maintain highly optimistic 2026 forecasts:

Standard Chartered: Projects $7,500 based on accelerating institutional demand.

VanEck: Targets $6,000, driven by network revenues and staking-enabled funds.

Tom Lee (Fundstrat): Forecasts a range of $7,000–$9,000 as Wall Street shifts to blockchain infrastructure.