The transition from blockchain speculation to blockchain settlement has revealed a structural truth that most crypto-native architectures were never designed to handle: regulated markets do not move on rails that expose trading intent, counterparty identity, regulatory status, or institutional flows. They operate under confidentiality by default, auditability by design, and legal accountability when triggered not broadcast surveillance. The failure of most public blockchains to accommodate this reality is not philosophical. It is architectural. And it is precisely the gap Dusk Network is positioning itself to fill.

The transition from blockchain speculation to blockchain settlement has revealed a structural truth that most crypto-native architectures were never designed to handle: regulated markets do not move on rails that expose trading intent, counterparty identity, regulatory status, or institutional flows. They operate under confidentiality by default, auditability by design, and legal accountability when triggered not broadcast surveillance. The failure of most public blockchains to accommodate this reality is not philosophical. It is architectural. And it is precisely the gap Dusk Network is positioning itself to fill.

In traditional capital markets, privacy is not an optional convenience. It is market structure. Order books are opaque for a reason. Bid and ask sizes reveal strategy. Corporate actions reveal balance sheet structure. Counterparty relationships shape liquidity dynamics. If that information leaks in real-time, markets distort and participants withdraw. Crypto’s early transparency-first ethos was remarkable for verifying trust without intermediaries, but it broke the confidentiality expectations that make regulated finance functional. Dusk’s thesis is simple but non-negotiable: tokenized markets cannot scale without privacy that regulators can still audit.

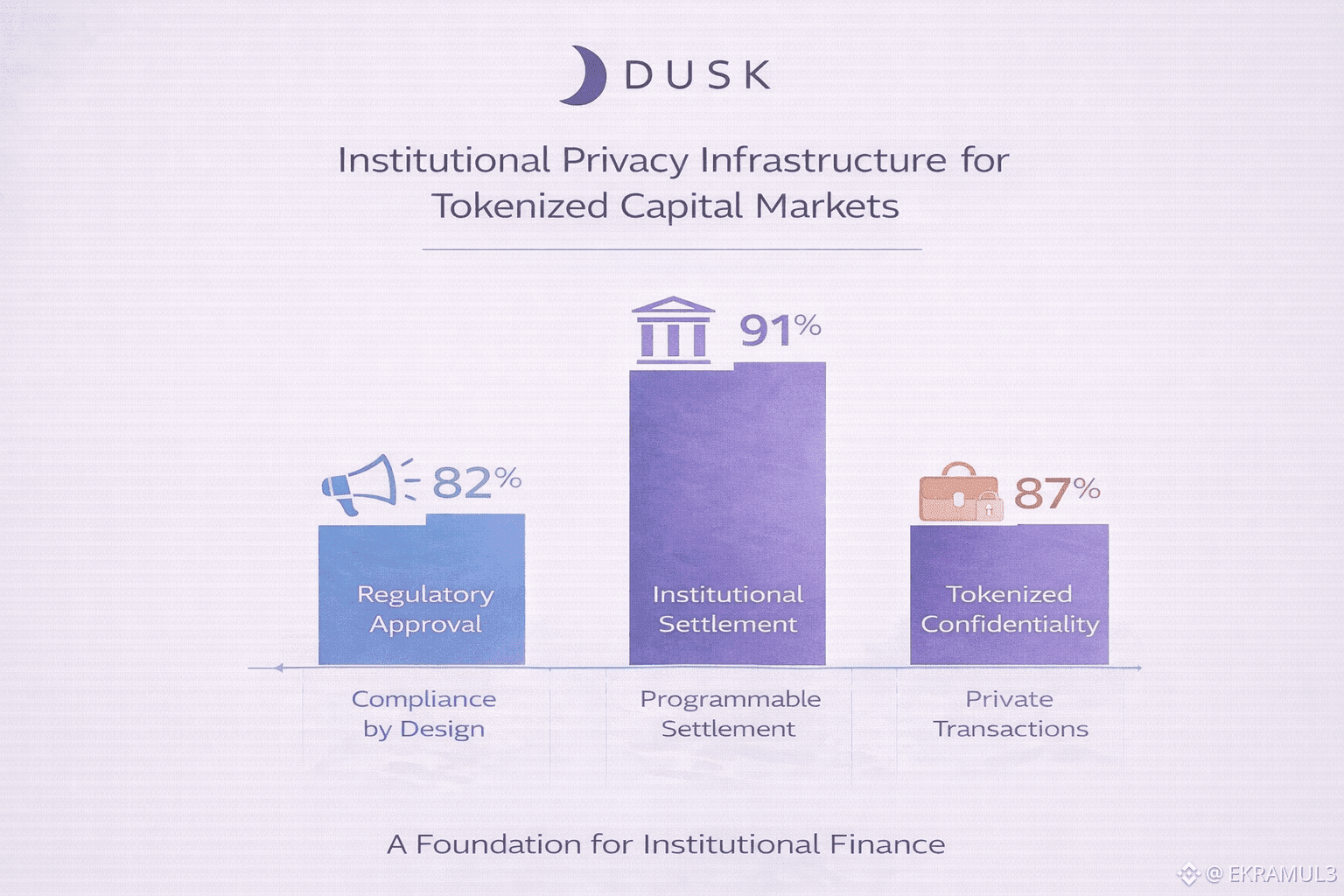

Where most privacy chains aimed at anonymity or censorship resistance, Dusk takes a fundamentally different stance: confidentiality without opacity. Dusk proposes an execution environment where identities, positions, and transactional state remain private at the public layer, while compliance disclosures can be revealed selectively to authorized actors regulators, auditors, venues without exposing the broader market. This model resembles how securities markets already operate: clearing houses, custodians, and regulators have visibility; the crowd does not.

Layer-1 architecture really makes a difference here. Dusk bakes privacy, compliance logic, and deterministic settlement right into the protocol itself, instead of leaving them up to each app. That means you don’t end up with flimsy, add-on privacy fixes. Apps built on Dusk automatically get these confidentiality and compliance features, kind of like how smart contracts on Ethereum just use the account model by default. For things like tokenized securities, funds, money market instruments, credit products, and stablecoin settlement, this setup cuts down on messy integration work and takes the guesswork out of compliance for issuers and platforms.

The cryptographic infrastructure behind Dusk is not cosmetic. Zero-knowledge execution allows verification without exposing trade sizes, investor identities, or portfolio composition. Programmable selective disclosure transforms regulatory oversight into a workflow rather than a data leak. Audit trails become cryptographically enforceable instead of database artifacts. Succinct Attestation-based consensus (SA) provides deterministic settlement finality an absolute requirement for delivery-versus-payment (DvP) and redemption workflows. This is not a chain optimized for farming. It is a chain optimized for legal settlement.

One of the most overlooked reasons tokenized securities have been slow to mature is the absence of compliant settlement cash legs. Dusk’s alignment with stablecoin settlement and RWA issuance infrastructure closes that loop. Tokenized equities and tokenized bonds are meaningless if redemption, coupon payments, dividend distributions, and collateral transfers cannot settle under regulatory constraints. Dusk’s integrations with venues such as 21X (DLT-TSS licensed) and collaboration with NPEX for securities infrastructure highlight a shift away from DeFi volatility and toward regulated issuance and lifecycle management.

A critical piece here is data integrity. Capital markets run on verified reference data prospectuses, corporate actions, ISIN mappings, price feeds, risk data. Dusk’s adoption of Chainlink standards for data publishing and interoperability signals that the chain is being built for how regulated capital markets actually operate, not how crypto imagines they could operate. Without verified data models, tokenized finance devolves into speculation. With them, tokenized finance becomes infrastructure.

Institutional investors care about another dimension: legal finality. Public blockchain “finality” is probabilistic something is final until the next reorg. Regulated markets cannot function on probabilistic guarantees. When a trade clears, ownership transfers legally. Dusk’s deterministic settlement approach reflects that reality. Once a block is finalized, regulatory logic treats the transfer as complete. This alignment between computational finality and legal finality is the difference between a demonstration and a market.

From an investor perspective, the strategic takeaway is not that Dusk is chasing the RWA narrative. It is that Dusk is building for the form of tokenization that actually matters: institutional-grade issuance, regulated trading venues, compliant settlement, and private execution. Retail DeFi has already plateaued. Institutions are not coming to fight retail on AMMs. They are coming for predictable rails to issue, distribute, settle, and redeem instruments the same way they already do just faster, programmatically, and with fewer intermediaries.

This is why Dusk’s progress feels quiet. Infrastructure adoption follows a different curve than narrative cycles. It compounds slowly and publicly only once the rails are already in place. If Dusk succeeds, it won’t look like hype. It will look like regulated venues listing tokenized bonds, SMEs issuing equity on-chain, stablecoins settling DvP, custodians onboarding, and regulators treating the chain as compliant market infrastructure instead of an experiment. That shift is not loud. It is structural.

And if tokenized capital markets really emerge not as a meme but as a regulated sector the winning chains will not be the fastest or the most decentralized or the most composable. They will be the ones that satisfy the only three competencies regulated finance actually requires: confidentiality, compliance, and finality. Dusk is one of the few L1s that treats those not as narrative flavors, but as protocol primitives. That is why it is worth watching not as a bet on crypto, but as a bet on market infrastructure.