Early 2026: The simmering tensions between the United States of America and the Iran government reach a point of critical flashpoint, causing shockwaves throughout the global financial markets. For the cryptocurrency markets, this situation has ceased to be a hypothetical "black swan syndrome." Instead, it serves as a real-time "stress test" for cryptocurrencies, whether speculative or safe-haven instruments.

In the following analysis, the dual nature of the crypto market’s response to the growing crisis between the U.S. and Iran is examined.

1. “Flash Crash” in Bitcoin: Risk Asset or Best In-Class Performer

When these military escalations are first rumored, the first reaction in the cryptocurrency market is a sell-off. In the most recent military escalation in January of the year 2026, the intraday price fluctuations in the Bitcoin cryptocurrency caused the loss of billions of positions.

Liquidation Tsunami: Historical events such as the strike in June 2025 and the heightened tensions of 2026 prove that a geopolitical event unleashes a tsunami of liquidations. On January 14th, 2026, a massive liquidation of bear put options exceeding $500 million occurred.

Panic Selling: Institutional as well as retail investors tend to run to cash (USD) or more conservative safe havens during the early stages of a conflict, as they do not wish to be exposed to the risks associated with “risk assets.” This normally causes a 5-10% drop in Ethereum and Solana.

2. The "Digital Gold" Pivot: Bitcoin as a Safe Haven

“Once the first waves of panic have passed, a secondary trend may begin to emerge. This involves the decoupling of Bitcoin markets and the general stock market.”

Flight to Sovereignty: Unlike traditional fiat, the Bitcoin system is not anchored to the central bank of Iran or possibly any other central bank around the world.

During the blackouts and protests in Iran, data evidenced an increase in the withdrawal of Bitcoins to individual wallets.

Hedge Against Inflation: As tensions mount and the price for oil climbs due to possible war efforts with WTI crude prices ranging around $60-65 per barrel, investors are nervous about inflation making a comeback. Historically, this has been perceived as supporting the ‘store of value’ use case for Bitcoin, having surged back to around $97,000 in mid-January 2026.

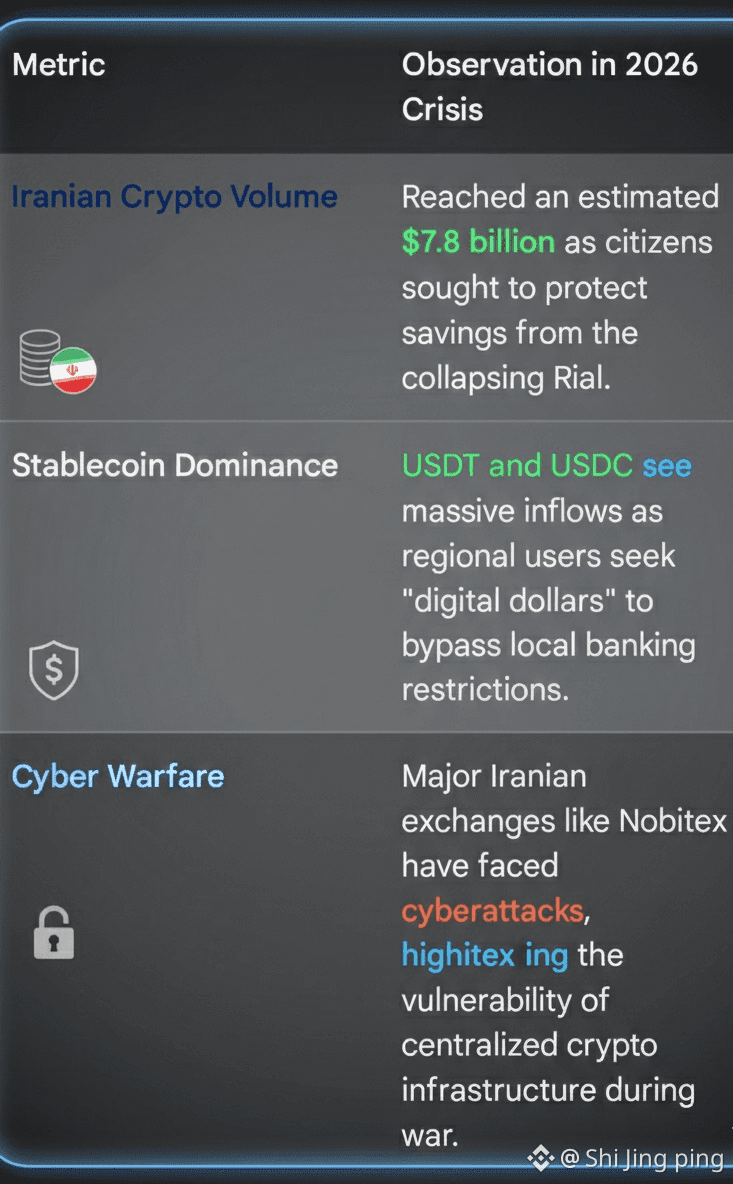

3. On-Chain Activity: A Conflict Barometer

It is the first major conflict to highlight how blockchain data can act as a "real-time pulse" of geopolitical events.

The "Trump Factor" and Market Sentiment

The return of the Trump administration in 2025/2026 brings a "Maximum Pressure" policy that markets are still learning to price in.

Market Desensitization: A few analysts believe that markets are getting "conditioned" to geopolitical rhetoric. Unless there is a direct disruption to the Strait of Hormuz-affecting 20% of the world's oil-the crypto market has shown a remarkable ability to "buy the dip" and recover within days of a headline.

Regulatory Moves: Interestingly, while the U.S. remains hawkish on Iran, it has become more "pro-crypto" domestically. This is a paradox in which geopolitical war-mongering may hurt short-term prices, but pro-crypto U.S. policy provides a long-term floor for the market.

Conclusion: A Bifurcated

“The conflict between the U.S. and Iran illustrates that the cryptocurrency market is anything but a monolith. For a hedge fund operating in New York, Bitcoin is a risk asset that must be sold at the earliest hint of war. For a resident of Tehran or a speculator tracking worldwide inflation trends, it’s a lifeline,” he said.

As we further enter 2026, it is a certainty that the "war premium" surrounding crypto prices will be high and that Bitcoin will further incorporate itself into a "macro asset" and respond in a similar manner to drone strikes as it does when it is influenced by interest rate changes.