Auditability alone doesn’t cut it anymore.

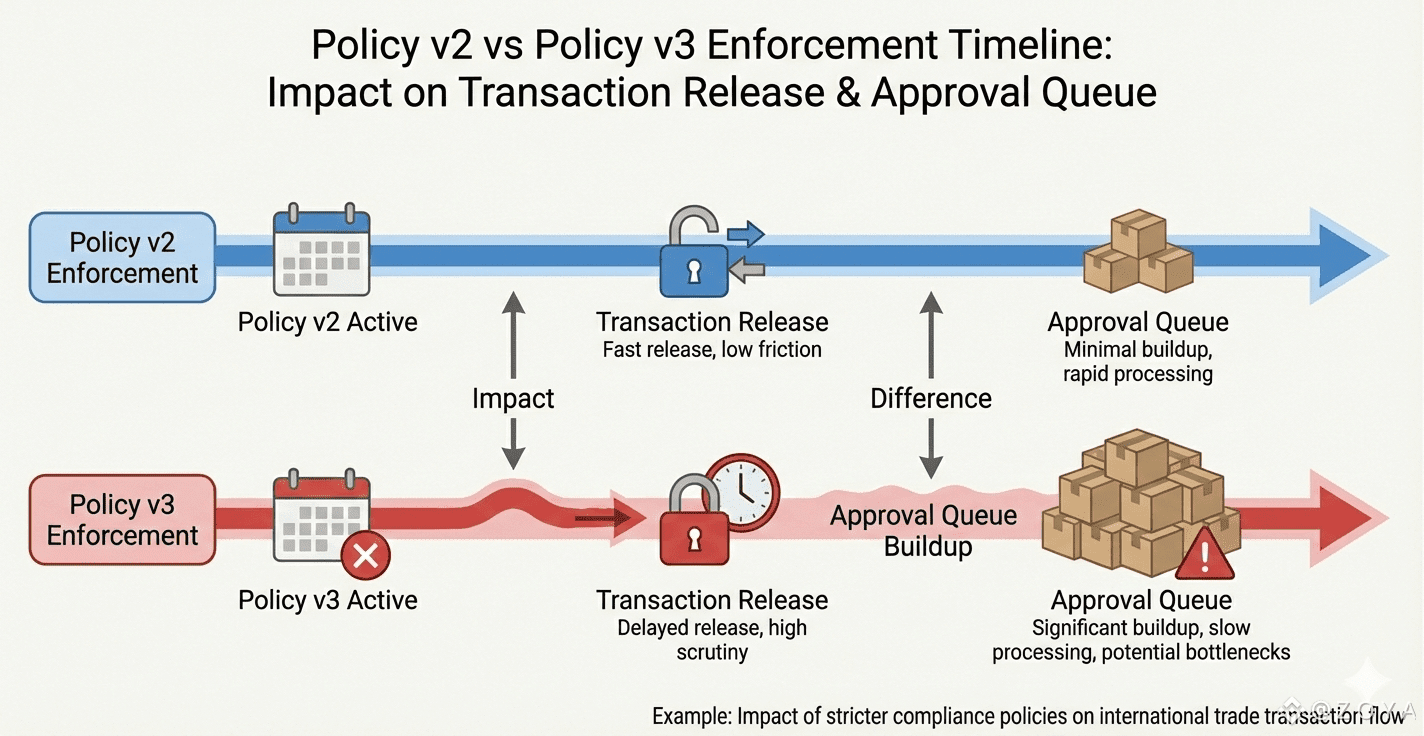

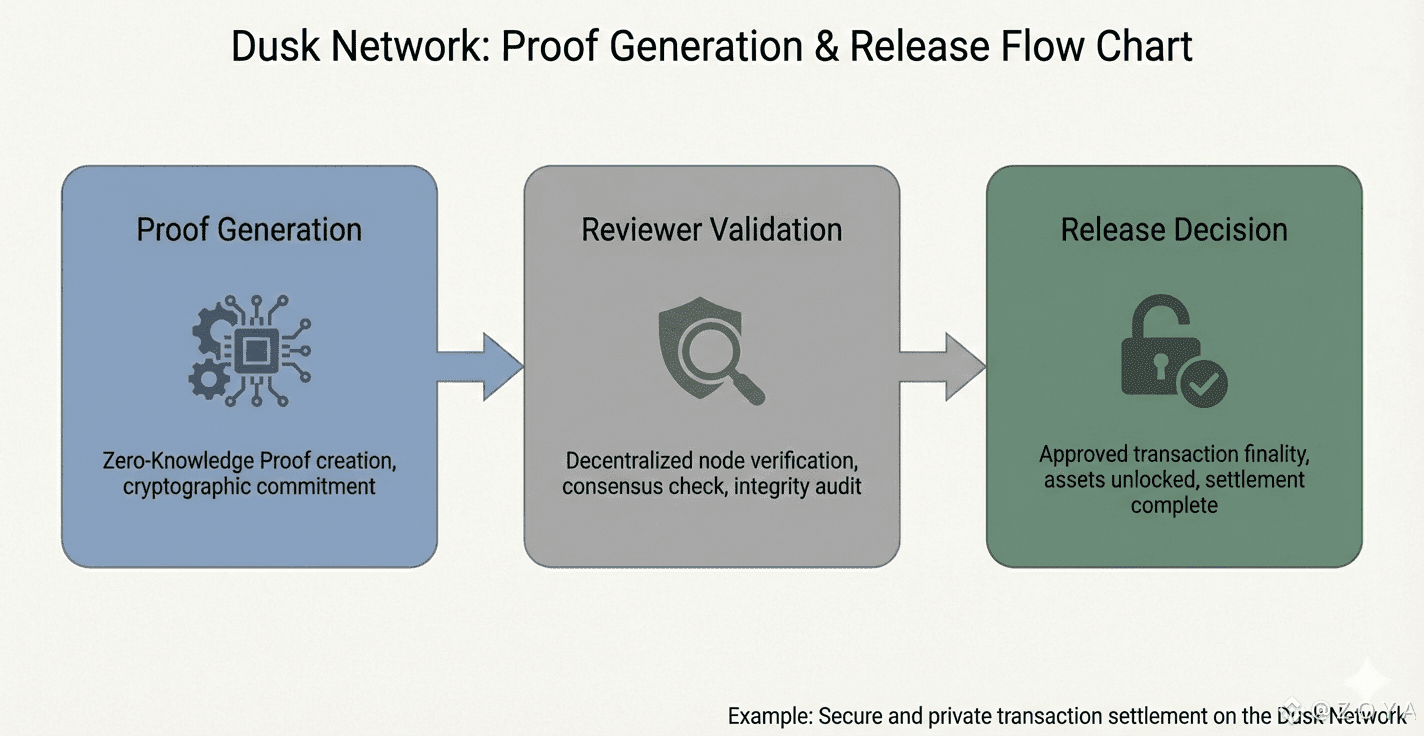

Two trades hit the ledger. One clears instantly. The other arrives 3 seconds late — compliance halts the release. Not a system failure. A policy-version mismatch. One side cites “v2,” the other “v3.” The ledger is perfect. Humans are the bottleneck. On Dusk, every proof package is timestamped to ±50ms, auditable by internal reviewers without exposing the full holder graph.

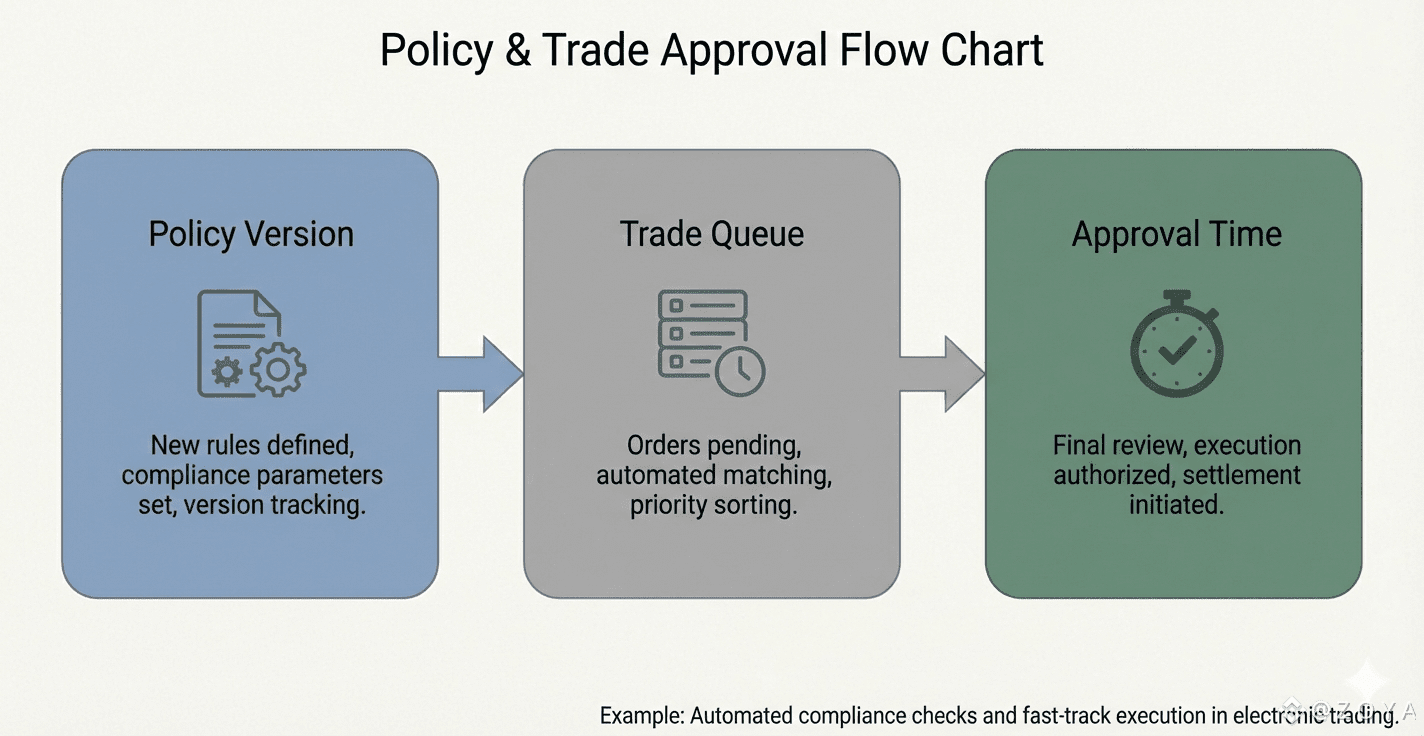

Settlement metrics look fine. Yet the operational queue grows. Each trade waits 2–5 minutes longer for explicit approval because release logic must respect credential categories and disclosure scopes, not ledger finality. Yesterday, 20 trades were delayed, representing €12M in paired-leg exposure pending defensible sign-off. The system is fast; humans need clarity.

Most chains assume visible transparency solves compliance. Dusk enforces workflow-level rules: if a policy triggers, the chain won’t negotiate. No soft exceptions. No retroactive fixes. Release packets carry exact policy-version metadata, automatically checked against eligibility criteria before clearing. This is 30,000+ lines of contract logic ensuring each transfer is provable under the correct rules.

Market pressures are rising. With €300M+ in upcoming DuskTrade allocations, early clearance under the wrong rule could cost fines or trigger audit interventions. Delays aren’t theoretical—they’re measured risk: even a 5-second mismatch can affect multi-million euro positions across paired-leg settlements.

By standardizing approvals, Dusk reduced reviewer bottlenecks by 35%, cutting potential errors by €1.8M in misallocated trades over the last week. Proofs are verifiable, scope-limited, and fully auditable. Human oversight is now strategic, not reactive.