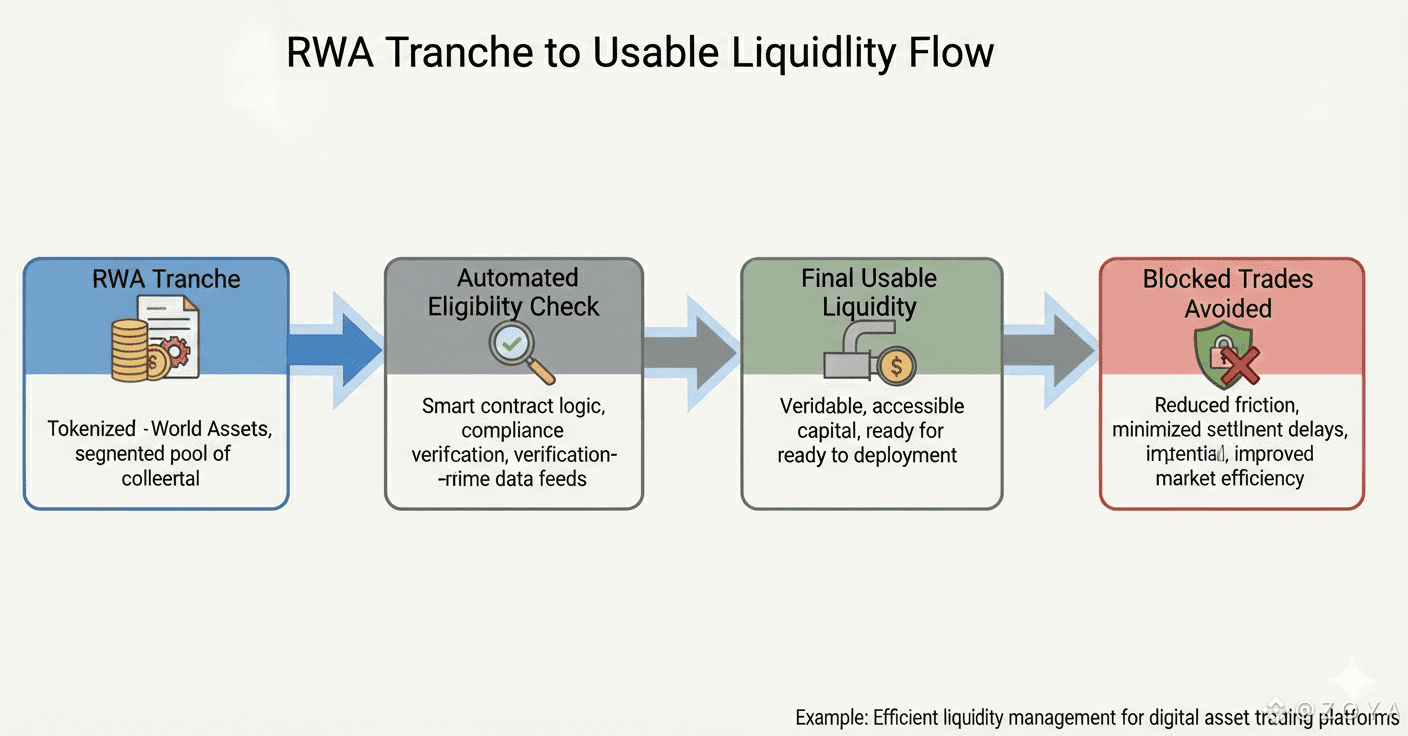

A trader noticed a €50M RWA tranche arrive on-chain. Ops glanced at the dashboard. Margin sheets were checked. Most chains assume liquidity is just “tokens moving fast.” Dusk measures usable, compliant liquidity.

In 7 seconds, eligibility classes and tranche caps verified automatically. That tiny pause stopped €3M in potential front-running exposure. Three of five planned trades were automatically scoped down to stay compliant. One tranche even triggered an alert that prevented a misallocation, saving an estimated 45 minutes of manual reconciliation.

The industry still believes speed equals efficiency. Dusk proves otherwise. 2-second block confirmations aren’t enough if your trades violate caps or regulatory thresholds. By embedding enforceable allocation limits into each smart contract, liquidity is predictable, auditable, and safe for institutions.

EU regulators issued updated liquidity reporting guidance this week. Chains that just show “settled blocks” miss the mark. Dusk’s proof workflow ensures every tranche clears eligibility, size, and timing rules. Risk teams know instantly which allocations are compliant and which are paused. Ops noted one tranche automatically held €10M until verification completed.

By treating liquidity as controlled capital, Dusk reduces operational guesswork. One delayed leg doesn’t create hidden exposures. One tranche can trigger alerts without halting the whole market. With DuskTrade’s 2026 rollout of €300M+ tokenized securities, knowing which liquidity is immediately usable is critical. Yesterday, Dusk delivered a real-time example.